One of the most important steps to starting a business on Shopify is setting up a way to collect payments. Among the many payment providers that Shopify supports, Shopify Payments is still the most prominent name. And this Shopify Payments review will shed light on all aspects.

Join LitExtension – #1 eCommerce Migration Service to walk through everything you need to know about Shopify Payments:

- What is Shopify Payments?

- How does Shopify Payments work?

- All pros & cons of Shopify Payments

- Shopify Payments review in terms of fees and security

- How to set up Shopify Payments in 5 steps?

Let's get the ball rolling!

What is Shopify Payments?

Before getting to the nitty-gritty of this Shopify Payments review, let's head down to the biggest question: What is Shopify Payments?

Shopify Payments is an in-house payment provider by Shopify, a top eCommerce platform in the market. It plays the role of the default integrated payment gateway for your Shopify store. From the moment your customers fill in their credit card information, it is responsible for managing all the steps up until the money has already been in your bank account.

Shopify Payments accepts major credit cards like Visa, Mastercard, Discover, and American Express, along with Diner Club debit and credit cards and Elo, JCB, and Union Pay via Discover. To cater to international customers, you can opt for plans enabling sales in various currencies.

How Does Shopify Payments Work?

Whenever a customer makes a purchase in your Shopify store, Shopify Payments collects their money and sends it directly to store owners. It ensures that the checkout process is quick, smooth, and highly secure.

Then how does Shopify pay you? Well, you get paid by Affirm, and your payouts are sent to the same bank account that you use for Shopify Payments. For U.S. stores, payouts typically reach bank accounts within two business days. In certain cases, such as needing a 30-day payout period or a fund reserve, Shopify Payments may require adjustments, with affected store owners receiving notifications.

Additionally, using Shopify Payments, you can handle transactions both in-person with point-of-sale (POS) systems (available in Starter and Retail versions) and online. The hardware POS setup comprises a card reader, barcode scanners, cash drawers, printers, and an interactive screen.

Shopify Payments Review – Pros & Cons

Just like any other payment provider, there's no perfect solution. The important thing is that whether it fits in your business needs or not. After introducing Shopify Payments, this section of our Shopify Payments review will highlight its pros & cons for your consideration.

Shopify Payments pros

Setting up Shopify Payments is quick

Different from conventional payment acceptance methods, Shopify Payments is a super straightforward solution for eCommerce merchants. You no longer have to go through a third-party provider and be approved for a merchant account before you can process payments. Once you have finished setting up Shopify Payments for your store, your finances are synced up with your sales and inventory.

In the latter part of this Shopify Payments review, we will walk you through the detailed setup instructions so that you can activate your Shopify Payments right away.

Shopify Payments is fully integrated

With Shopify Payments, your customers will stay on your website at all times because all transactions are on your Shopify store. Meanwhile, if you choose PayPal or other third-party providers, buyers will be redirected to the platform to complete the purchase. The complexity can annoy your customers who are not tech-savvy, which can decrease your conversion rate.

Besides, all payments will be synced with their corresponding orders. This makes Shopify Payments the only solution that can track all your orders and payments all in one place.

Shopify Payments charges nothing for a transaction

You will incur a transaction fee when using third-party payment processors. The rate varies based on the Shopify pricing plan that you choose.

To be specific, you will have to deduct 0.6%, 1%, and 2% of your revenue if you are using Advanced, Shopify, and Basic, respectively. That number can turn out to be hundreds of thousands of dollars per month, even higher than the subscription fee that Shopify charges you.

Customers have more options to pay

Choosing Shopify Payments does not mean you cannot use other payment providers. In fact, you can choose over 100 payment providers on Shopify. More Shopify payment methods mean that customers will have more options to check out.

In addition, Shopify Payments can also be fully integrated with Shopify POS. More specifically, all your business data, including both online and in-store sales, is unified.

Shopify Payments cons

Not available in every country

Although people worldwide are able to open a Shopify store, the number of countries that Shopify Payments supports is still small. Here is the list of countries in which Shopify Payments are available.

In case your country does not appear on the list, you will have to wait for Shopify's approval in a long time. This is because they must ensure that the Shopify version in that country is compliant with its requirements. If this is the case, you can integrate with third-party payment options other than Shopify Payments.

Must comply with products T&Cs

Before starting to sell on Shopify, you may have heard from other seniors that Shopify has such a long list of prohibited products that you cannot sell. That was owing to Shopify Payments’ compliance with the laws, the rules from Payment Networks, or the requirements of the Processor’s Financial Services Providers.

