Speaking of payment processing tools, Square vs QuickBooks are among the most popular platforms trusted by businesses worldwide. However, Square and QuickBooks are in two different leagues. While Square focuses on payment processing and point-of-sale solutions, QuickBooks is renowned for its comprehensive accounting capabilities.

To help you better understand how QuickBooks vs Square differ from each other, we will compare them in 10 crucial aspects, including:

- Pricing

- Payments

- Invoice

- Ease of use

- eCommerce integration

- Payroll

- Capital

- Card readers

- Email marketing

- Customer support

Without further ado, let’s dive in!

Square vs Quickbooks Comparison

Square | QuickBooks | Winner | |

Pricing | Free plan available. One paid plan at $29/month and one custom plan. |

| Square |

Payments | You can accept credit & debit cards at competitive rates with an aggregated account. | You can accept credit & debit cards at competitive rates with your own merchant account. | It’s a tie |

Invoice | Square provides you with basic invoicing features. | QuickBooks offers businesses advanced invoicing features such as automatic reminders. | QuickBooks |

Ease of use | On most software review platforms, Square scores quite high– around 4.7 in ease of use. | Compared to Square, QuickBooks only scores around 4.2 regarding ease of use. | Square |

eCommerce integration | Square supports managing an online store with Square Online. | QuickBooks doesn’t have eCommerce selling features. | Square |

Payroll | Square Payroll offers basic payroll functionality | QuickBooks Payroll has more advanced features like tax filing, direct deposit, and employee benefits management | QuickBooks |

Capital | $300 - $250,000 Revenue requirement: $120,000/year | $5,000 - $200,000 Revenue requirement: $50,000/year | It’s a tie |

Card readers | Square offers a range of card readers for small businesses, such as magstripe reader contactless and chip payments. | Similar to Square, QuickBooks lets you accept EMV chip, debit, credit cards, as well as Google Pay and Apple Pay. | It’s a tie |

Email marketing | Built-in email marketing tool. | Support email marketing but needs integration with Mailchimp. | Square |

Customer support | Square provides free customer support via phone, chat, email, and social media, with extended business hours for all merchants. | QuickBooks POS charges a steep fee for phone-based customer support while offering free chat support. | Square |

#1. Square vs Quickbooks: Pricing (Square Wins)

| 🔎 Square is more affordable than QuickBooks.

Square offers more economical pricing plans than QuickBooks and even has a free forever plan. For transaction fees, there won’t be any big difference between the rates both platforms offer. |

