Square is well-known as an all-in-one commerce solution that provides businesses with various sales tools: a powerful POS system with built-in payment processing and online store capabilities. Nevertheless, Square isn’t a one-size-fits-all solution. But the good thing is there are now tons of Square competitors in the market that cater to different use cases.

The best competitors of Square are:

- #1. Shopify POS – Best for eCommerce

- #2. Toast – Best for restaurants

- #3. Lightspeed – Best for inventory management

- #4. Clover – Best for flexible payment options

- #5. Stripe – Best for customization

- #6. Payment Depot – Best for high-volume stores

- #7. PayPal – Best for global selling

- #8. Helcim – Best for budget-friendly

- #9. Adyen – Best for enterprise-level omnichannel payments

- #10. Wise – Best for affordable cross-border business payments

In this article, we will break down each platform to determine if it’s the best fit for your business. Let’s explore!

Square POS Competitors: A Quick Verdict

No | Square competitors | Pricing | Suitable for | Rating score (G2) |

1 | Shopify POS | Included in Shopify plan Shopify POS Pro is $89/month | Stores that want to integrate Shopify POS with Shopify’s advanced eCommerce features | 4.4/5 |

2 | Toast | From $69/month per location | Restaurants, food trucks, or F&B businesses want a specialized POS system for the food industry | 4.2/5 |

3 | Lightspeed | From $89/month for one location | Businesses looking for Square competitors with strong inventory management features | 4.0/5 |

4 | Clover | From $13/month (different services might have different pricing system) | Those seeking a system with versatile payment options and hardware options | 3.8/5 |

5 | Stripe | In-person: 2.7% + $0.05 Online: 2.9% + $0.30 | Brands that need extensive customization options and accept multiple currencies. | 4.2/5 |

6 | Payment Depot | From $79/month | Stores that process large numbers of transactions | 4.2/5 |

7 | PayPal | In-person: 2.29% + 9¢ Online: 3.49% + 49¢ | Businesses that have a strong focus on eCommerce | 4.4/5 |

8 | Helcim | In-person: from 1.83% + 8¢ Online: from 2.77% + 25¢ | Those who want to benefit from lower rates as your business expands. | 4.0/5 |

9 | Adyen | Interchange++ model; e.g., Visa/Mastercard: $0.13 + 0.80% + interchange; varies by method | Large, enterprise-level brands needing global, omnichannel payments and high customization | 3.8/5 |

10 | Wise | Conversion fees from ~0.33%; card/setup fees vary; no monthly fees | Businesses that frequently send/receive global payments and manage multiple currencies, not needing a POS system | 4.2/5 |

#1. Shopify POS – Best Square Competitor for eCommerce

⭐ Users' rating for Shopify POS: 4.4/5 on G2

When to choose Shopify POS over Square?

If you require deep eCommerce capabilities, scalable tools for growth, and a centralized platform for inventory, customers, and orders across all channels, Shopify POS is among the best Square Up competitors you shoud watch out for.

Shopify POS Pricing

POS has two versions: POS Lite vs POS Pro. The POS Lite is free. However, to use POS Lite, you need to use one of Shopify’s pricing plans, which start from $39 to $399 per month.

For Shopify POS Pro with more advanced in-person selling functionalities, you’ll need to pay $89/month per location setting.

Highlight features of Shopify POS

- Awesome multichannel capabilities: You can sync your Shopify POS products with the online store, Google Merchant Center, Amazon, etc., and manage your inventory in one place.

- Extensive App Store: The Shopify App Store is crowded with over 8,000 robust apps, allowing you to extend your store functionality without the technical hassle

- Various payment methods: You can accept various payment methods with Shopify POS like credit cards, debit cards, digital wallets, Buy Now Pay Later (BNPL), etc.

Pros | Cons |

|

|

#2. Toast – Best Square POS Competitor for Restaurants

⭐ Users' rating for Toast: 4.2/5 on G2 | 3.5/5 on Trustpilot

When to choose Toast over Square?

