Choosing the best eCommerce payment gateways is one of the most important steps for running a successful online store, as it ensures that your customers can check out with safety and confidence. Nonetheless, with hundreds of payment providers available, selecting the ideal option for your business might be overwhelming.

Understanding your struggle, we have created this guide to walk you through the top choices and help you make a smart decision. Then, we’ll share everything you need to know about payment systems for eCommerce, including how payment gateways work and how to choose the one that fits your needs.

Based on our comprehensive analysis, the top selections for the best eCommerce payment gateways are:

- #1. PayPal

- #2. Shopify Payments

- #3. Stripe

- #4. Square

- #5. Authorize.net

- #6. Dwolla

- #7. 2Checkout

- #8. Adyen

- #9. Payline

- #10. Helcim

- #11. Mangopay

Keep on reading to explore the top eCommerce payment gateways trusted by online businesses around the world!

10+ Best eCommerce Payment Gateways for Your Business

Finding the right payment gateway is one of the most important decisions you’ll make when setting up your online store. It affects how customers pay, how much you pay in fees, and how smoothly your checkout process runs. With so many options available, each with unique strengths, it’s essential to choose a solution that fits your business model, industry, and growth goals.

To help you make the right decision, we’ve put together a list of the best eCommerce payment gateways based on reliability, ease of use, global reach, and industry specialization. Whether you're a small business owner, a growing brand, or an enterprise platform handling multi-vendor payments, there’s a solution here for you.

Payment Gateways | Users' Ratings | Transaction Fee for Online Payment | Best For |

PayPal | Capterra: 4.7/5 G2: 4.4/5 | 3.49% + $0.49 per transaction | Small businesses with global sales |

Shopify Payments | Capterra: 4.6/5 G2: 4.2/5 | Depends on your Shopify plan | Store owners already using Shopify |

Stripe | Capterra: 4.6/5 G2: 4.2/5 | 2.9% + 30¢ per transaction | Developers and subscription models |

Square Payments | Capterra: 4.7/5 G2: 4.6/5 | 2.9% + 30¢ per transaction | Small retail and service businesses |

Authorize.net | Capterra: 4.5/5 G2: 4.2/5 | 2.9% + 30¢ per transaction Monthly gateway subscription: $25 | Medium to large businesses |

Dwolla | Capterra: 4.4/5 G2: 4.3/5 | Custom pricing based on usage | ACH-focused platforms and B2B models |

2Checkout | Capterra: 4.2/5 G2: 4.6/5 | 3.5% + $0.35 per successful sale | Digital product sellers with global reach |

Adyen | Capterra: 4.6/5 G2: 3.4/5 | $0.13 plus a custom fee determined by payment method | Enterprise and omnichannel brands |

Payline | Capterra: 4.9/5 G2: 4.6/5 | Custom based on your monthly total transaction value | U.S. merchants wanting custom pricing2211 |

Helcim | Capterra: 4.9/5 G2: 4.6/5 | 2.27%+ 25¢ per transaction | Transparent, small-business pricing |

Mangopay | Capterra: 4.3/5 G2: 4.5/5 | Custom based on your monthly total transaction value | Marketplaces and crowdfunding sites |

#1 PayPal

Best for:

PayPal is an exceptional choice for small to mid-sized businesses seeking fast setup, global reach, and established customer trust without complex integration. As one of the first digital wallets to gain global traction, PayPal has built a strong reputation among both consumers and merchants.

PayPal ratings from users: 4.7/5 on Capterra | 4.4/5 on G2

We believe PayPal is an excellent option for businesses of all sizes, particularly those starting out or selling internationally. What makes PayPal stand out as one of the best eCommerce payment gateways is its instant familiarity. Millions of online shoppers already have PayPal accounts, which allows for faster checkout times without needing to re-enter payment details. This critical feature reduces checkout friction and consistently drives higher conversion rates. From our point of view, PayPal offers a great balance between simplicity, robust functionality, trust, and global reach, cementing its position among the best payment services available.

Key features:

- One-touch checkout: Let returning customers complete purchases with just one click, reducing cart abandonment.

- PayPal seller protection: Covers eligible transactions against chargebacks, reversals, and claims.

- Buy Now, Pay Later: Allows customers to finance purchases through PayPal Credit, increasing average order value.

- Dispute resolution center: Helps merchants manage refund requests and resolve customer disputes from one dashboard.