Before migrating to Shopify or opening a brand new business on this platform, make sure that you have checked the table below. Otherwise, Shopify will terminate your account at any time for any reason:

Shopify Products Restrictions | Details |

Financial and professional services |

|

IP Infringement, regulated or illegal products and services |

|

Products or services that are prohibited by law or Shopify’s financial partners |

|

Unfair, predatory, or deceptive practices |

|

High Chargeback fees

Chargeback is a return of money to a payer of an online credit card transaction. Suffering a chargeback means that you have just lost the order and may incur an additional charge. Obviously, one of the biggest concerns of a small online business is how to protect itself from chargebacks.

When your buyer contacts their bank to dispute a charge on your store, you will be deducted $15 right away from your next available payout in your Shopify Payments Account (it varies based on countries, but will fluctuate $15). Shopify will refund you that $15 if you win the chargeback, but the chance is way too low.

However, Shopify Payments always does its best to protect its merchants and help them thrive. When you are issued a chargeback, Shopify will compile all the evidence and send it to the issuing bank on your behalf. Besides, they also provide a free app Fraud Filter on app stores to help you avoid chargebacks. It can provide an additional layer of protection to help you fight fraud.

Sudden account frozen

Whenever there is a chargeback or suspicious account activity that needs investigating, Shopify Payments always freezes your payment until the problem is solved. If the final verdict is quickly made, you will receive your money in the next payout. However, there is a likelihood that it will take longer to look into. In that case, your payment can be frozen for months, which is the topic with most complaints in the Shopify Community.

Shopify Payments Review – All Fees Revealed

Accepting payments in Shopify will mainly involve 2 types of fees:

- Credit card processing fee: The fee that your payment provider charges you for executing all the transactions, including transmitting data among buyers, sellers, issuing banks, and acquiring banks. Fortunately, after activating Shopify Payments, you will not have to pay a single coin for this.

- Transaction fee: The fee that Shopify charges you on each transaction. The exact rate will depend on your choice of Shopify pricing plan when running your business.

For your complete Shopify Payments review experience, we will list out the details in the table below:

Shopify plan | Monthly subscription (Billed annually) | Online payment | In-person payment |

Shopify Starter | $5/month | 5% plus per transaction | Shopify POS is unavailable |

Basic | $29/month | 2.9% plus 30 cents per transaction | 2.6% plus 10 cents per transaction |

Shopify | $79/month | 2.7% plus 30 cents per transaction | 2.5% plus 10 cents per transaction |

Advanced | $299/month | 2.5% plus 30 cents per transaction | 2.4% plus 10 cents per transaction |

But that's not enough for you to estimate the Shopify Payments pricing. There are several additional optional and circumstantial fees that you should be aware of, including:

- Chargeback fee: When a chargeback occurs, Shopify imposes a $15 fee, which is refundable upon winning the dispute.

- POS Pro for retail businesses: While all monthly plans include Shopify POS Lite features, upgrading to POS Pro's advanced capabilities incurs a monthly charge of $89 per location.

Please note that customers who use the Shop Pay speed checkout button won't be charged any transaction fee for their purchases.

Shopify Payments Review – Security

When it comes to payment and money, security should be a priority for any merchant or business. The moment your customers lose their money due to payment errors, your business reputation will fall down. And, as we completed this Shopify Payments review, we found that it surely understands the importance.

All Shopify stores meet Level 1 PCI DSS standards, which are essential security measures for businesses handling credit and debit card transactions. Meanwhile, Shopify Payments ensures compliance by enforcing security protocols that include:

- Maintaining network security;

- Safeguarding cardholder information;

- Running a vulnerability management program;

- Enforcing strict access controls;

- Monitoring and testing networks;

- Upholding an information security policy.

Not to mention the fact that Shopify Payments is equipped with a fraud analysis feature. For any payment, it automatically runs an analysis to detect any suspicious activities. It will protect e-merchants from scam orders or fake transactions.

Explore more Shopify Features below:

- Shopify Metafields: How to Enhance Your Product Pages

- Shopify One Page Checkout: Simplify the Purchase Process

- Mastering Shopify Product Image Size: Improve Your Store's Appearance

- Shopify Inventory Management Made Easy: A Complete Guide

How to Set Up Shopify Payments in Simple Steps?