If you run a restaurant, Toast is one of the best Square POS competitors you can choose. It shines in full-service and quick-service environments alike, giving staff the tools they need to move quickly and efficiently.

Toast Pricing

Toast standard plan costs $69/month per location. For advanced features, you'll need to opt for higher-tier plans or custom pricing. For instance, you must be on The New Restaurants Plan ($110/month) for payroll and scheduling tools. Or, if you want online ordering, you might need to pay $165/month for the Growth plan.

And if you need to use certain add-ons, you’ll have to pay separate fees. For instance, the loyalty program add-on will cost you $50/month.

It’s also noteworthy that payment processing fees range from 2.49% + $0.15 to 3.39% + $0.15 per transaction, depending on your chosen plan (higher plans have lower fees).

Toast's highlight features

- Restaurant-specific functionality: Toast provides comprehensive tools tailored for food businesses, including table management, menu management, and kitchen display systems.

- Integrated online ordering: The platform offers built-in online ordering capabilities with commission-free in-house ordering.

- Advanced hardware options: Toast's hardware is specifically designed for restaurant environments, offering durability and functionality for busy kitchens and dining areas.

Pros | Cons |

|

|

#3. Lightspeed – Best Square Competitor for Inventory Management

⭐Users' rating for Lightspeed: 4.0/5 on G2 | 4.0/5 on Trustpilot

When to choose Lightspeed over Square?

If your business depends on advanced inventory management, Lightspeed is one of the best Square Up competitors you can consider. This platform is built to handle large product catalogs and streamline operations behind the scenes.

Lightspeed pricing

Lightspeed offers flexible pricing plans to suit different business needs. The basic plan starts at $89/month per location and one cash register. For more advanced features, Lightspeed Standard and Advanced cost $149 and $269 per month, respectively.

Lightspeed's highlight features

- Great multi-location features: Lightspeed POS enables you to seamlessly manage inventory across various store locations. Specifically, you can transfer stock or compare store performance between different locations

- Supplier management functionality: With Lightspeed, you can keep close records of your suppliers, track orders, and manage relationships with them efficiently

- Automated re-ordering: With the automatic reordering feature, you can set reorder points for each variant. For instance, you can set an automatic reorder for a white T-shirt if the stock level for this unit hits 50 items.

Pros | Cons |

|

|

#4. Clover – Best Square POS competitor for Flexible Payment Options

⭐ Users' rating for Clover: 3.8/5 on G2

When to choose Clover over Square?

Clover is one of the best Clover competitors for businesses that want flexible payment options. With a wide range of hardware and customization options, Clover is ideal for businesses that want more control over how they accept payments.

Clover Pricing

Clover offers five pricing plans:

- Payments Plus: Starts at $14.95/month

- Register Lite: Starts at $14.95/month

- Register: Starts at $39.95/month

- Counter Service Restaurant: Starts at $54.95/month

- Table Service Restaurant: Starts at $84.95/month

Clover’s hardware costs range from $99 for the Clover Go mobile card reader to $1,799 for the Clover Station Duo.

Clover's highlight features

- Flexible payment processing: You can accept payments in-person, online, over the phone, and through various methods, including credit cards, debit cards, and digital wallets.

- Integrated scale support: For businesses that sell products by weight, Clover's built-in support for weight scales is a significant advantage, streamlining the checkout process for delis, produce markets, and similar establishments.

- Advanced restaurant features: Clover provides more comprehensive table management tools, making it a stronger choice for full-service restaurants compared to Square's more basic offerings in this area.

Pros | Cons |

|

|

#5. Stripe – Best Square Competitor for Customization

⭐ Users' rating for Stripe: 4.2/5 on G2

When to choose Stripe over Square?

If your business operates online, needs advanced subscription billing, or requires tailored checkout experiences, Stripe stands out among the best competitors of Square. Choose it when flexibility and customization matter more than out-of-the-box ease.