PayPal pros | PayPal cons |

✓ Offers a simple setup process with no technical knowledge required | ✗ Fees can add up, especially for international transactions and currency conversion |

✓ Requires no setup or monthly fees | ✗ Provide limited control over the look and feel of the payment process |

✓ Is compatible with major eCommerce platforms (Shopify, WooCommerce, BigCommerce, etc.) | |

✓ Supports multiple payment methods, including cards, PayPal balance, and bank transfers |

PayPal pricing:

- Online payments: 3.49% + $0.49 per transaction for payments via PayPal & Venmo | 4.99% + $0.49 per transaction for Pay Later service.

- Credit and debit cards: 2.99% + $0.49 per transaction for PayPal Checkout | 2.89% + $0.49 per transaction for Expanded Checkout.

- In-person payments: 2.29% + $0.09 per transaction for card present | 3.49% + $0.09 per transaction for card keyed in | 2.29% + $0.09 per transaction for payments made via QR code.

#2 Shopify Payments

Best for:

Shopify Payments is a native option for Shopify users that eliminates extra fees and offers seamless integration with orders, analytics, and the Shop Pay checkout.

Shopify POS ratings from users: 4.5/5 on Capterra | 4.4/5 on G2

Shopify Payments is Shopify’s built-in payment gateway, designed to make accepting online payments as seamless as possible for Shopify users. From our experience, it’s one of the best eCommerce payment gateways if you’re already running your store on Shopify.

What we love about Shopify Payments is how it removes the need for third-party integrations. Your payment system is fully embedded into your store, so everything just works right out of the box without any extra cost or coding.

While it’s only available in certain countries and requires your store to be on the Shopify platform, it offers a convenient, reliable, and cost-effective payment solution for most online sellers.

Key features:

- Shop Pay express checkout: Speeds up the checkout process with saved details, increasing conversion rates.

- Native Shopify integration: No need for third-party accounts – payments, orders, and reporting are managed in one place.

- Fraud analysis tools: Automatically flag risky orders to help reduce chargebacks and protect your business.

- Real-time tracking and analytics: Let you view and manage payments directly from your Shopify dashboard.

Pros | Cons |

✓ Instantly available for all Shopify stores, no third-party app required | ✗ Must be using Shopify as your eCommerce platform |

✓Seamless integration with your orders, analytics, and inventory | ✗ Only available in specific countries |

✓ Accepts major cards and digital wallets with localized options | ✗ Can’t be used if your business falls under Shopify’s restricted products list |

✓ Enhanced checkout speed with Shop Pay |

Shopify Payments pricing: Already included in your Shopify pricing plans.

#3. Stripe

Best for:

Stripe is the ideal choice among the best eCommerce payment gateways for growing businesses, SaaS, and developers who require a highly customizable gateway paired with robust API support and extensive global payment options.

Stripe ratings from users: 4.6/5 on Capterra | 4.2/5 on G2

If you're looking for one of the best eCommerce payment gateways that combines advanced features with a smooth user experience, Stripe is a serious contender. It is a powerful, developer-friendly payment gateway that offers unmatched flexibility, sleek design, and deep customization options for tech-savvy teams and large-scale eCommerce brands.

What we love about Stripe is how much control it gives you. Unlike hosted solutions that limit your checkout design, Stripe lets you build a fully branded, seamless payment experience right inside your store. While it may require a more technical setup, the long-term value it delivers is more than worth it for growing businesses.

Key features:

- Customizable API-based checkout: Gives developers full control over the look and flow of the payment process.

- Subscription and billing tools: Supports recurring payments, trials, metered billing, and invoicing.

- Advanced fraud protection: Includes Stripe Radar, a machine-learning fraud detection system built into every account.

- Instant payouts: Allows eligible merchants to access funds immediately, not just in the standard 2-day window.

Stripe pros | Stripe cons |

✓ Supports a wide range of payment methods (cards, wallets, bank transfers, etc.) | ✗ Requires technical knowledge or developer support for full integration |

✓ Provides an extremely flexible and customizable interface | ✗ Might be overwhelming for very small or beginner businesses |

✓ Offers built-in fraud detection with customizable rules | |

✓ Integrates seamlessly with trusted eCommerce platforms like WooCommerce, Shopify, and Magento |

Stripe pricing:

- Cards and wallets: 2.9% + 30¢ per transaction for domestic cards

- Link: 2.9% + 30¢ per transaction for domestic cards | 2.6% + 30¢ per transaction for Instant Bank Payments

- Buy Now Pay Later: Starting at 5.99% + 30¢ per transaction for Klarna

#4. Square Payments

Best for:

Square is a user-friendly choice for small businesses selling both online and offline, offering free tools and sleek hardware for retail environments.

