BigCommerce payment gateways are a crucial part of your online business operation, ensuring secure and smooth transactions between you and your customers.

But the questions are, how they works and what are the best options for your BigCommerce store?

In this blog, LitExtension – #1 eCommerce Migration Service will provide a comprehensive overview of BigCommerce payment gateways, including:

- What is a BigCommerce payment gateway?

- How do BigCommerce payment gateways work?

- How to add a payment gateway to your BigCommerce store?

- What to Consider when choosing the best BigCommerce payment gateway for your online store?

- Best BigCommerce payment gateways.

Now, let’s get into it!

What is a BigCommerce Payment Gateway?

What is BigCommcerce payment gateways?

BigCommerce payment gateways are online services or software integrated into BigCommerce stores. They process online payments between the customer, merchant, and banks, such as credit card processors and digital wallets.

Benefits of Using BigCommerce Payment Gateways

BigCommerce payment gateways offer a winning combination of convenience, security, and variety for your online store.

- Streamlined checkout process: You can focus on running your business since BigCommerce's payment gateways handle all the heavy work behind the scenes.

- Secure payment process: BigCommerce payment gateways offer fraud protection and data security features to protect merchants and customers from illegal activity.

- Wide range of payment methods: BigCommerce offers a wide range of payment methods, including major credit cards, PayPal, Square, and more.

Overall, BigCommerce payment gateways make it easier, safer, and more convenient for you to accept payments and for your customers to buy your products.

Different Types of Payment Gateways for BigCommerce Stores

As of this writing, there are three types of BigCommerce supported payment gateways: hosted payment gateways, on-site payment gateways, and off-site payment gateways (with on-site checkout).

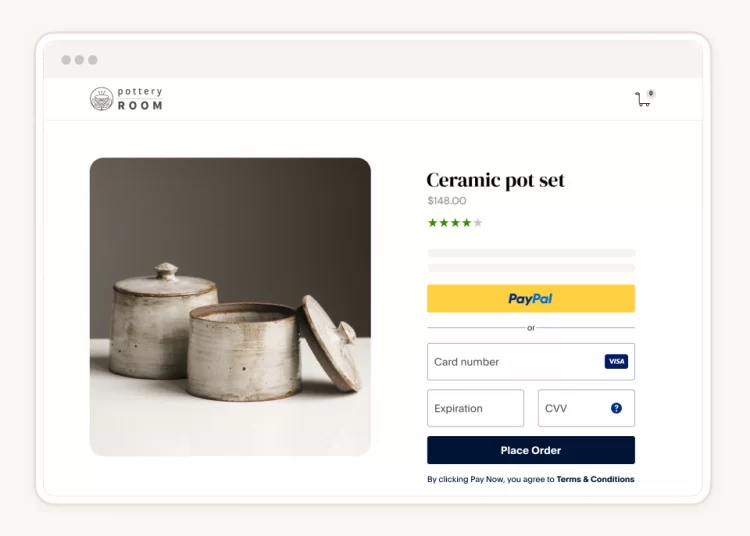

Hosted (Redirect) payment gateways

First and foremost, hosted payment gateways (or redirect payment gateways) are separate secure pages where you can enter your payment information when shopping online.

As the name suggests, this type of BigCommerce payment gateway redirects customers to a secure payment page. This eliminates the need for merchants to handle sensitive payment data while ensuring customer convenience.

A common example of a BigCommerce hosted payment gateway is PayPal. It allows you to collect payments in 100+ currencies across 200 markets. Moreover, its risk management tools can help you prevent fraud and minimize chargebacks.

On-site payment gateways

On the other hand, BigCommerce on-site payment gateways allow your customers to submit credit card information directly on your store's checkout page. While this ensures a smooth buying experience for buyers (since they don't have to leave the store's website), it also means you are responsible for securing their payment data.

Popular examples of on-site payment gateways for BigCommerce stores include Stripe and Authorize.net. These two services are two of the easiest payment gateways to set up with BigCommerce. In addition, they allow you to offer several digital wallet payment methods on your storefront.

On-site checkout with Off-site payments

Last but not least, this type of BigCommerce payment gateway combines the key features of the above-mentioned methods. It allows customers to complete most of the checkout process on the merchant's website and enter the sensitive payment information on a separate page of the payment gateway service.

Therefore, it offers a balance between a smooth checkout experience and robust security. However, the downside is that you won’t be able to control your customers' entire checkout experience.

One of the most popular payment gateways of this method is Stripe. By using Stripe, you can manage customers' order details without having to protect their payment information yourself.