Stripe pricing

Stripe offers a simple, transparent pricing structure:

- Online transactions: 2.9% + $0.30 per successful card charge

- In-person transactions: 2.7% + $0.05 per transaction (with Stripe Terminal)

- No monthly fees for the standard plan

Stripe's highlight features

- Global payment support: With Stripe, you can accept payments in 135+ currencies, which is ideal for international businesses.

- Robust subscription management: Stripe comes with powerful tools for handling recurring billing and subscription-based business models.

- Customizable checkout experience: Stripe offers extensive options to tailor the payment flow to your brand

Pros | Cons |

|

|

#6. Payment Depot: Top Square Competitor for High-volume Stores

⭐ Users' rating for Payment Depot: 4.2/5 on G2

When to choose Payment Depot over Square?

If your business handles significant sales volume and wants predictable, low-cost processing, Payment Depot is a smarter financial choice. Choose it when cutting processing costs matters more than having an all-in-one system.

Payment Depot pricing

Payment Depot entry-level plan costs you $79/month. They also offer custom pricing if you process over $250,000 per year. For in-person transactions, you'll pay the interchange rate plus a flat fee of $0.08 per transaction. Online transactions are slightly higher, with a fee structure of interchange plus $0.18 per transaction.

Payment Depot's highlight features

- ACH payment processing: Payment Depot is a great choice for businesses that need to accept bank transfers.

- Free equipment: Depending on the plan, Payment Depot may offer you a free POS equipment setup.

- Transparent pricing: Payment Depot has no hidden fees or markups on interchange rates

Pros | Cons |

|

|

#7. PayPal: Best Square competitor for global selling

⭐ Users' rating for PayPal: 4.4/5 on G2

When to choose PayPal over Square?

PayPal is one of the best Square competitors for businesses focused on online sales and global reach. Therefore, consider choosing PayPal if your priority is fast, familiar online payments with global capabilities, and strong consumer trust.

PayPal Pricing

PayPal offers a straightforward pricing structure for accepting payments:

- In-person: 2.29% + 9¢ per transaction

- Online: 3.49% + 49¢ per transaction

For businesses processing over $3,000 per month, PayPal allows merchants to apply for preferred rates and get their own custom pricing plans, potentially having lower fees.

PayPal's highlight features

- eCommerce integration: PayPal offers ready-made integrations for popular eCommerce platforms like Shopify, WooCommerce, Magento, and BigCommerce.

- Pay Later options: Integrated installment payment solutions like Pay in 4 and Pay Monthly at no additional cost to merchants.

- Recurring payments: For subscription-based businesses or those offering recurring services, PayPal supports automated recurring billing