Cost

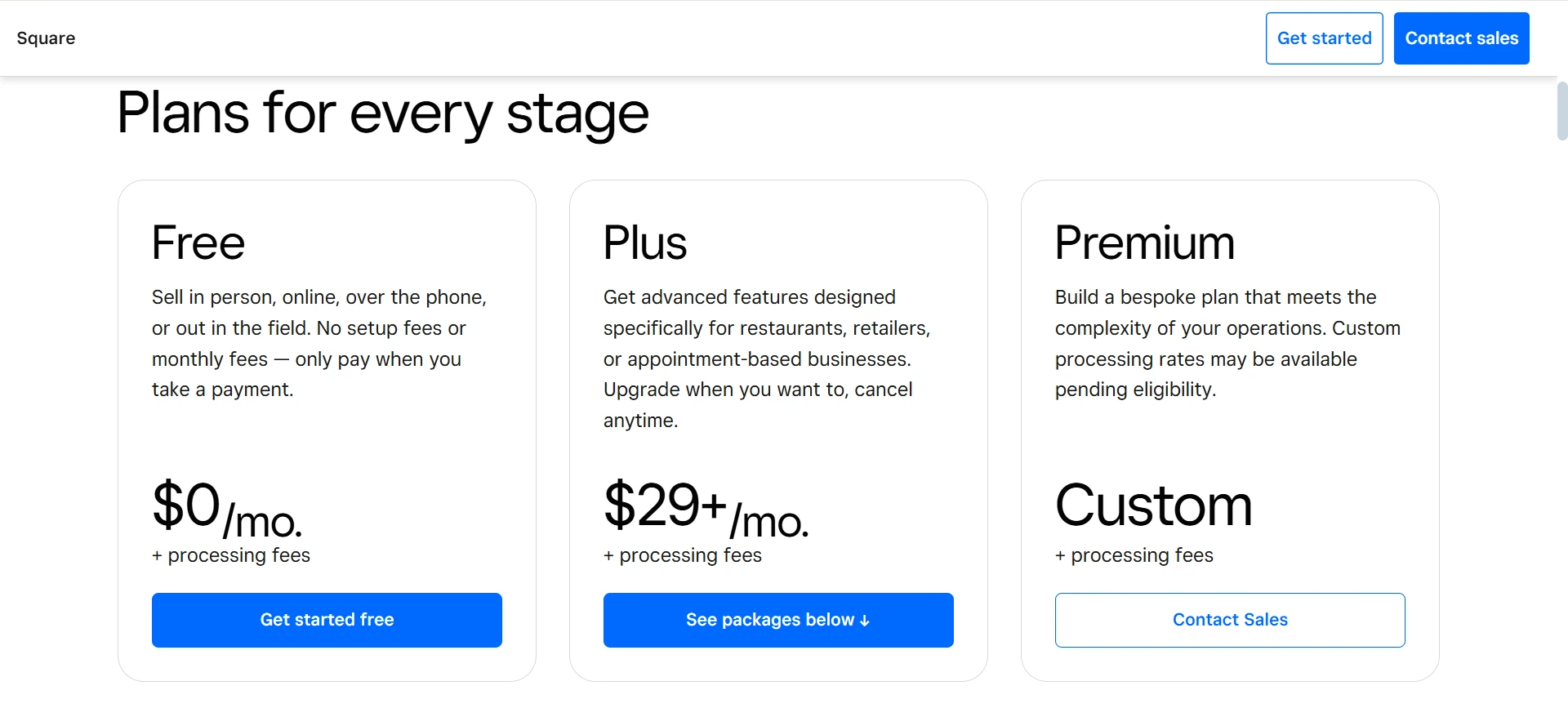

In terms of cost, Square offers three main plans for you to choose from:

- Free: With Square’s free plan, you can process as many payments as you want, get your money the next business day, and enjoy secure transactions.

- Plus: At $29/month, you can access features tailored to your niche, such as advanced restaurant, appointment booking, or retailer.

- Premium: If you need a tailored solution for your business, you can contact them for custom pricing, which will come with better card processing rates as well.