After shedding light on all aspects of the Shopify Payments review, it's time to get to the detailed setup procedure!

First, you need to set up and activate Shopify Payments before your clients can purchase items on your e-store using their credit cards. In the Shopify settings, you can activate Shopify Payments from the Payment Providers tab.

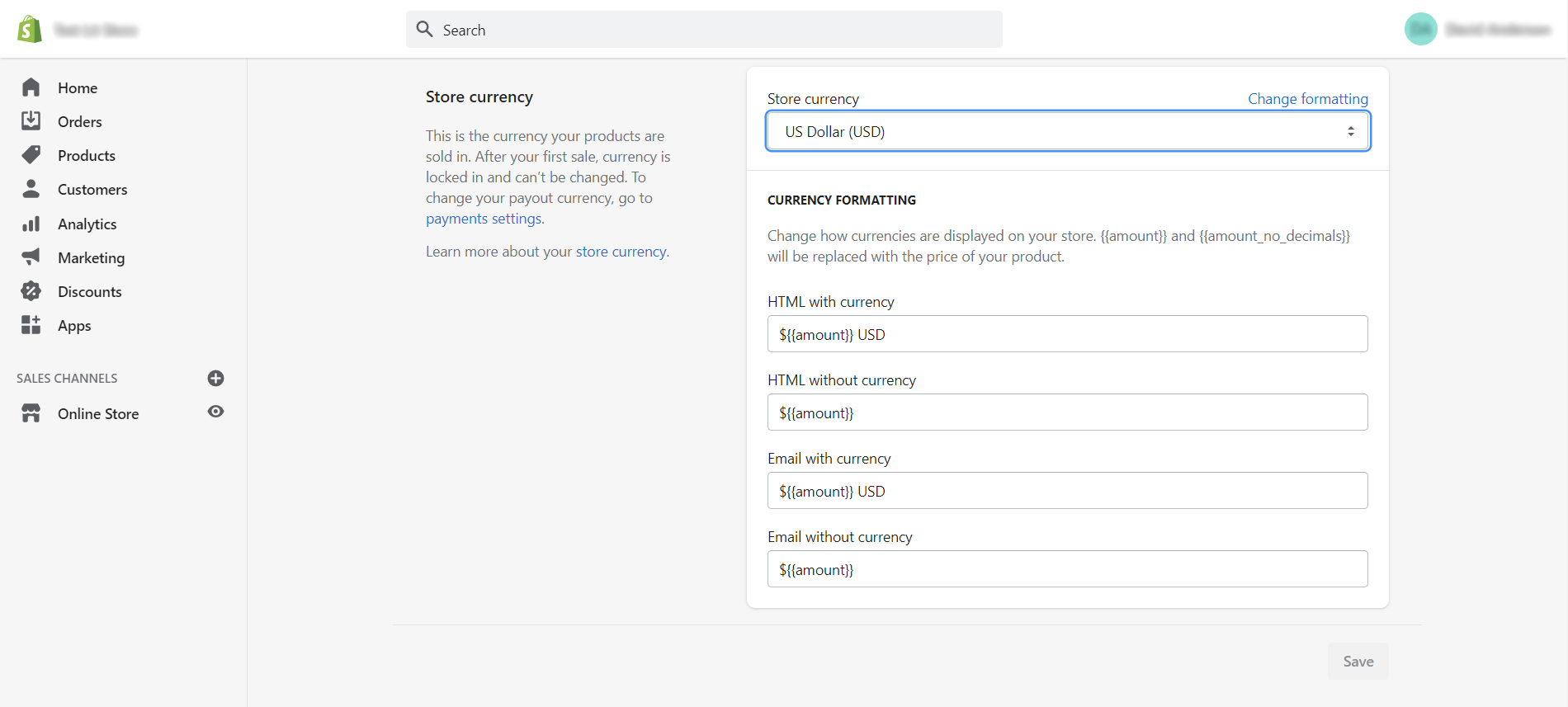

Step 1: Decide on your store currency

This is such an essential part of the setup process, as it will affect your product price and sales report in your Shopify admin. Therefore, make sure you choose the right currency. In case you want to select a new monetary unit, go to Settings > General > Store currency.