Pros | Cons |

|

|

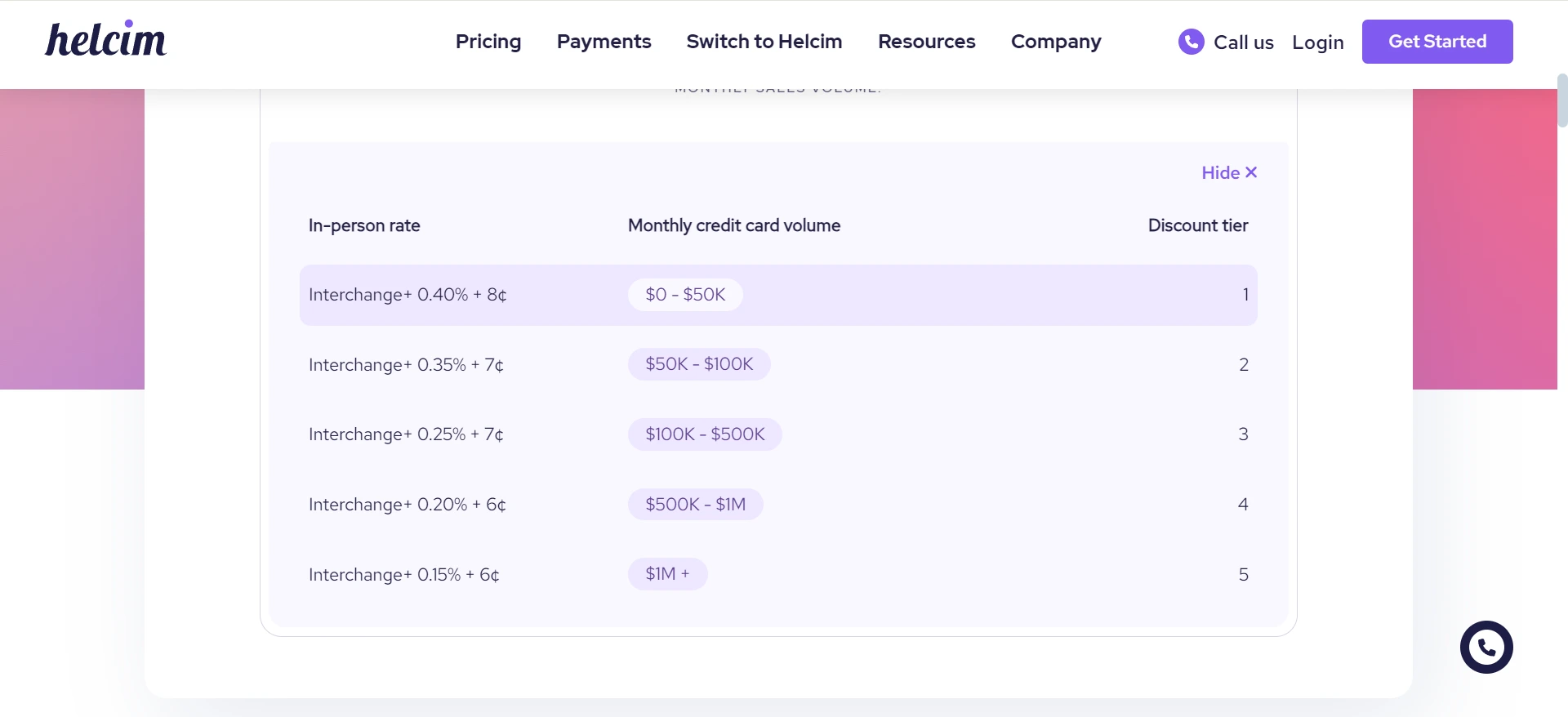

#8. Helcim: Best budget-friendly Square competitor

⭐ Users' rating for Helcim: 4.0/5 on G2 | 4.4 on Trustpilot

When to choose Helcim over Square?

Helcim stands out among the best Square payment competitors for budget-conscious businesses. With strong support for both in-person and online payments, invoicing, and inventory management, this platform delivers great value without sacrificing features.

Helcim pricing

Helcim costs you nothing to get started, which makes it one of the most economical Square competitors in this list. However, using Helcim to process payment certainly comes with fees depending on your sales volumes.

As of the time being, if you process less than $50,000 a month, your rates would be:

- In-person: 1.83% + 8¢ (Visa, Mastercard, Discover) and 2.61% + 8¢ (American Express)

- Online: 2.77% + 25¢ (Visa, Mastercard, Discover) and 3.01% + 25¢ (American Express)

The best part is that as you reach the higher transaction tiers (100K, 500K, 1M), the lower rates you’ll get.

Helcim's highlight features

- Affordable pricing: Helcim has different pricing tiers based on monthly processing volume. As your business processes more transactions, you automatically move into a lower-cost tier.

- Low stock alerts: You can set custom thresholds for low stock notifications to help with timely reordering.

- Great variant tracking: Helcim lets you easily manage products with multiple options (e.g., sizes, colors) and their respective stock levels.