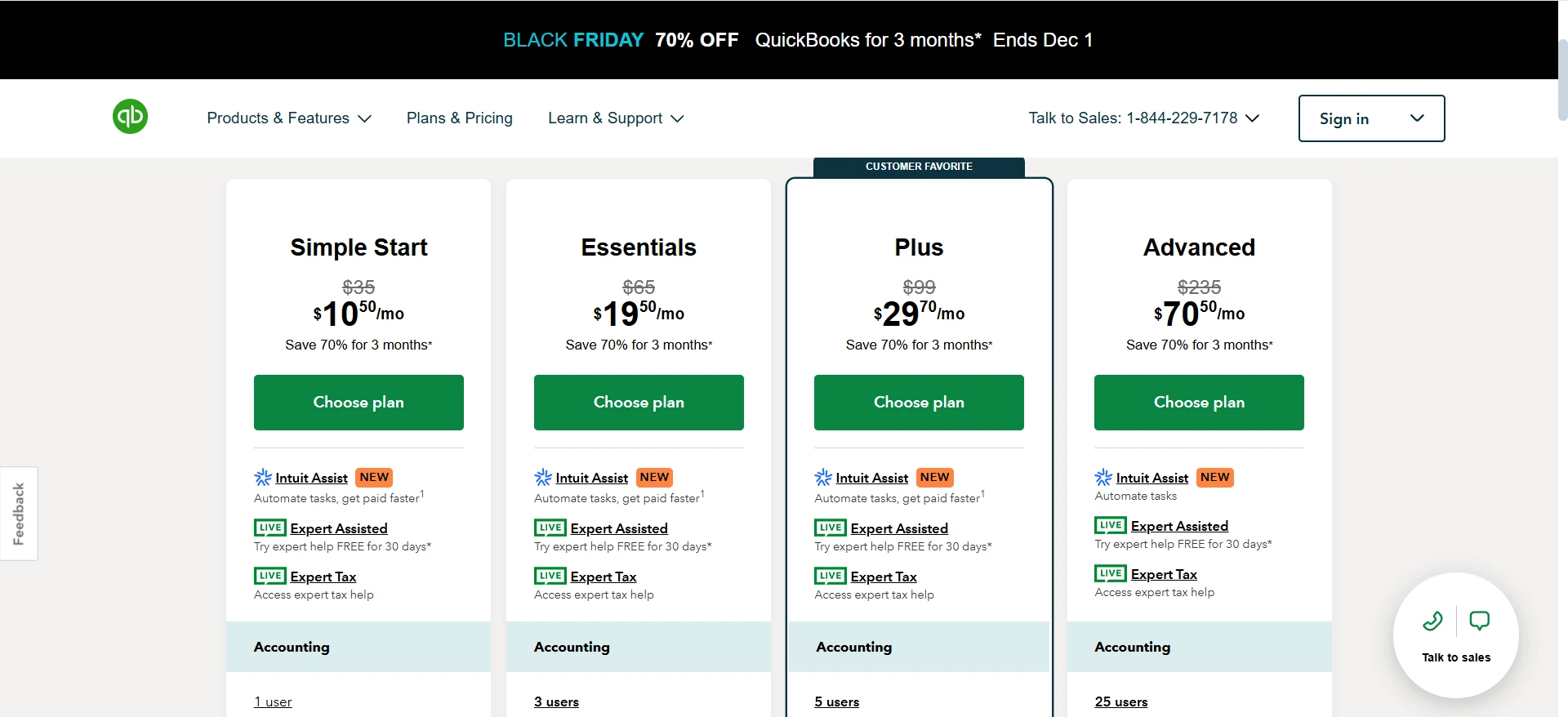

On the other hand, QuickBooks brings four plans to the table:

- Simple Start: $10.50/month for the first 3 months, then $35/month. Simple Start allows you to track your money ins and outs, manage your cash flow, as well as monitor your sales and taxes.

- Essentials: $16.50/month for the first 3 months, then $55/month. With Essentials, you get everything in Simple Start, plus you can connect three more channels with QuickBooks, add three more users, and manage your bills.

- Plus: $29.70/month for the first 3 months, then $99/month. Plus gives you everything in Essentials, plus inventory tracking and project profitability tracking

- Advanced: $70.50/month for the first 3 months, then $235/month. With the highest QuickBooks plan, you’ll get premier features like workflow automation, data sync with Excel, etc.

Clearly, between the two platforms, Square costs less than QuickBooks. It has a free plan and also more affordable paid plans than QuickBooks.

Transaction fees

Here’s a summary of common transaction fees charged by both platforms:

Transaction Type | Square | QuickBooks |

In-person | 2.6% + $0.10 | 2.4% + $0.25 |

Online | 2.9% + $0.30 | 2.9% + $0.25 |

Manually entered | 3.5% + $0.15 | 3.4% + $0.25 |

ACH bank transfer | 1% (max $10) | 1% (max $10) |

As you can see, there are some differences in their fee structures that might make one more suitable than the other depending on your business type and average transaction size.

For example, Square tends to be more cost-effective for businesses with smaller average transaction sizes due to its lower fixed fee component. On the other hand, QuickBooks might be more advantageous for businesses with larger average transaction sizes, particularly those over $100.

#2. Square vs Quickbooks: Payments (A Tie)

| 🔎 It’s a tie.