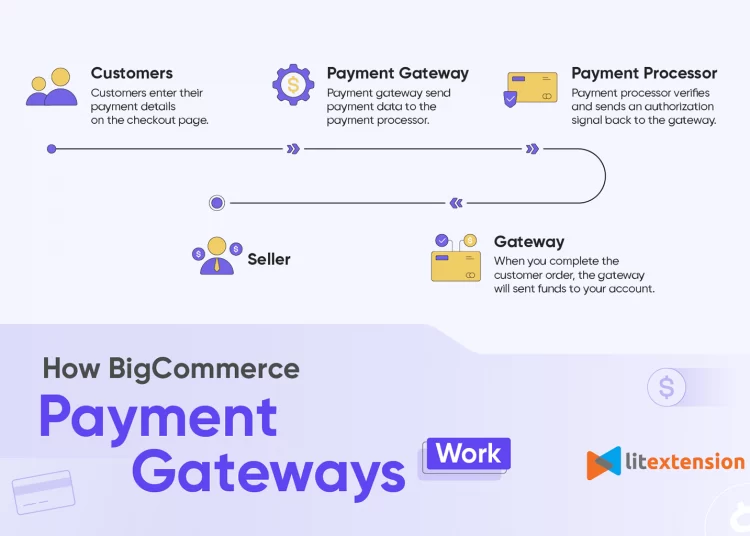

How Do BigCommerce Payment Gateways Work?

Now that you have a better grasp of what a payment gateway is and the different types of BigCommerce available payment gateways. Let's dig deeper into how BigCommerce payment gateways operate:

- Customer checkout: After shopping on your BigCommerce store, customers enter their payment details on the checkout page.

- Payment processing: The payment gateway acts as a bridge, sending the encrypted payment data to the payment processor (also known as a merchant acquirer). The processor verifies the information with the customer's bank and checks for available funds.

- Authorization & funds transfer: If approved, the processor sends an authorization signal back to the gateway. The gateway then relays this approval to your BigCommerce store. Once authorized, funds are transferred from the customer's account to a holding account.

- Order fulfillment: Upon receiving authorization, you can fulfill the customer's order. BigCommerce gateways then allow the capture of funds at this point, moving them from the holding account to your merchant account.

How to Add a Payment Gateway to Your BigCommerce Store?

After providing a comprehensive overview of BigCommerce payment gateways, we’ll guide you through the steps to integrate a payment gateway into your BigCommerce store.