Pros | Cons |

|

|

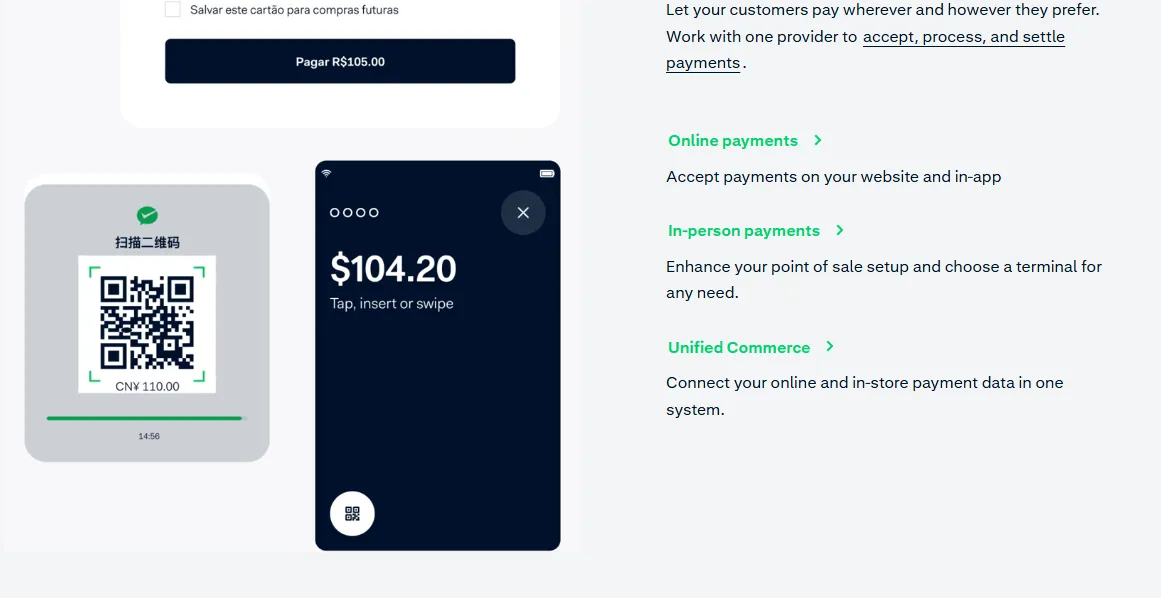

#9. Adyen: Best Square Competitor for Enterprise-Level Omnichannel Payments

⭐ Users’ rating for Adyen: 4.6/5 on Capterra

When to choose Adyen over Square?

Choose Adyen if your brand processes large volumes across multiple countries, wants highly customizable checkout flows, or needs a single platform to manage online, in-person, and cross-channel payments at scale. After all, Adyen is designed for businesses prioritizing flexibility, international reach, and full control over their payment stack.

Adyen pricing

Adyen uses a transparent Interchange++ pricing model, charging a combination of a fixed processing fee and a variable payment method fee for each transaction. There are no setup, monthly, or closure fees, but a minimum monthly invoice may apply depending on the business type. For example:

- Visa/Mastercard: $0.13 (processing fee) + 0.80% (Adyen fee) + Interchange++ (variable fees).

- American Express: $0.13 (processing fee) + 0.80% (Adyen fee) + 3.95% (Amex fee).

- SEPA Direct Debit: $0.13 (processing fee) + 0.80% (Adyen fee) + €0.25 (scheme fee).

Adyen's highlight features

- Unified omnichannel payments: Adyen lets you accept payments online, in-person, and through mobile apps using a single unified system. Basically, all transactions flow into one dashboard, allowing you to track customer activity across channels (for example, a shopper who browses online but completes the purchase in-store).

- Support for 250+ global payment methods: With Adyen, businesses can offer customers their preferred local payment methods such as iDEAL, Bancontact, Alipay, or Klarna. This feature is especially valuable for international stores wanting to boost conversions by displaying familiar options at checkout.

- Advanced fraud detection with machine learning: Adyen’s built-in RevenueProtect system analyzes payment patterns in real time to detect suspicious behavior. You can set custom rules (e.g., automatically flagging high-risk transactions from specific countries) while still allowing legitimate customers to pay smoothly.

Pros | Cons |

● Superior global payment support with 250+ payment methods | ● Not beginner-friendly; requires technical expertise |

#10. Wise: Best Square Competitor for Affordable Cross-Border Business Payments

⭐ Users’ rating for Wise: 4.3/5 on Trustpilot

When to choose Wise over Square?