Square Payments ratings from users: 4.7/5 on Capterra | 4.6/5 on G2

In our experience, Square is one of the best eCommerce payment gateways for small to medium-sized businesses, especially those that operate both online and in person. It stands out for its all-in-one ecosystem, offering sleek hardware for retail sales, intuitive software for managing your business, and a fully integrated online payment system.

We would highly recommend Square if you’re looking for a unified solution that combines point-of-sale (POS), eCommerce, invoicing, inventory management, and customer data in one platform. For businesses that value ease, mobility, and a clean user experience, Square is worth considering.

Key features:

- Unified POS and eCommerce system: Allows you to manage sales, inventory, and customer data across all channels.

- Offline payments: Accept payments without internet access and sync them later when you’re back online.

- Invoicing and recurring billing: Send digital invoices or set up recurring payments with ease.

- Built-in inventory management: Automatically tracks stock levels in real-time across physical and digital stores.

Square pros | Square cons |

✓ Is extremely easy to set up and use, even for beginners | ✗ Is only available in some select countries |

✓ Offers free tools like online store builder, POS app, and inventory tracking | ✗ Offers limited customization for advanced eCommerce sites |

✓ Requires no monthly fees for basic features | |

✓ Accepts major credit cards, Apple Pay, Google Pay, and gift cards |

Square Payments pricing:

- Monthly subscription: $0 for the Free plan | $29 for the Plus plan | Custom pricing for the Premium plan

- Processing fees:

- 2.6% + 15¢ per transaction for in-person payment

- 2.9% + 30¢ per transaction for online payment

- 3.5% + 15¢ per transaction for manually keying in card details

- 3.3% + 30¢ per transaction for invoices

#5. Authorize.net

Best for:

Authorize.net is a reliable and secure option for mid-to-large businesses that want advanced fraud tools, recurring billing, and flexibility with merchant accounts.

Authorize.net ratings from users: 4.5/5 on Capterra | 4.2/5 on G2

Authorize.net is one of the oldest and most trusted names in online payment processing. Backed by Visa, its secure gateway service connects businesses to essential payment processors, making it a solid choice for those wanting a stable, feature-rich solution with a long-standing reputation.

In our opinion, Authorize.net is one of the best eCommerce payment gateways for merchants who want a full-service payment solution with robust fraud protection, recurring billing support, and flexible integration options. While it's not as flashy or modern as some newer platforms like Stripe, it makes up for it with industry credibility, powerful features, and a strong network of merchant services.

Key features:

- Advanced fraud detection suite: Offers customizable filters and tools to prevent suspicious activity and reduce chargebacks.

- Support for multiple payment types: Accepts credit/debit cards, eChecks, digital wallets, and recurring payments.

- Virtual terminal: Allows you to manually enter transactions from any device, ideal for phone or mail orders.

- Recurring billing support: Enables subscription models and automated payment plans with flexible billing schedules.

Authorize.net pros | Authorize.net cons |

✓ Stands among the most trusted payment platforms in the industry | ✗ Requires more technical knowledge to customize |

✓ Offers excellent fraud protection and security tools | ✗ May be outdated in setup and interface when compared to modern gateways |

✓ Supports both online and in-person transactions | |

✓ Provides virtual terminal for keyed-in payments |

Authorize.net pricing:

- Monthly gateway subscription: $25

- Processing rates per transaction: 2.9% + 30¢ for All-in-one plan | 0.75% for eCheck | 10¢ + daily batch fee 10¢ for Payment gateway

#6 Dwolla

Best for:

Dwolla is designed for businesses that rely on bank transfers, such as platforms, marketplaces, or B2B services dealing with high-value transactions.

Dwolla ratings from users: 4.4/5 on Capterra | 4.3/5 on G2

Dwolla is a modern payment platform built specifically for ACH (Automated Clearing House) transactions. In our experience, Dwolla stands out as one of the best eCommerce payment gateways for businesses that prioritize bank transfers over traditional credit card payments.

What we like most about Dwolla is how it helps reduce transaction costs. Unlike card-based gateways that charge percentage-based fees, ACH payments are often much cheaper, making Dwolla a great alternative for businesses looking to save money on payment processing. It also offers powerful API tools, allowing developers to build custom workflows that fit complex business models.

Key features:

- ACH payment processing: Facilitates direct bank transfers between customers and businesses with low fees.

- White-label API: Allows you to fully brand the payment experience and integrate Dwolla into your existing platform.

- Real-time payment (RTP) support: Enables faster transfers when speed is a priority.

- Webhook event notifications: Keep your system in sync with transaction status updates in real-time.