Both Square and QuickBooks let you accept credit and debit cards at reasonable fees. Nevertheless, the setup is easier with Square. Meanwhile, your account will be more stable with a dedicated merchant account provided by QuickBooks. |

Square and QuickBooks Payments have some things in common. Both let businesses accept card payments and track their finances without breaking the bank. But there's a big difference in how they handle accounts. QuickBooks Payments gives you your own merchant account, while Square puts you in a shared account with other businesses.

Setting up a merchant account with QuickBooks Payments takes more work and paperwork. But it pays off with a more stable account. This means your account is less likely to be suddenly frozen or closed compared to using a service like Square. With Square's shared account system, you might face a higher chance of unexpected issues popping up.

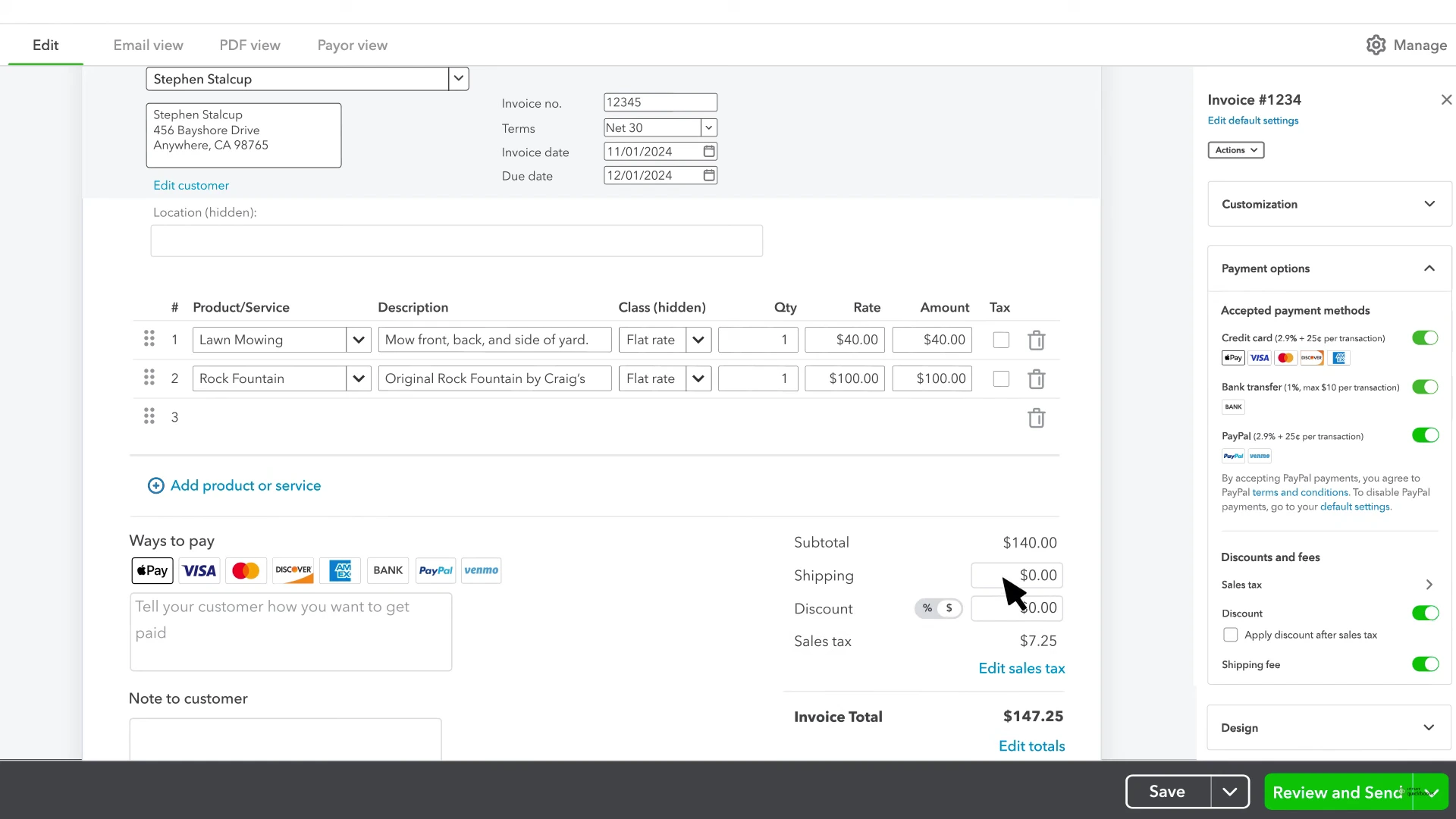

#3. Square vs Quickbooks: Invoice (Quickbooks Wins)

| 🔎 QuickBooks beats Square regarding invoice features.

With professional invoicing features that have been improved over the years, QuickBooks easily triumphs over Square in terms of invoice functionality. |

QuickBooks has spent many years improving its invoicing feature, making it highly customizable and automated. To name a few, here are some professional-grade invoicing features QuickBooks is offering:

- Multi-lingual invoicing: QuickBooks supports invoicing in multiple languages, allowing you to cater to a diverse customer base.

- Customizable invoices: You can customize the look and feel of the invoices to match your brand.

- Automated payment reminders: QuickBooks can automatically send payment reminders to your customers, helping reduce late payments and improve your cash flow.

On the other hand, Square’s invoicing feature is simpler with fewer customization and automation options, but it is a good choice if you need a straightforward way to send basic invoices via email or SMS.

#4. Square vs Quickbooks: Ease of Use (Square Wins)

| 🔎 Square is generally easier to use than QuickBooks.

Square’s simple and intuitive dashboard allows businesses to manage everything easily. Meanwhile, QuickBooks’ miscellaneous features come with a steeper learning curve. |

According to user ratings from Software Advice, Square Point of Sale scores 4.7/5 for ease of use, while QuickBooks Online scores 4.2/5. This is consistent across other review platforms as well. Users frequently praise Square for its intuitive interface, especially for small businesses and those just starting out.

Square's simplified approach to inventory tracking and payment processing makes it particularly user-friendly. While QuickBooks offers more comprehensive features, its complexity can be a hurdle for some users, especially those not familiar with accounting software.