Wise (formerly TransferWise) is one of the best options for Square competition, tailored for international businesses that need low-cost, multi-currency tools rather than a traditional POS or payment processing system. So, choose Wise if your business frequently sends or receives funds globally, manages suppliers in different countries, or wants a simple alternative to banks for international payments with transparent fees and real exchange rates.

Wise pricing

Wise pricing includes conversion fees starting from 0.33% and a fixed fee for sending money that varies by currency. Personal accounts are free to open and hold currencies, with some local account details and a card costing a one-time fee (e.g., $9 USD for the card). Business accounts have a one-time setup fee for local account details (e.g., $31 USD in the US) and a fee for the card (e.g., $5 USD).

General pricing for personal and business accounts:

- Sending money: Fees vary by currency, starting around 0.33%.

- Holding currencies: Free for personal accounts.

- Spending with the card: Free for spending in a currency you already hold. A conversion fee applies if you don't have the currency, starting from 0.33%.

- ATM withdrawals: Free up to a certain limit per month (e.g., $100 USD or 200 GBP). After that, fees apply (e.g., $1.50 USD + 2% or 1.75% of the amount over the limit).

- Account details: Free to receive local payments in many currencies like EUR, GBP, AUD, NZD, and SGD. Receiving international wires has fixed fees.

Business-specific pricing

- Account setup: One-time fee (e.g., $31 USD) for local account details and a card (e.g., $5 USD).

- Receiving SWIFT payments: Fixed fees apply depending on the currency (e.g., $6.11 USD, £2.16 GBP, €2.39 EUR).

- Employee cards: Additional employee cards have a fee (e.g., $6 USD each).

Wise's highlight features

- Multi-currency account supporting 40+ currencies: Wise Business allows you to hold, convert, and manage more than 40 currencies in one place. If you frequently pay global suppliers, you can instantly convert funds at the mid-market rate and avoid excessive bank markups.

- Local account details for 9 major currencies: Wise provides you with local bank details (such as IBAN or routing and account numbers) in currencies like USD, EUR, GBP, AUD, and CAD. This lets your international clients pay you as if they were making a local transfer, reducing delays and fees.

- Low-cost international transfers with transparent fees: Wise is built for sending money overseas at a fraction of the cost of traditional banks. Fees are shown upfront, and exchange rates use the real mid-market rate. For example, if you send payments to freelancers in Europe weekly, you’ll know exactly how much each transfer costs, with no hidden charges.

Pros | Cons |

● Extremely low-cost international payments | ● Not a full POS or payment processing system |

Why Look For Square Competitors?

Square is famous for many things: a powerful point-of-sale (POS) system, a convenient payment processor, and, recently, an eCommerce website builder. However, as versatile as it sounds, Square comes with certain setbacks.

After enabling thousands of businesses to migrate from Square to another platform, here are the top reasons why people look for an alternative from Square competitors:

- Lower transaction fees: As businesses grow, they seek more competitive pricing structures. For example, some Square competitors offer subscription-based models with lower per-transaction fees, which can result in significant savings for high-volume stores.

- More advanced features: Many businesses outgrow Square's functionality as they expand. Square payment alternatives like Lightspeed offer more robust inventory management systems, while Shopify provides superior e-commerce capabilities for businesses focusing on online sales.

- Customization options: Square's one-size-fits-all approach doesn't always meet the needs of specialized industries. Competitors like Clover offer more flexible solutions that can be tailored to specific business types, such as full-service restaurants or complex retail operations.

- Improved customer relationship management (CRM): Many Squareup competitors offer more advanced CRM features, loyalty programs, and marketing tools to help businesses build stronger relationships with their customers.

How to Choose the Best Square Alternatives?

Here are the key factors to consider when choosing the best Square alternatives:

1. Business type & industry needs

Some platforms cater better to certain industries, like retail, restaurants, or service-based businesses. Consider whether the alternative has features tailored to your sector, such as table management for restaurants or inventory tracking for retail.