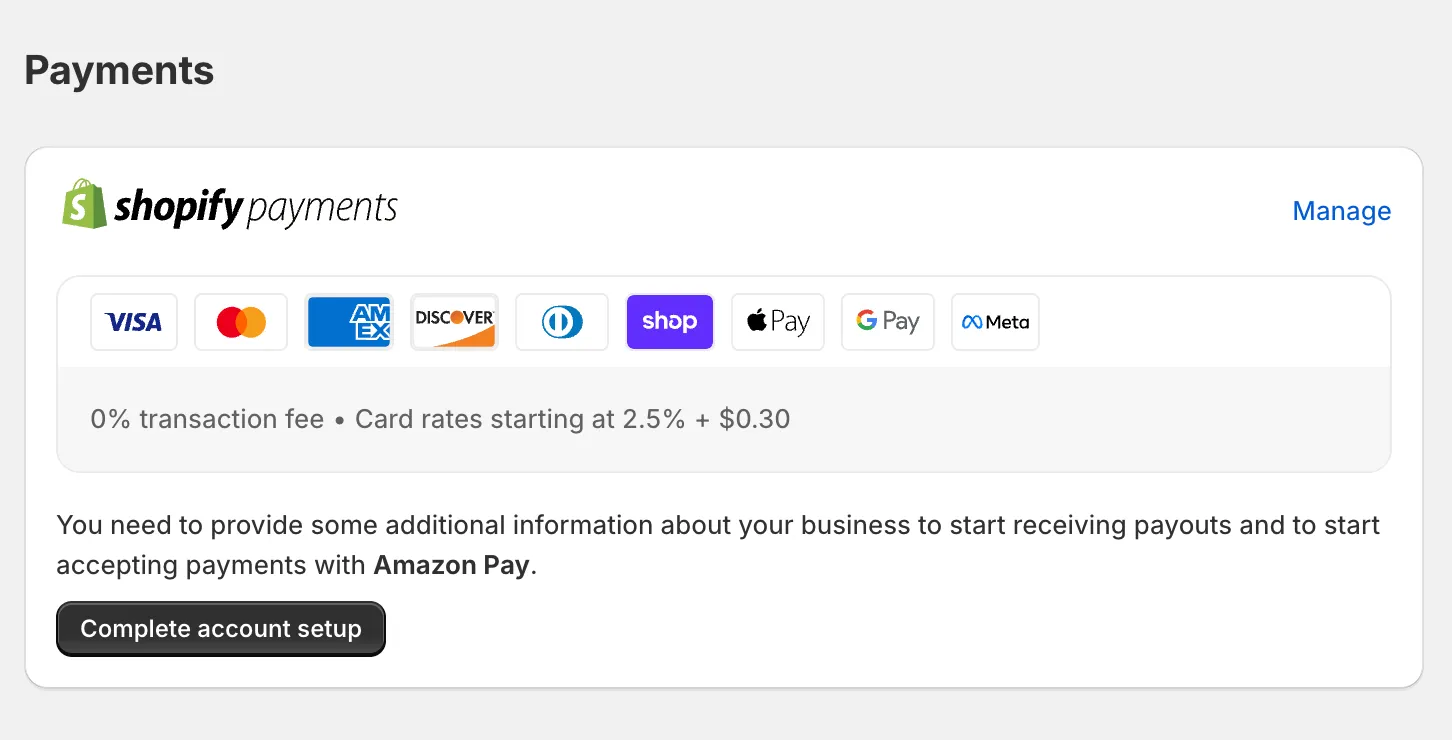

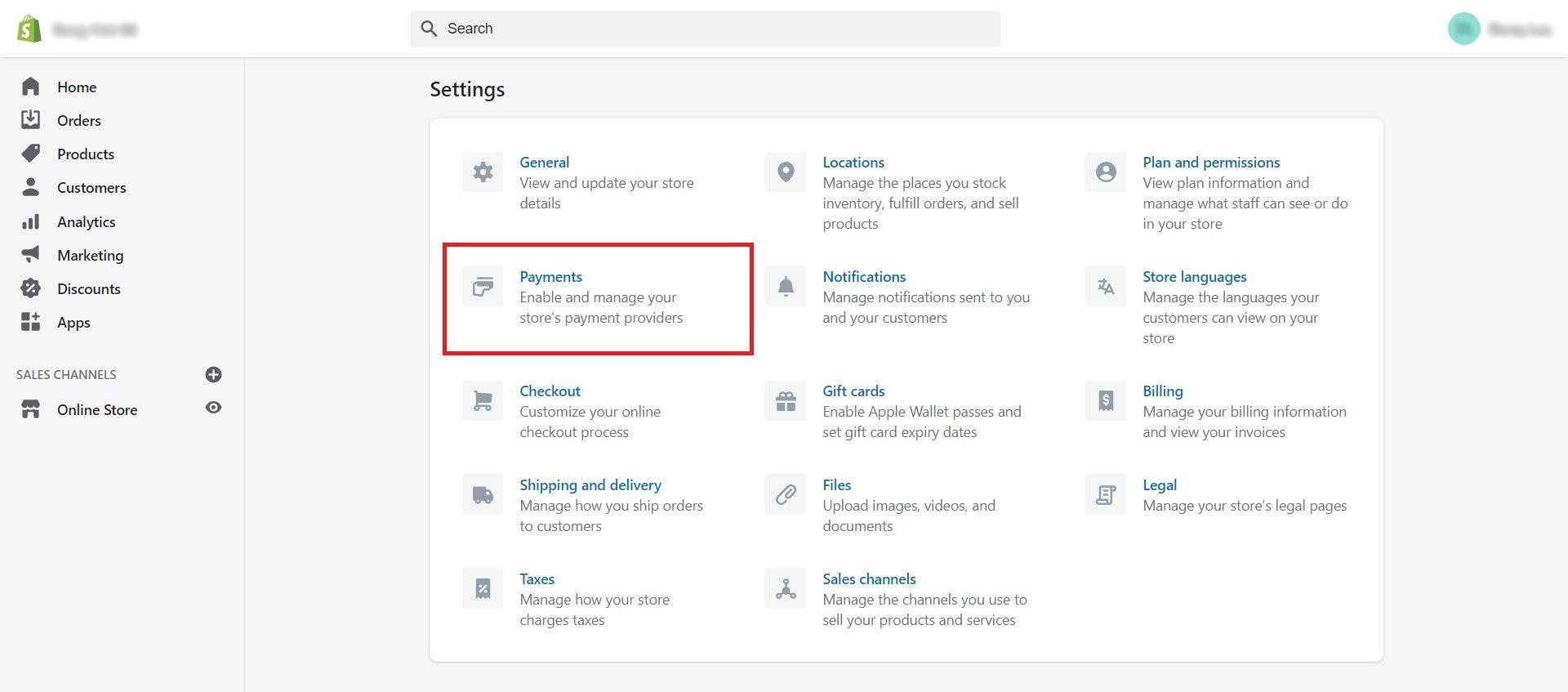

Step 2: Go to the Payments section

After clicking on the Settings section on your left, you can see a section named “Payments: Enable and manage your store’s payment providers”.