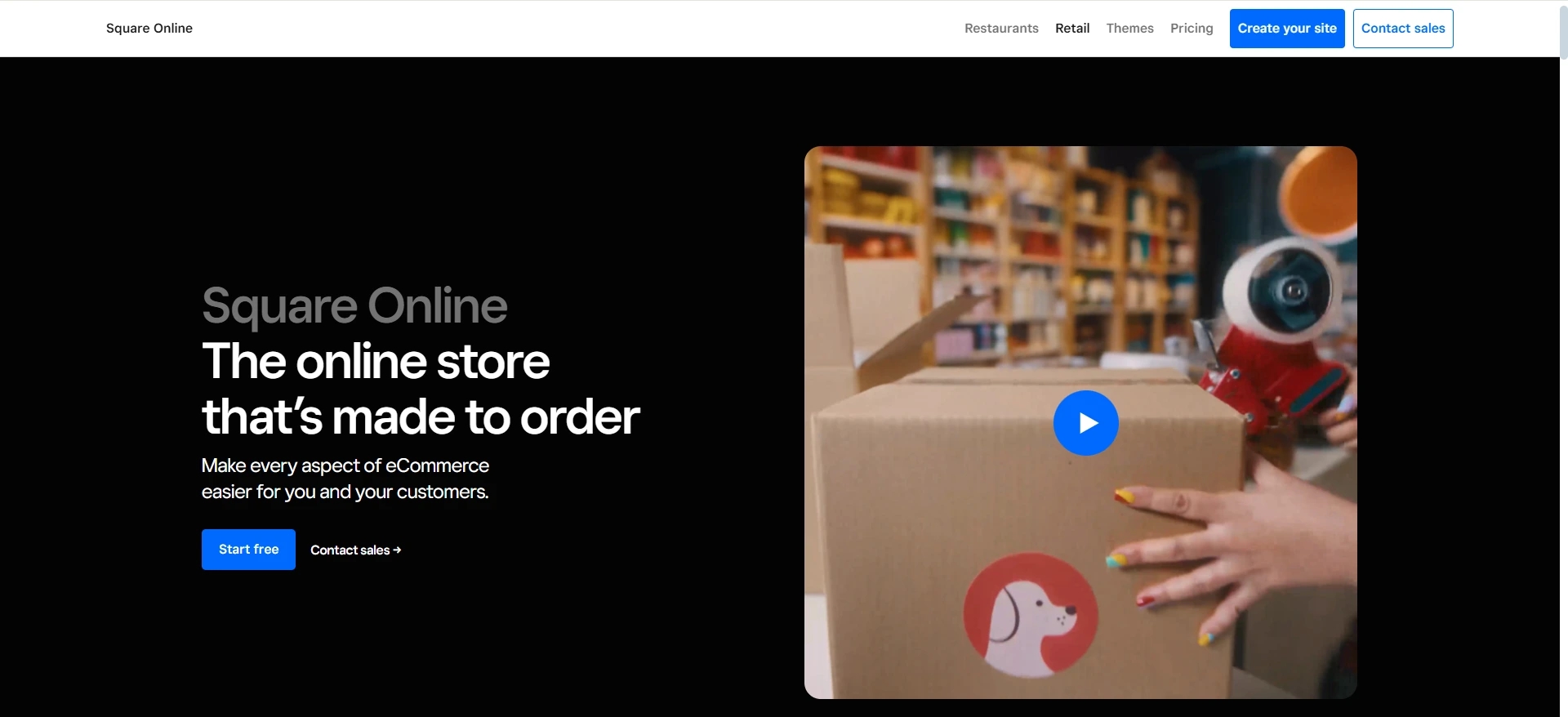

#5. Square vs Quickbooks: eCommerce Integration (Square Wins)

| 🔎 Square overshadows QuickBooks regarding eCommerce.

Square supports eCommerce features through Square Online. On the opposite, QuickBooks doesn’t offer eCommerce functionalities at all. |

Besides its point-of-sale systems and payment processing, Square has recently expanded its offerings with Square Online, a platform that allows you to manage an e-shop powered by Square Payments.

By contrast, QuickBooks offers eCommerce integration with multiple sales channels. However, to clarify, these integrations are for tracking and accounting purposes, not running an online store with QuickBooks.