2. Features & functionality

Make a list of must-have features that Square currently provides (e.g., POS system, online payments, invoicing, mobile support), and ensure the best Square competitors match or exceed those capabilities. Also, look for extras that might improve your workflow, such as CRM tools, appointment scheduling, or advanced reporting.

3. Ease of use

A smooth onboarding process and user-friendly interface are critical, especially if you have a team. Look for demos, trials, or reviews to gauge how easy it is to get started and train staff.

4. Pricing & fees

Compare transaction fees, monthly costs, hardware expenses, and any hidden charges. Some providers may offer lower rates or tiered pricing that better suits your transaction volume.

5. Payment flexibility

Make sure the platform supports various payment types, including contactless payments, digital wallets (like Apple Pay and Google Pay), and online checkouts, especially if you're running an omnichannel business.

6. Scalability

Last but not least, be sure to choose a solution that can grow with your business. Even if you’re a small operation today, look for a platform that can handle more volume, more locations, or more complex features as you expand.

What to consider when replacing Square?

Switching from Square to another POS or payment provider isn’t always straightforward. So make sure you choose the optimal Square competitors if you plan to replace Square with another solution.

Here are a few questions to ask yourself:

- Will switching to the new platform address your current issue? When considering a switch from Square, it's crucial to clearly identify the specific problems you're facing with Square. For example, if you're looking for more advanced inventory management, make sure the new platform offers robust features in this area.

- How much will the new platform cost? Carefully evaluate the pricing structure of the new platform. Consider not just the processing fees but also any monthly subscriptions, hardware costs, and potential hidden fees if you don’t want to break the bank.

- Is the new platform compatible with your existing hardware and software? Check if the new platform works with your current POS hardware, card readers, and other equipment. Also, consider its compatibility with any third-party software you use for accounting, inventory management, or customer relationship management.

- How will the transition affect your customers? Consider the impact on your customers' experience. Will they need to update their payment information or create new accounts? How will recurring payments be handled?

Square Competitors – FAQs

Who is Square's main competitor?

Square doesn't have a single main competitor, as it offers a wide range of services. Sp, different Square up competitors will compete with Square in various aspects. For example:

1. For payment processing: PayPal and Stripe

2. For eCommerce: Shopify

3. For inventory management: Lightspeed

What is the downside of Square?

Here are top potential downsides of Square that make people search for Square competitors:

1. Higher costs for businesses processing over $25,000 per month

2. Limited customization options compared to some competitors

3. Risk of account holds or terminations due to less thorough vetting process

4. Fewer third-party integrations compared to some alternatives

5. Less specialized features for specific industries

Is Square the best payment processor?

Square is not necessarily the best payment processor for every business. While it's an excellent choice for small businesses, startups, and those with low transaction volumes, other processors may be better suited for different needs:

1. For high-volume businesses: Helcim or interchange-plus providers

2. For online-focused businesses: PayPal or Shopify

3. For businesses needing specialized features: Industry-specific solutions like Toast for restaurants

Are there better alternatives to Square?

Yes, depending on your business model, there may be a better alternative to Square.

For example, Shopify POS offers superior eCommerce capabilities and is better suited for omnichannel brands. Toast is a stronger choice for full-service restaurants that need specialized kitchen and menu tools. Meanwhile, Lightspeed delivers advanced inventory management for multi-location retailers.

Is Square or Wix better?

Square is better if you want an all-in-one POS system with built-in payment processing, basic eCommerce features, and seamless in-person selling tools. However, Wix is ideal for businesses that prioritize creative control and website design.

Best Competitors of Square: Final Thoughts

Square provides businesses with tons of services, including POS, payment processing, and eCommerce. However, Square isn’t suitable for certain brands, especially brands that do large-volume transactions or need a more industry-specific solution.

That’s why we hope our list of the best Square competitors can help you choose the alternative solution that better suits your demand and budget.

Lastly, don't forget to explore LitExtension’s blog site to get insider tips and tricks on all things eCommerce.