Dwolla pros | Dwolla cons |

✓ Offers competitive transaction fees | ✗ Does not support credit or debit card payments |

✓ Offers full control over the user experience with white-label features | ✗ Requires technical resources for API integration |

✓ Provides fast and secure ACH transfers | |

✓ Supports automated workflows and recurring payments |

Dwolla pricing: Custom pricing based on usage

#7 2Checkout

Best for:

2Checkout is suitable for SaaS, digital goods, and international sellers who want localized checkout and global tax compliance without complex legal setup.

2Checkout ratings from users: 4.2/5 on Capterra | 4.6/5 on G2

2Checkout, now operating under the Verifone brand, is a global payment gateway known for its strong international capabilities and wide range of eCommerce features. In our experience, 2Checkout is one of the best eCommerce payment gateways for businesses that want to sell internationally without dealing with the complexities of setting up local entities or handling multiple currencies and tax regulations.

While it may not be as developer-centric as Stripe or as beginner-friendly as PayPal, 2Checkout is an excellent middle ground, offering powerful features, flexible integrations, and a clear focus on helping businesses expand across borders.

Key features:

- Global payments: Accepts transactions from over 200 countries, supporting 100+ currencies and 45+ payment methods.

- Localized checkout: Automatically adapts checkout pages based on customer location, language, and currency.

- Built-in tax and compliance management: Automatically calculates and handles VAT, GST, and sales tax across regions.

- Integrations with major platforms: Works with Shopify, WooCommerce, BigCommerce, Magento, and more.

2Checkout pros | 2Checkout cons |

✓ Offers built-in support for subscription billing and licensing | ✗ Provides limited customization of checkout flow |

✓ Helps improve global conversion rates with localized checkout | ✗ Might charge higher fees for international transactions |

✓ Handles tax compliance automatically | |

✓ Supports a wide range of payment methods beyond credit cards |

2Checkout pricing:

- 2Sell: 3.5% + $0.35 per successful sale

- 2Subscribe: 4.5% + $0.45 per successful sale

- 2Monetize and 4Enterprise: Custom pricing

#8 Adyen

Best for:

Adyan is built for large-scale businesses and enterprises that need unified payments across online, in-store, and mobile with maximum flexibility.

Adyen ratings from users: 4.6/5 on Capterra | 3.4/5 on G2

Adyen is a powerful, enterprise-grade payment gateway built for global businesses that need scalability, flexibility, and complete control over their payment infrastructure. From our point of view, Adyen is one of the best eCommerce payment gateways for large brands and fast-growing companies that want to accept payments across multiple channels and markets, all under one unified system.

What we admire about Adyen is its end-to-end solution. It provides both the payment gateway and the acquiring bank services, meaning you don't need a third-party processor. This leads to faster settlements, lower costs, and better data insights.

Key features:

- Unified commerce platform: Manages online, in-app, and in-store payments in one system for a seamless customer experience.

- Built-in acquiring: Eliminates the need for third-party processors, leading to better approval rates and faster payouts.

- Risk management engine: Includes advanced fraud detection and customizable risk rules.

- Real-time reporting and insights: Gives detailed analytics on transactions, performance, and customer behavior.

Adyen pros | Adyen cons |

✓ Trusted by major global brands for enterprise-level payment processing | ✗ Requires technical resources for integration and ongoing management |

✓ Combines gateway, processing, and risk tools into one platform | ✗ Requires no public flat-rate pricing, custom quotes only |

✓ Supports omnichannel payments (web, mobile, in-store) | |

✓ Offers flexible API for full customization and integration |

Adyan pricing:

- Processing fee: $0.13

- Plus fee determined by the payment method

#9 Payline

Best for:

Payline iss a reliable and transparent option for U.S.-based businesses, especially those needing support for high-risk industries or in-person payments.

Payline ratings from users: 4.9/5 on Capterra | 4.6/5 on G2

Payline is a flexible and reliable payment gateway that caters to both small businesses and larger enterprises. In our view, Payline stands out as one of the best eCommerce payment gateways for businesses that want customizable pricing, high-risk merchant support, and a strong blend of online and in-person payment features. What we appreciate about Payline is its transparency; it offers clear, competitive rates and flexible payment plans that suit a variety of business types.

To be honest, Payline may not be as flashy or widely known as Stripe or PayPal, but its combination of personal support, flexible plans, and honest pricing makes it a strong and dependable option.

Key features:

- Interchange-plus pricing model: Offers more transparent, competitive rates compared to flat-rate gateways.

- Retail + eCommerce support: Accepts payments online, in-store, or through mobile POS systems.

- API and gateway integration: Flexible options for custom online payment solutions.

- Advanced fraud protection: Includes tools to prevent chargebacks and reduce transaction risks.