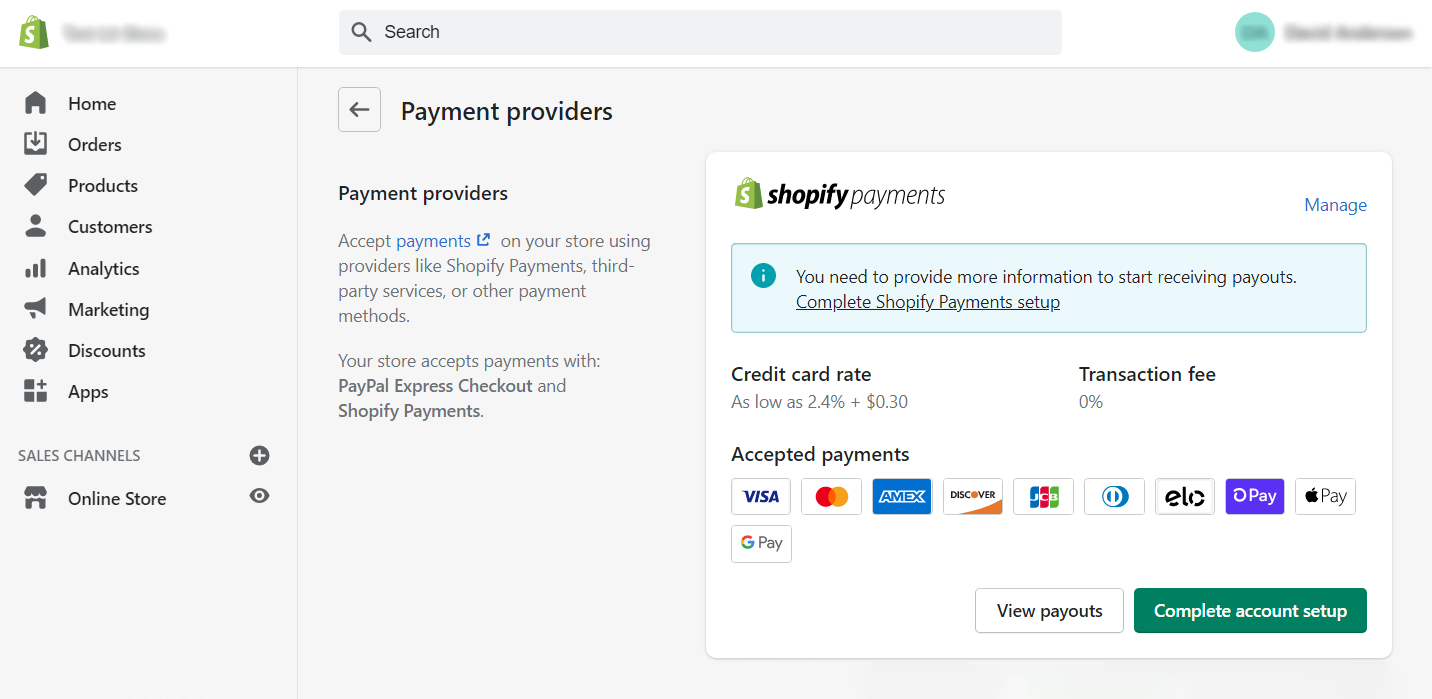

Step 3: Choose Shopify Payments as a payment provider

In the Accept credit cards section, Shopify Payments is right at the top of the payment provider list. Shopify has briefly listed some basic information, such as the Credit card rate, Transaction fee, and Accepted payment methods. Merchants who conduct research on other payment providers like PayPal and Amazon Pay can see that they are obviously at competitive prices.

To proceed, just click on “Complete account set up” and then provide all the necessary information to Shopify.