1. Go to the website “bigcommerce.com” and log into your BigCommerce account.

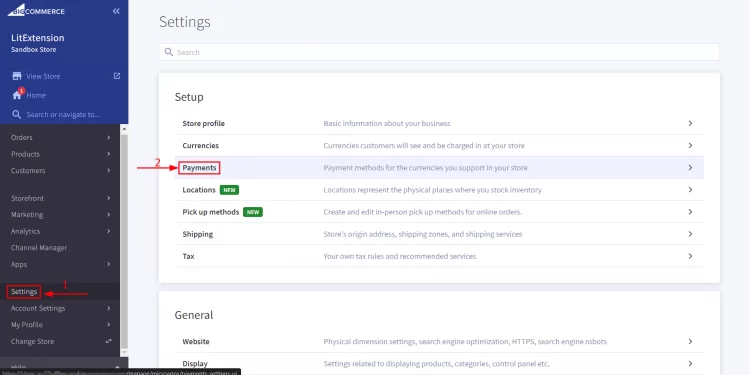

2. Open the “Settings” tab in the dashboard on the left of your screen and select “Payments.”

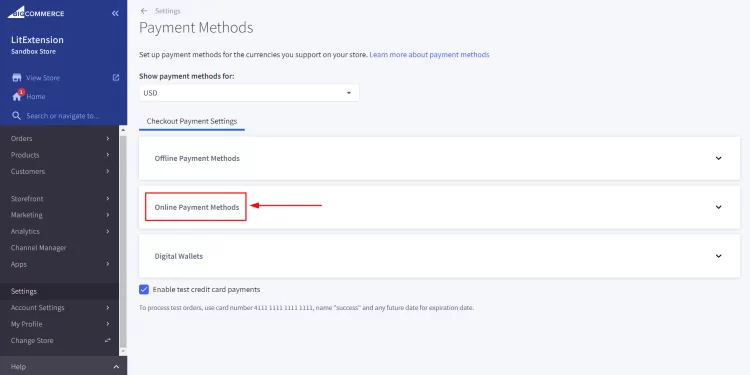

3. Next, click the “Online Payment Methods” button to open a list of compatible payment gateways.

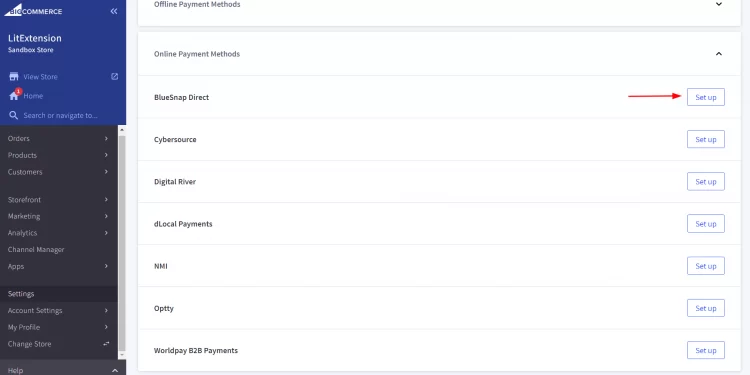

4. Select the payment gateway of your choice and click “Set Up”.

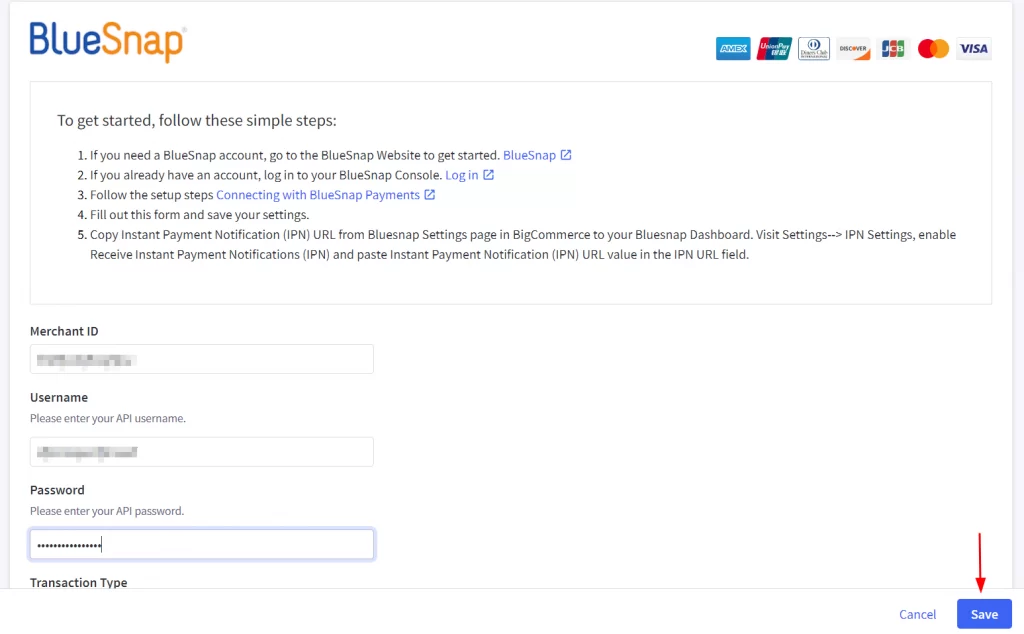

5. Input the requested details and click “Save” to complete the process.

And those are all the steps for integrating BigCommerce payment gateways.

Next, we’ll recommend some criteria for choosing the best payment gateway for eCommerce.