Payline pros | Payline cons |

✓ Offers transparent pricing with an interchange-plus model | ✗ Requires merchant account setup, which adds complexity for small businesses |

✓ Supports a wide variety of business types, including high-risk merchants | ✗ May not be ideal for international businesses outside the U.S. |

✓ Provides strong security tools and fraud protection | |

✓ Supports ACH and recurring billing |

Payline pricing: Custom based on your total monthly transaction volume

#10 Helcim

Best for:

Helcim is a no-hidden-fees option for small to mid-sized North American businesses that value simplicity, volume discounts, and all-in-one tools.

Helcim ratings from users: 4.9/5 on Capterra | 4.6/5 on G2

In our experience, Helcim is one of the best eCommerce payment gateways for businesses that want competitive rates, modern tools, and honest, no-hidden-fee pricing. What sets Helcim apart is its commitment to transparency; it publishes its full pricing model online, uses interchange-plus pricing, and doesn't lock you into long-term contracts or charge monthly fees.

The platform combines a payment gateway, virtual terminal, POS system, and invoicing into one simple and intuitive interface. It’s especially ideal for businesses that want to accept payments online, in-person, or via recurring billing – all while managing everything from a single dashboard.

Key features:

- Interchange-plus pricing: Offers complete rate transparency with no hidden fees or monthly charges.

- All-in-one merchant platform: Includes payment gateway, virtual terminal, invoicing, POS, and inventory management.

- Volume-based discounts: Automatically reduces transaction rates as your sales increase.

- Recurring billing tools: Supports subscriptions and installment payments with customer management built in.

Helcim pros | Helcim cons |

✓ Offers transparent, fair pricing with no monthly or setup fees | ✗ Is only available in the U.S. and Canada |

✓ Includes POS tools and invoicing at no additional cost | ✗ Offers fewer international payment methods compared to global platforms |

✓ Provides a clean, user-friendly dashboard with real-time reporting | |

✓ Requires no contracts or cancellation fees |

Helcim fee per transaction for businesses with a monthly sales volume of $10K:

- In-person selling: 1.83%+ 8¢ for Mastercard, Visa, Discover cards | 2.61%+ 8¢ for American Express cards | 1.00%+ 8¢ for PIN-Debit

- Keyed & Online: 2.27%+ 25¢ for Mastercard, Visa, Discover cards | 3.01%+ 25¢ for American Express cards

- ACH: 0.5% + 25¢ for transactions below $25,000 | 0.55% + 25¢ for transactions above $25,000

#11. Mangopay

Best for:

Mangopay is tailored for multi-vendor platforms and regulated industries that need escrow, split payments, and KYC compliance under one flexible system.

Mangopay ratings from users: 4.3/5 on Capterra | 4.5/5 on G2

Mangopay is a specialized payment gateway built specifically for platforms, marketplaces, crowdfunding sites, and fintech services. In our opinion, it’s one of the best eCommerce payment gateways for businesses that need complex payment flows, like holding funds in escrow, splitting payments between users, or managing multi-party transactions.

What we really like about Mangopay is its customizability. You get access to a full-featured API that lets you build flexible workflows, such as delaying payouts to vendors until an order is delivered, or splitting a single transaction across multiple sellers. It also comes with built-in tools for KYC (Know Your Customer), AML (Anti-Money Laundering), and other compliance requirements, making it an ideal fit for businesses operating in regulated sectors.

Key features:

- Escrow and split payments: Supports holding funds and distributing them to multiple parties based on your platform rules.

- Custom API for platforms: Gives full control over the user experience, payment flows, and payout schedules.

- KYC and compliance tools: Built-in identity verification, AML, and GDPR compliance for regulated platforms.

- Multi-currency support: Accepts payments in multiple currencies and converts them automatically.

Pros | Cons |

✓ Designed for platforms and marketplaces with complex payment needs | ✗ Not suitable for traditional one-to-one eCommerce stores |

✓ Supports advanced payout logic and escrow functionality | ✗ Requires technical resources for setup and API integration |

✓ Fully customizable with developer-friendly APIs | ✗ No plug-and-play checkout for non-developers |

✓ White-label wallet system for user-level transaction tracking |

Pricing: Custom, based on your monthly transaction volume.

eCommerce Payment Gateways – All You Need to Know

How does the payment system for eCommerce work?

An eCommerce payment gateway is a secure technology that helps online businesses accept payments from customers. It works by transferring payment information between your website, the customer’s bank, and your bank. This process allows money to move safely from the buyer to the seller.

In simple terms, the eCommerce payment gateway is like a digital cashier. It handles the behind-the-scenes steps that make online transactions possible. This includes verifying card details, checking for fraud, and making sure the funds are available.