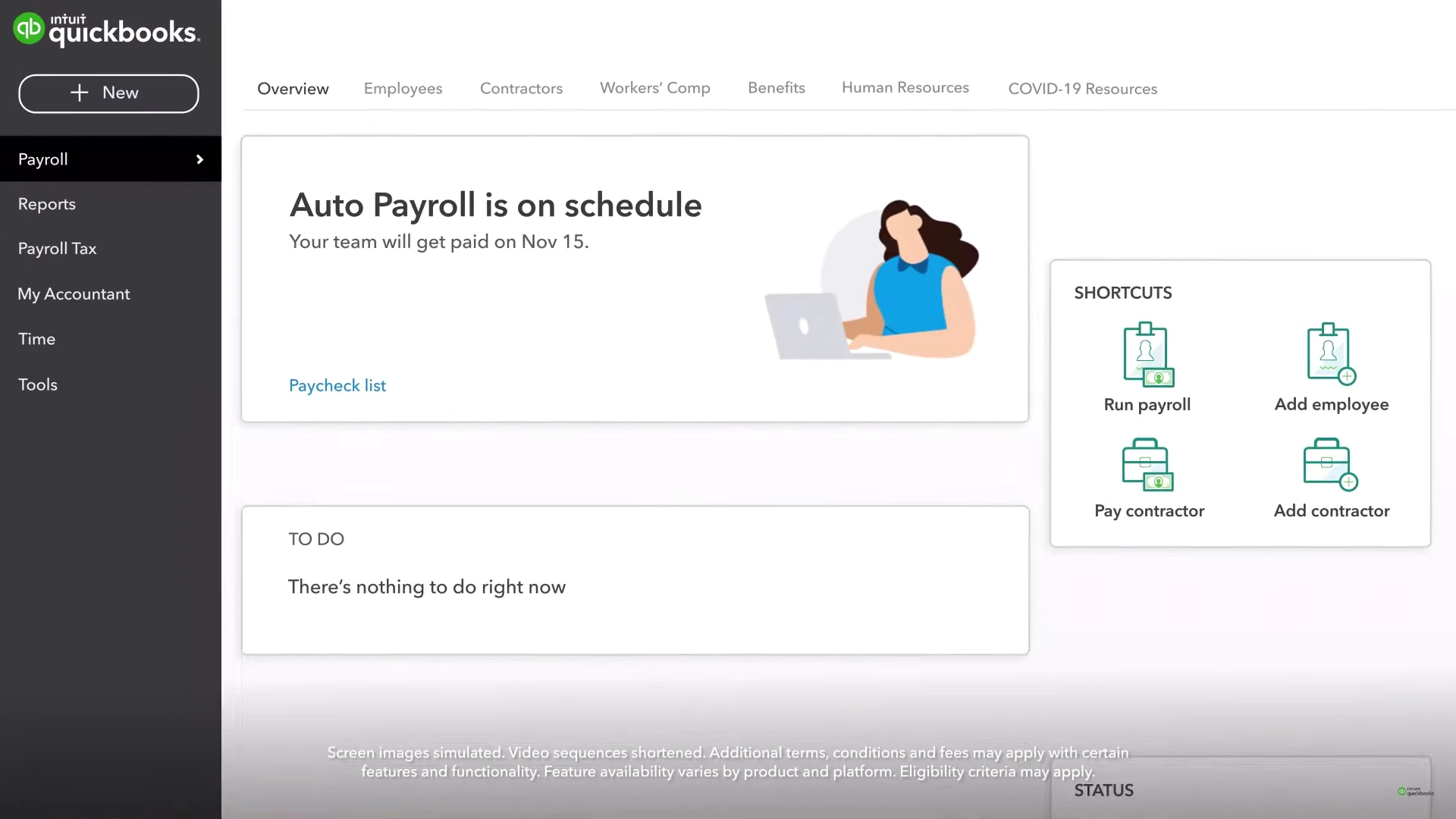

#6. Square vs Quickbooks: Payroll (Quickbooks wins)

| 🔎 QuickBooks defeats Square in terms of payroll features.

QuickBooks Payroll is better suited for growing businesses and can accommodate the needs of larger companies more effectively than Square Payroll in areas such as local tax filing and HR support. |

Both Square and QuickBooks provide payroll functionality as an additional paid service to complement their standard offerings.

When comparing Square's payroll option to QuickBooks' Core Payroll package, Square emerges as the more cost-effective choice. Meanwhile, QuickBooks distinguishes itself by including HR support, which is absent from Square's offering.

Hence, for larger enterprises with the financial capacity to invest in a more comprehensive payroll solution, QuickBooks will be the superior option. In contrast, Square is better suited for smaller businesses operating on tighter budgets and requiring only basic payroll capabilities.

#7. Square vs Quickbooks: Capital (A Tie)

| 🔎 It’s a tie.

Both Square and QuickBooks provide short-term business loans, each with unique advantages. Square Capital offers higher maximum loan amounts and doesn't require credit checks, while QuickBooks has lower revenue requirements for eligibility. |

Square Capital gives loans from $300 to $250,000 with a simple fee. It's easy to apply, and the costs are clear. They don't check your credit but look at your Square sales instead. Specifically, you need to make $10,000 a month and have both new and regular customers to qualify.