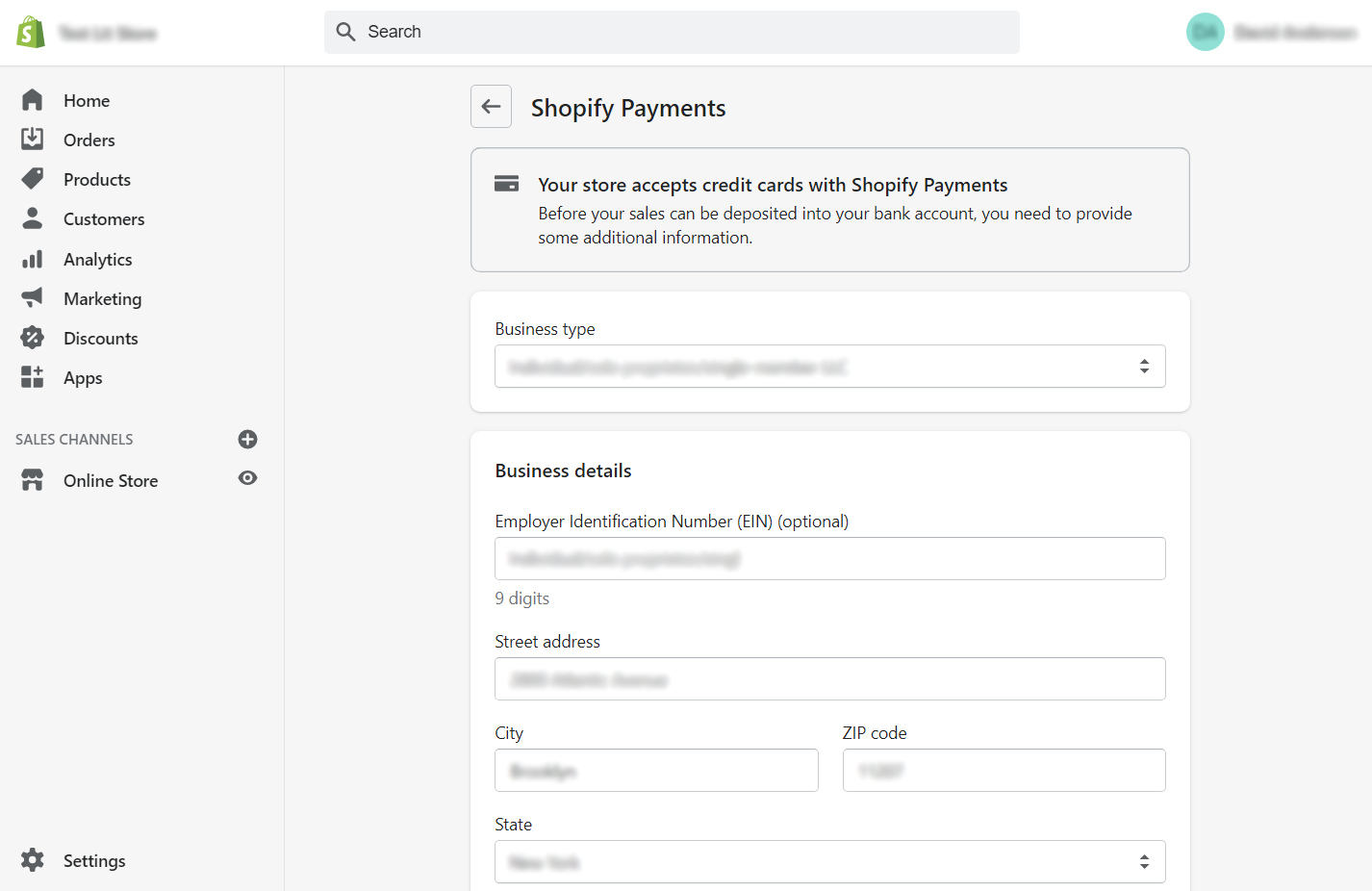

Step 4: Complete account setup

Here you can see all the required information to set up your Shopify Payments account, including Business details, Personal details, Product details, Customer billing statements, and Banking information. Do not forget to read the terms and conditions of Shopify Payments before clicking on the “Complete account setup” button at the bottom of the page.

Step 5: Test Shopify Payments

And you have finished the setup process. Now all you need to do is wait for Shopify to review your application and start the approval process for applicable local payment methods and credit card methods.

Last but not least, make sure to test your Shopify Payments by placing orders. This will help you control the customer experience and fix possible errors before publishing the website.

Shopify Payments vs Other Shopify Payment Methods

Though Shopify Payments is a payment processor tailored for Shopify stores, it is not the sole solution for business owners on Shopify. Besides Shopify Payments, Stripe and PayPal appear as top payment providers for any online business and fierce competitors to Shopify.

So the question is, who is the winner? Which one is better for your business? We will answer one by one in this section of the Shopify Payments review.

Features | Shopify Payments | Stripe | PayPal |

Supported payments |

|

|

|

Currencies | 130 currencies | 135+ currencies | 25 currencies |

Available in | 23 countries | 46 countries | 200 countries |

Transaction fee | Depends on your pricing plan. |

| 3.49% + fixed fees based on the currency. |

Average payout time | 2 business days for stores based in the US. | 2 business days for stores based in the US. | 5 – 7 business days. |

Mobile app | Yes | Yes | Yes |

Customer support | 24/7 support via phone call, live chat and email. | 24/7 support via phone call, live chat and email. | 24/7 support via phone call, live chat and email. |

Shopify Payments vs Stripe

Stripe provides an excellent solution for companies seeking to tailor their online payment process. With Stripe, you will benefit from an extensive developer platform, round-the-clock customer assistance, and a diverse range of payment options.

For those desiring a simpler checkout experience, Stripe offers seamless integrations with eCommerce platforms, accounting software, and other tools. Stripe applies a fixed transaction fee of 2.9% plus an additional 30 cents for online transactions.