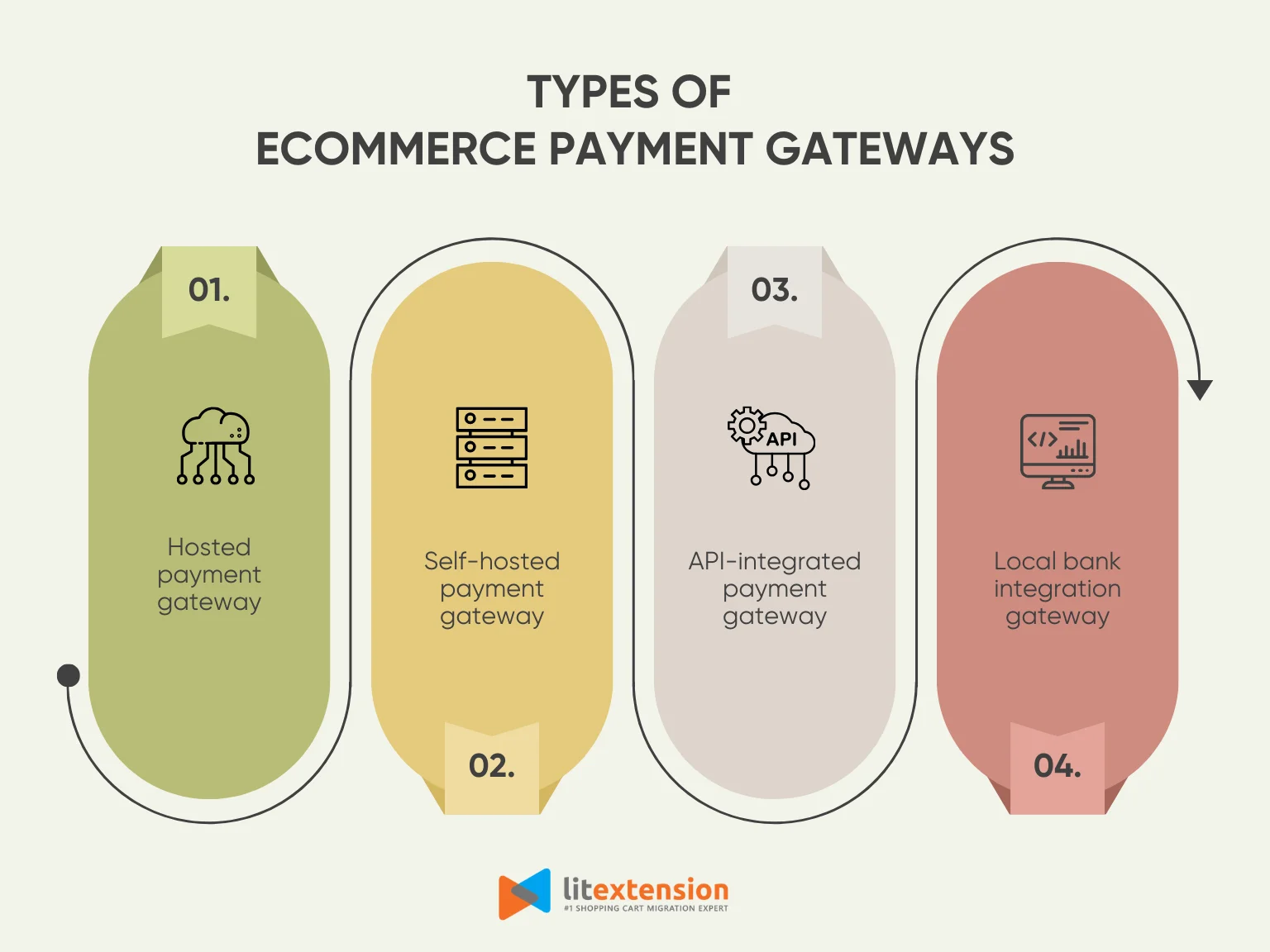

Types of eCommerce payment gateways

eCommerce payment gateways come in different types, depending on how they handle transactions, how they interact with your website, and who manages the security. Typically, there are four main types of payment systems including.

- Hosted payment gateway: A hosted payment gateway takes the customer away from your website to complete the transaction on the provider’s platform. After the payment is made, the customer is redirected back to your store.

- Self-hosted payment gateway: In this model, customers enter their payment details directly on your website, but the data is then sent to the payment gateway’s server for processing.

- API-integrated payment gateway: Also known as non-hosted or direct gateways, API-integrated gateways allow complete control over the payment process. Customers enter their details directly on your site, and payments are processed through an API in the background.