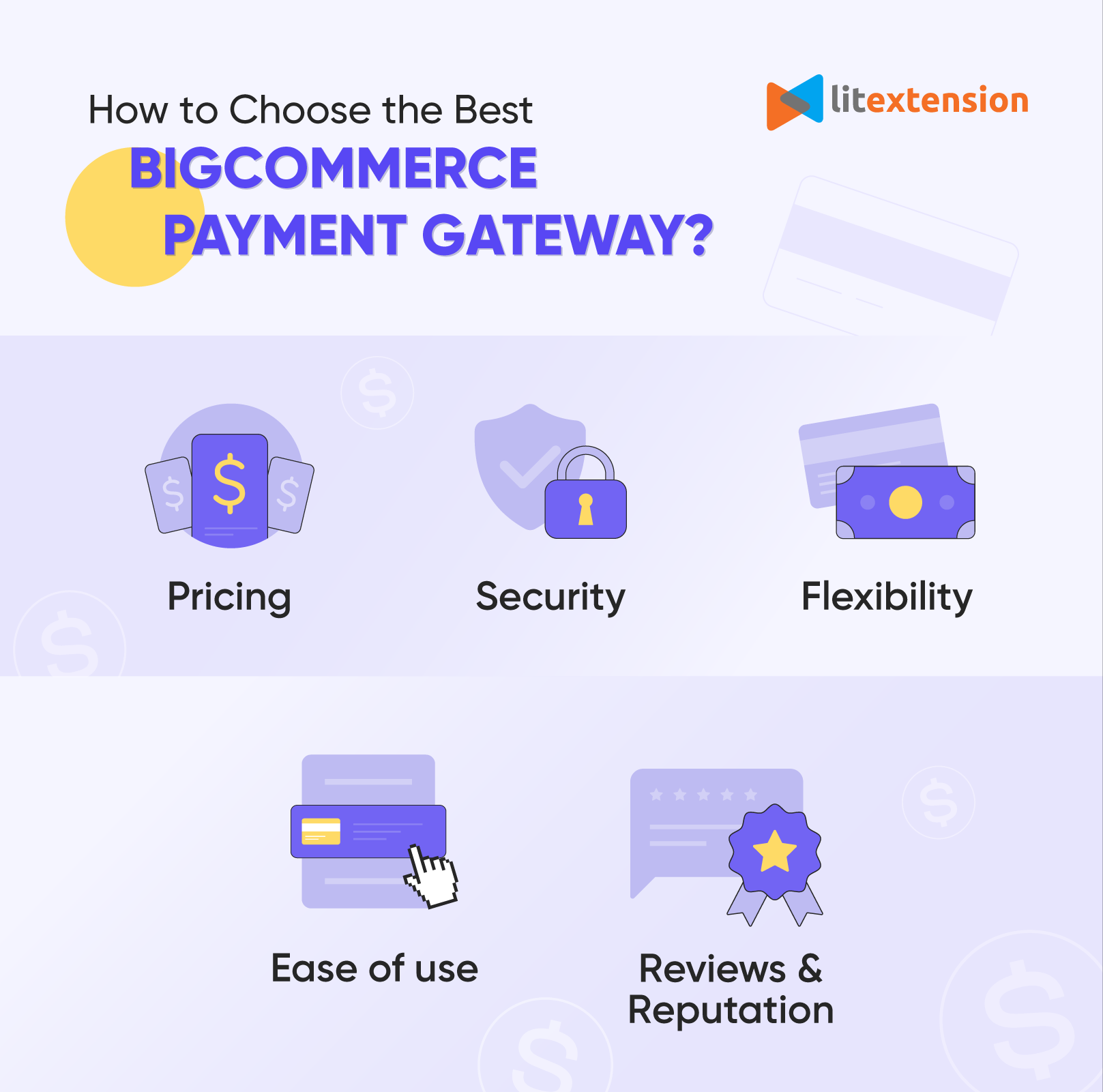

What to Consider When Choosing the Best Online Payment Gateway for Your BigCommerce Store?

Choosing the best payment gateway for eCommerce is crucial for the success of your BigCommerce store. With plenty of options available, here's a breakdown of key factors to consider:

Pricing

Every payment gateway has its own fee structure, including transaction fees, monthly charges, and potential setup costs. Analyze your projected sales volume to pick a gateway with a pricing model that best suits your business.

Ease of use

A seamless integration with BigCommerce and a user-friendly interface are essential. Consider how easy it is to set up the gateway, manage transactions, and reconcile accounts. Seamless integration ensures that your payment gateway works smoothly with BigCommerce, providing a hassle-free experience for both you and your customers.

Security

Since you'll be handling sensitive customer data, prioritize robust security features. Look for BigCommerce payment gateways that comply with PCI standards and offer fraud prevention tools.

Flexibility

Your business needs may evolve. Therefore, choose a gateway that offers a variety of payment methods, including credit cards, digital wallets, and recurring billing options. This will cater to a wider customer base and foster smoother transactions as you grows.

Reviews & reputation

Don't underestimate the power of real user experiences. Read customer reviews and research the gateway's reputation within the eCommerce community. This can give us more insight into their customer support quality, reliability, and how they handle potential issues.

By carefully considering these factors, you can choose a payment gateway that empowers your BigCommerce store to flourish. Remember, the ideal BigCommerce payment gateways balance affordability, security, and flexibility to meet your current and future business needs.

Best Payment Gateways for BigCommerce Store

Now, let’s discover the best BigCommerce payment gateways for your online store.