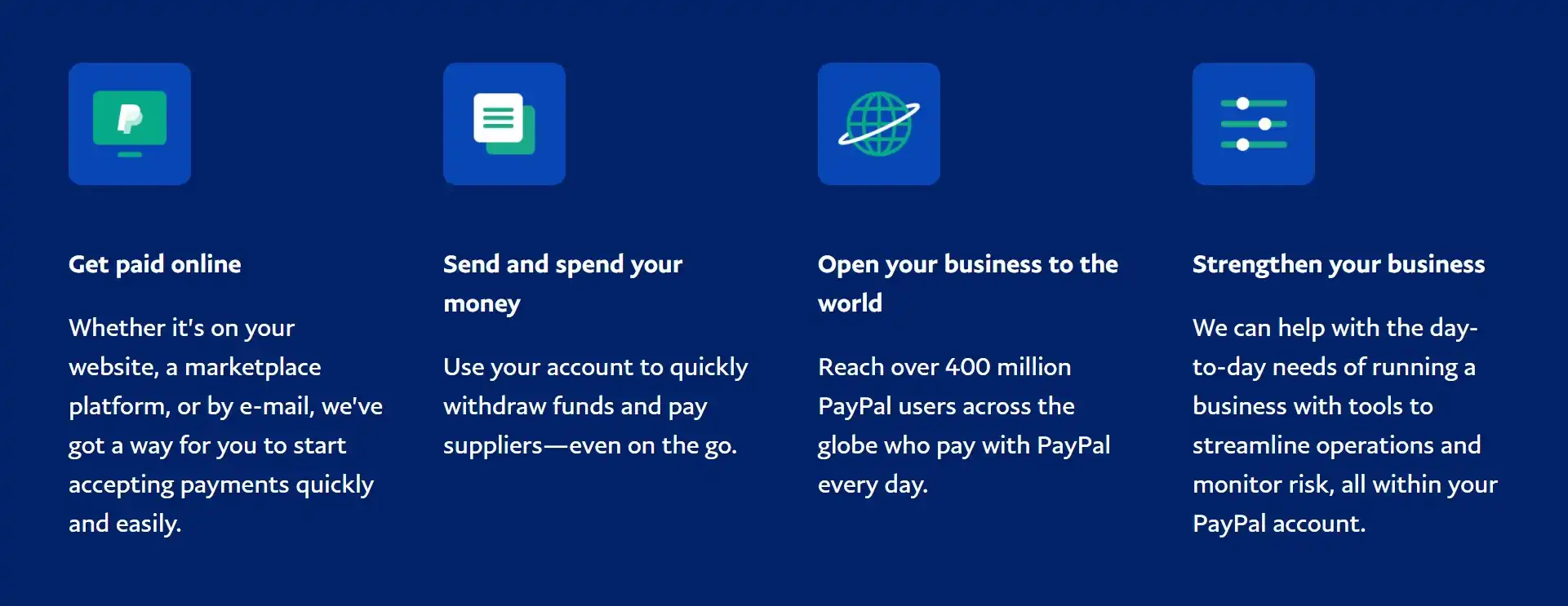

Shopify Payments vs PayPal

Another popular name for payment among Shopify users is PayPal. Similar to Shopify Payments, it also enables the processing of both card and bank payments within your store.

Offering both paid and free plans, PayPal's paid option includes features like chargeback protection, recurring billing, and fraud detection. Conversely, the free plan is ideal for budding small businesses, furnishing all essential payment processing functionalities necessary for your store.

Related Article: Top 10 Best Shopify Payment Gateways: A Complete Guide

Shopify Payments Review – FAQs

How does Shopify Payments work?

Shopify Payments simplifies the process of setting up and managing payments for Shopify merchants. When a customer makes a purchase, the payment is processed securely through Shopify Payments, and the funds are then deposited into the merchant's bank account.

Is Shopify Payments free?

Shopify Payments doesn't require any fee to get started with. However, in order to use Shopify Payments, store owners need to pay for a Shopify pricing plan to get your store up and running.

Is Shopify Payments the same as PayPal?

No, Shopify Payments and PayPal are two different payment methods. Shopify Payments is a built-in payment gateway provided by Shopify, whereas PayPal is a third-party payment processor that integrates with various eCommerce platforms, including Shopify.

You can choose to use either Shopify Payments, PayPal, or both, depending on their preferences and needs.

Do I have to use Shopify Payments?

No, you are not required to use Shopify Payments. While Shopify Payments offers convenience and seamless integration with the platform, merchants can also choose from a variety of alternative payment gateways, including PayPal, Stripe, Authorize.Net, and more. The availability of payment gateways may vary depending on your location and Shopify plan.

Final Words

In short, Shopify Payments is the most recommended payment provider when selling on Shopify, bringing in so much convenience. It is easier than ever for Shopify users to sell their products, receive money, and manage revenue.

Although there are still many complaints about strict regulations, Shopify Payments continues to stay ahead of the game. The convenience of Shopify Payments also contributes greatly to its success.

We hope that this Shopify Payments review has gathered all the information you need about the option. Don't forget to check out LitExtension blog and join our Facebook Community to get more eCommerce tips and news.

See more:

- Why Becoming a Shopify Partner Could Be Your Next Big Move

- Shopify Gift Cards: A Simple Way to Increase Customer Loyalty

- Streamline Your Ecommerce Operations with Shopify Flow