- Local bank integration gateway: This type of gateway redirects customers to their own bank’s payment portal to approve the payment. After confirmation, the user returns to your site.

By understanding these types, you can better evaluate the best eCommerce payment gateways based on how they integrate with your store, what kind of user experience they offer, and the level of security they provide. Each type serves different needs, so selecting the right one depends on your goals and resources.

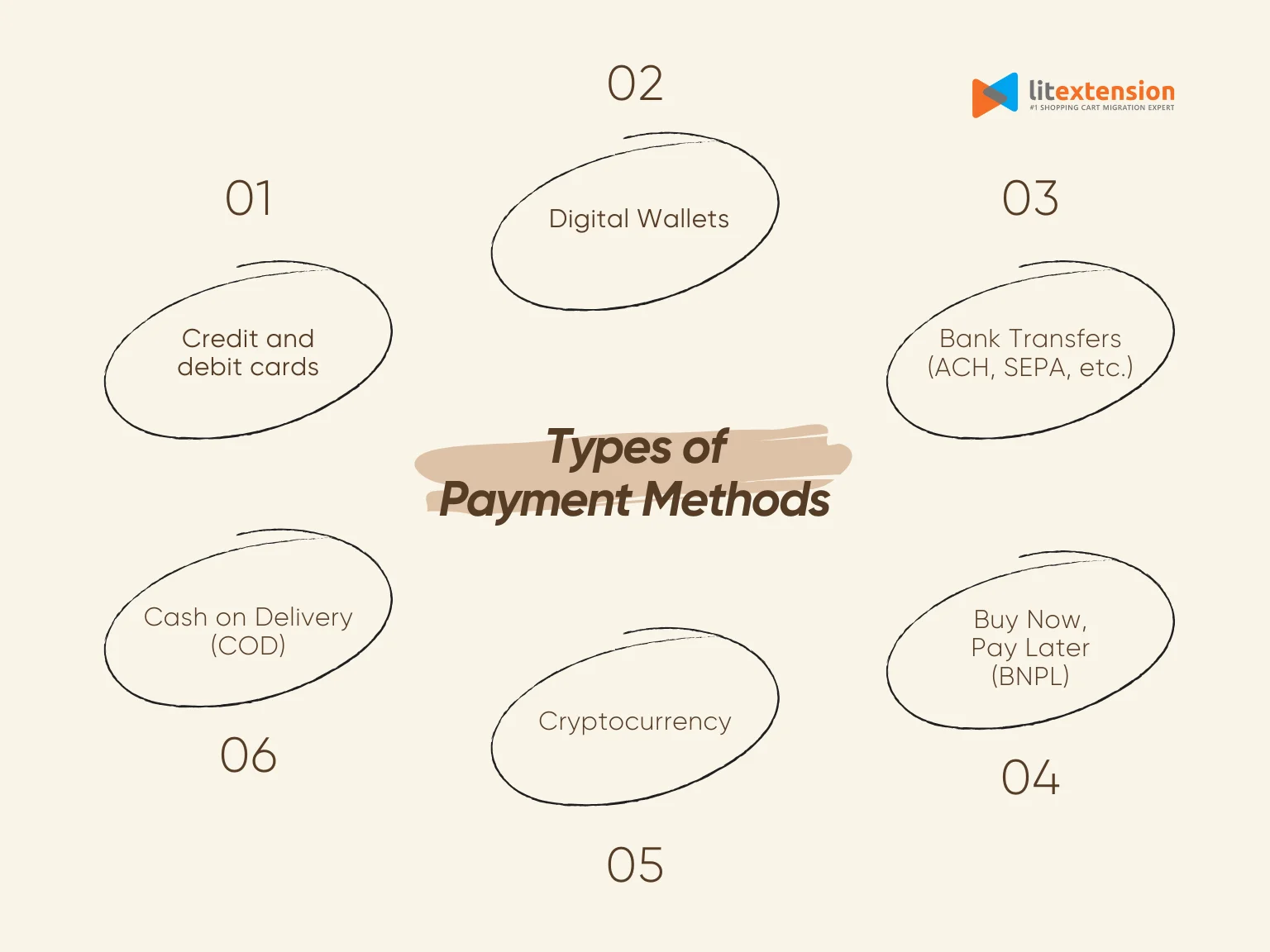

Types of eCommerce payment methods

When setting up an online store, offering a variety of payment methods is essential. It helps improve customer satisfaction, reduce cart abandonment, and support global buyers with different preferences. The best eCommerce payment gateways often support multiple payment methods to give your customers flexibility at checkout.