Throughout our experience with the 5 most popular BigCommerce payment gateways, we have gathered valuable insights. The table below provides quick reviews of each BigCommerce payment gateway based on the criteria we mentioned above:

Paypal | Stripe | Square | Authorize.net | 2CheckOut | |

Pricing | |||||

Ease of use | |||||

Security | |||||

Flexibility | |||||

Customer reviews & reputation | |||||

Overall |

Paypal

The first choice for you is PayPal. PayPal is a widely used online payment platform that makes sending and receiving money easy. It is known for its user-friendly interface and strong security features.

PayPal charges a standard fee of 2.9% + $0.3 per transaction within the U.S., with higher fees for international transactions.

Here are Paypal’s key features:

- User-friendly interface

- Strong security measures and fraud protection

- Wide acceptance by online retailers around the world

- Multiple currencies support.

- Easy integration with BigCommerce store

- Quick and reliable transaction processing

- Mobile app.

Stripe

Another option is Stripe. Stripe is a popular online payment platform known for its flexibility and ease of use. It provides a range of developer-friendly tools to customize payment processes.

Stripe's pricing is competitive, with a standard fee of 2.9% + $0.3 per successful card charge.

Stripe’s benefits:

- Flexible and customizable payment processing

- Developer-friendly with extensive API documentation

- Supports multiple currencies and global payments

- Strong security and fraud protection measures

- Seamless integration with various eCommerce platforms

- Detailed reporting and analytics tools

Square

Square is a popular payment gateway known for its ease of use and straightforward setup. It provides small businesses with a reliable way to process payments both online and in-person.

This platform charges a flat fee of 2.9% + $0.3 per online transaction.

Square’s strength:

- Transparent pricing with no hidden fees

- User-friendly setup and interface

- Integrated point-of-sale (POS) system for in-person transactions

- Strong security and PCI compliance

- Versatile payment options

Authorize.net

One more option for you to consider is Authorize.net. Authorize.net is a reliable payment gateway that has been trusted by businesses for years. It offers robust security features and supports more than 9 payment methods, including credit cards, debit cards, e-checks, digital wallets, and more.

Authorize.net charges a monthly fee of $25, plus 2.9% + $0.3 per transaction.

Authorize.net’s key features:

- Supports multiple payment methods

- Advanced fraud detection tools

- Recurring billing and subscription management

- Comprehensive customer support

- Provide a mobile option and access to transaction data from any location.

2CheckOut

The last option is 2CheckOut. 2Checkout is an affordable payment gateway with a user-friendly interface, ideal for businesses on BigCommerce seeking a cost-effective solution. It is easy to integrate with BigCommerce and offers strong security features.

2Checkout charges a fee of 3.5% + $0.35 per successful transaction.

2CheckOut’s advantages:

- Customized subscription plans

- Multi-currency and Multi-language support

- Customized checkout options

Multiple payment methods

BigCommerce Payment Gateways: FAQs

Does BigCommerce have a payment gateway?

Yes, BigCommerce has a payment gateway. It supports various payment options, including credit cards and digital wallets. Additionally, it integrates with popular services like PayPal, Stripe, and Square for seamless transactions.

What is the best payment processor for BigCommerce?

From our experience, PayPal is the best BigCommerce payment gateway because of its global reach, ease of integration, and secure transactions. However, you should choose the payment gateway that suits your specific business needs.

Does BigCommerce use Stripe?

Yes, BigCommerce uses Stripe as one of its supported payment gateways.

How does BigCommerce payment work?

BigCommerce Payment Gateway operates through four main stages:

- Customer checkout: Customers enter their payment details on the checkout page.

- Payment processing: The payment gateway sends the encrypted payment data to the payment processor. The processor verifies the information with the customer's bank and checks for available funds.

- Authorization & funds transfer: If approved, the processor sends an authorization signal back to the gateway. The gateway then relays this approval to your BigCommerce store.

- Order fulfillment: Upon receiving authorization, you can fulfill the customer's order. After you finish the order, the funds will be transferred to your account.

What is BigCommerce payment processing fee?

BigCommerce payment processing fees are the costs businesses incur after finishing a successful payment, specifically when it comes to processing credit card transactions.

Conclusion

In summary, we have just given you the whole picture of BigCommerce payment gateways.

A payment gateway is a crucial part of eCommerce, and BigCommerce is no exception. Fully understanding the details of BigCommerce payment gateways, especially how they function, will make running your BigCommerce store much easier.

If you're looking for more eCommerce ideas and techniques, feel free to check out LitExtension Blog or join our Facebook community to connect with other eCommerce enthusiasts!