QuickBooks offers loans from $5,000 to $200,000. They will look at your credit and want proof that you made at least $50,000 last year. This yearly amount is less than Square's monthly requirement. However, QuickBooks might check your credit.

#8. Square vs Quickbooks: Card Readers (A Tie)

| 🔎 It’s another tie.

Both offer readers that accept EMV chip, debit, credit, and mobile wallet payments. They are durable, versatile, and can connect wirelessly to devices. |

Square offers a range of card readers for small businesses. When you open a Square account, you get a free magstripe reader. Their reader for contactless and chip payments costs $49. QuickBooks also has a card reader priced at $49. You can buy a power stand for it at $39, or get both for $79 through QuickBooks' website.

Both Square and QuickBooks readers accept EMV chip, debit, and credit cards, as well as Google Pay and Apple Pay. They're built to last and work well with other Square or QuickBooks products. These readers can connect wirelessly to Apple or Android devices and are easy to set up with Bluetooth.

#9. Square vs Quickbooks: Email Marketing (Square Wins)

| 🔎 Square edges over QuickBooks in email marketing.

Square's email marketing is natively integrated into its platform, while QuickBooks' email solution must be integrated with Mailchimp– an external email platform. |

Square offers built-in email marketing tools that allow you to easily manage customer information, segment your audience, and create targeted campaigns. It provides customizable templates and the ability to track campaign performance through analytics.

QuickBooks, through its integration with Mailchimp, also provides comprehensive email marketing features. This includes professional templates, content optimization, and the ability to send emails based on customer behavior.

#10. Square vs Quickbooks: Customer support (Square wins)

| 🔎 Square has better customer support.

Square provides better customer support than QuickBooks POS. Square offers free support via phone, chat, email and social media, with extended business hours, while QuickBooks POS charges a steep fee for phone support. |

Square provides free customer support via phone, chat, email, and social media for all its merchants. Users on free accounts can reach out for help during business hours (6 AM to 6 PM PT), while customers on paid plans have access to 24/7 support.

In contrast, QuickBooks POS customers are expected to be self-sufficient after purchasing the product. While chat support is available for free, QuickBooks POS clients must pay a fee of $79 per month or $59 for one-time phone-based assistance on a single issue.

Square vs Quickbooks: Who Wins in this battle?

There is hardly any winner here. Square vs QuickBooks are both powerful payment processing platforms for small to medium businesses. However, with their unique strengths and focuses, they will be more suitable for different users.

- Choose Square if you: Want a robust payment processing platform that has powerful POS features and eCommerce integration.

- Choose QuickBooks if you: Want a payment processing platform that integrates deeply with QuickBooks’ accounting ecosystem.

If you are fascinated by the amazing features of Quickbooks then LitExtension's Quickbooks Migration Service is the perfect choice for you. Remember to check out LitExtension’s blog site and join our Facebook Community to get yourself updated with the latest eCommerce affairs.

FAQs

Is Square a good alternative to QuickBooks?

Yes. Square can be a good alternative to QuickBooks, especially for smaller businesses that prioritize simple, affordable solutions for payment processing, invoicing, and basic accounting needs.

Is Square or QuickBooks better for payroll?

QuickBooks has more robust and feature-rich payroll capabilities compared to Square Payroll. QuickBooks Payroll offers advanced features like tax filing, direct deposit, and employee benefits management, making it a better choice for businesses with more complex payroll needs.

What are the disadvantages of QuickBooks?

Some key disadvantages of QuickBooks include:

- Expensive pricing, especially as you scale up and add more features/users

- Limited account users per plan (max 25 users on the highest plan)

- Steep learning curve for users unfamiliar with accounting principles

- Lack of industry-specific features for certain sectors like manufacturing, construction, etc.

Does Square feed into QuickBooks?

Yes, Square integrates with QuickBooks, allowing you to sync your Square payment data directly into your QuickBooks accounting system. This makes it easy to manage your finances and accounting when using both platforms together.