Below are the main types of eCommerce payment methods you should know:

1. Credit and Debit cards

This is the most common payment method worldwide. Customers can enter their Visa, Mastercard, American Express, or other card details directly at checkout. Most gateways support real-time card authorization and fraud protection.

2. Digital wallets

Digital wallets like Apple Pay, Google Pay, PayPal, and Shop Pay let customers store their payment information securely and check out with just a few clicks or taps. These methods are fast, secure, and mobile-friendly.

3. Bank transfer (ACH, SEPA, etc.)

Bank transfers, such as ACH in the U.S. or SEPA in Europe, allow customers to pay directly from their bank accounts. These payments are usually slower but come with lower fees, making them ideal for large or recurring transactions.

4. Buy Now, Pay Later (BNPL)

BNPL options like Klarna, Afterpay, and Affirm let customers pay in installments while the merchant receives full payment upfront. These services can increase order values and appeal to younger shoppers.

5. Cryptocurrency

Some payment gateways now allow customers to pay with digital currencies like Bitcoin, Ethereum, or USDT. While adoption is still limited, this method is gaining traction among certain customer segments.

6. Cash on Delivery (COD)

Though not truly digital, some eCommerce platforms, especially in regions like Southeast Asia or the Middle East, still support COD as a trusted payment option.

How to Choose the Best eCommerce Payment Gateways for Your Business

From our experience, selecting the best eCommerce payment gateways for your business is more than just choosing a tool to process transactions. It’s about finding a solution that matches your business model, supports your growth, and delivers a smooth, secure experience for your customers. To make the right choice, there are several key factors you should carefully evaluate. Each plays a role in how efficiently your payment system works and how confident your customers feel when making a purchase.

1. Consider your business size and type

The first step in choosing a payment gateway is understanding your business needs. Smaller businesses, startups, or solo entrepreneurs may benefit from hosted gateways that are simple to set up, require little to no technical knowledge, and handle all the security and compliance for you. On the other hand, larger businesses or those with more complex needs often prefer integrated gateways for more flexibility, scalability, and advanced features.

2. Evaluate transaction fees and pricing structures

Payment gateways come with different pricing models, and understanding the cost structure is critical for maintaining healthy profit margins. While a gateway with no monthly fee might seem appealing, it could become more expensive over time if you process a large number of transactions. Therefore, always compare the total cost based on your expected sales volume.

3. Check supported payment methods

The more options your gateway supports, the more likely customers are to complete their purchases. As a result, consider choosing the best eCommerce payment gateways that support a wide variety of payment methods, including major credit and debit cards, mobile wallets, direct bank transfers, and even Buy Now Pay Later (BNPL) services.

4. Prioritize security and compliance

Security is non-negotiable when handling sensitive payment information. Your chosen gateway should be PCI DSS (Payment Card Industry Data Security Standard) compliant, which means it meets strict industry standards for data protection. Make sure to look for features like SSL encryption, fraud detection tools, tokenization, and two-factor authentication.

5. Assess integration and ease of use

Integration matters, especially if you already use an eCommerce platform like Shopify, Magento, or BigCommerce. Some gateways offer built-in plugins or apps for easy setup, while others require more technical knowledge and API development.

If you have limited resources or no development team, a plug-and-play option may be the best choice. However, if you want full control over the checkout process and branding, an API-integrated gateway will offer more flexibility.

Bonus resources on eCommerce payment gateways:

6. Ensure mobile optimization

With more consumers shopping from mobile devices, the best eCommerce payment gateways that you choose must be mobile-friendly. This means fast loading times, responsive design, and support for mobile wallets. A poor mobile experience can lead to cart abandonment, so always test the mobile checkout flow when committing to an option.

7. Look into customer support and reliability

Strong support ensures that any payment interruptions are resolved quickly, preventing lost sales and unhappy customers. Hence, look for payment gateways that offer 24/7 customer service through multiple channels such as chat, email, or phone. Additionally, check for helpful documentation, a knowledge base, or community forums.

8. Consider global capabilities

If you plan to sell internationally or already do, it’s important to choose a gateway that supports multi-currency transactions and localized checkout experiences. Some gateways can automatically convert currencies, display local payment options based on a user’s location, and comply with regional laws and tax rules. These features can help expand your market and make international customers feel more comfortable buying from your store.

Best eCommerce Payment Gateways – FAQs

No schema found.Final Thoughts

All in all, the right gateway doesn’t just process payments, it helps you build trust with your customers, reduce cart abandonment, and streamline your sales process. Therefore, we hope that this article has helped you in choosing the best eCommerce payment gateways that best suit your online store.

If you like this article, please don’t forget to check out other blogs on our LitExtension website for more expert tips and insights.