Managing business finances and operations tends to get increasingly challenging as data volumes increase. What you need here is, obviously, an ultimate platform that can scale and grow along with your business over time. But between NetSuite vs QuickBooks, which one fits the bill?

Our team is here to address that question for you! In today's article, we will compare the two platforms across 11 key areas:

- Pricing

- Ease of use

- Workforce management

- Financial management

- Inventory management

- Globalization

- App store

- Integration APIs

- Loading speed

- Security

- Customer support

Without further ado, let's jump in!

Oracle NetSuite vs QuickBooks: A Quick Overview

Before looking into our detailed comparison, you should start with a general overview of each platform first! Let us break it down for you.

About NetSuite

Released in 1998, NetSuite is a comprehensive cloud-based enterprise resource planning (ERP) software. It's designed to help large businesses manage different operations, particularly customer relationship management (CRM) and financial management, on one centralized platform.

Industries that use NetSuite:

- eCommerce and retail

- Manufacturing

- Professional services

- Wholesale distribution

- Software and technology

NetSuite Pros | NetSuite Cons |

+ Customizable pricing based on business needs + Clean, intuitive interface + Comprehensive workforce management tools + Advanced inventory features like multi-location fulfillment and cycle counting + Supports 190 currencies and 20 languages + Extensive API tools for advanced customization + Multiple support channels. | + Overkill for small teams + No direct install button for apps + Slow loading times (15-25 seconds). |

In July 2016, Oracle Corporation announced a definitive agreement to acquire NetSuite for approximately $9.3 billion. Though NetSuite still maintains its original product offerings and market focus, it now benefits from Oracle's extra resources to attract more customers.

About QuickBooks

On the other hand, QuickBooks is a cloud-based management and accounting software for small to medium-sized companies. It mostly focuses on financial management (including invoicing, payroll, expense tracking, etc.) to help businesses stay organized without requiring extensive accounting expertise.

Industries that use QuickBooks:

- Freelancers and solopreneurs

- Small eCommerce stores

- Service-based businesses (e.g., consulting, legal, or creative services)

- Nonprofits and charities

- Retail and hospitality

QuickBooks Pros | QuickBooks Cons |

+ Transparent pricing + Beginner-friendly interface with simple navigation + Smooth integration with Shopify, WooCommerce, BigCommerce, Magento + Fast loading times (10 seconds or less) + Comprehensive support. | + Limited scalability for larger businesses + Inventory features are only available in higher-tier plans + Rate limits on API requests. |

As of now, QuickBooks offers two versions: QuickBooks Desktop (a locally installed, one-time purchase version) and QuickBooks Online (a cloud-based platform available through monthly subscriptions). Please note that our article will focus exclusively on the QuickBooks Online version from here.

NetSuite and QuickBooks: Which Is Better?

After four months of dedicated research and testing, we can confidently say that NetSuite comes out as the ultimate winner. Its workforce and inventory management features are leagues better than QuickBooks, for one. Plus, thanks to the diverse integration APIs, your businesses can scale effortlessly on NetSuite as data volumes grow over time!

That said, QuickBooks is still a strong contender at the end of the day; its core features conveniently suffice for small to medium-sized businesses. Not to mention, the platform still outshines the big giant NetSuite in some key areas, particularly loading speed and financial management functionalities.

Curious to see how NetSuite vs QuickBooks stack up in each criterion? Keep reading for a detailed breakdown.

Need Help To Migrate Your Store?

LitExtension provides a well-optimized All-in-One migration service for data transfer.

FREE DEMO NOW

NetSuite vs QuickBooks: Break Down The 12 Differences

To determine which platform stands out between the two, we have conducted extensive testing across 11 key factors as follows:

1. Market share (QuickBooks wins)

Overall, while market share may not always reflect a platform’s quality, it DOES indicate its market position and user preferences. With that in mind, let’s take a closer look!

- As of now, QuickBooks leads the business and accounting solutions niche with an impressive 38.55% market share. NetSuite comes in second, capturing approximately 8.45%.

- When it comes to user base, QuickBooks serves over 5 million users globally, while NetSuite has around 30,000 users.

The Verdict

QuickBooks clearly dominates the market here, though NetSuite’s position as the second most popular option also indicates its value as a strong, quality platform worth considering. That’s why we still keep going with our comparison to determine which platform is truly the better fit for your needs.

2. QuickBooks vs NetSuite cost (QuickBooks wins)

First, let's start with NetSuite vs QuickBooks cost, a key factor in deciding which platform fits your current budget. Here's what we found:

NetSuite pricing

As of this writing, NetSuite does not offer a fixed price for its services. Instead, the platform provides a variety of solutions categorized based on specific business needs, each with customizable pricing Check the table below for some notable offerings:

Categories | Options (personalized quotes) |

Business types | + Startups + Fast-growing businesses + Family-owned + Small business + Midsize business + PE-backed + Enterprise |

Role | + CEO + CFO + Controller + CIO |

Current software | + Microsoft + Sage Intacct + SAP + Deltek + Epicor + Legacy On-Premise ERP |

Quickbooks pricing

Currently, QuickBooks Online offers four cloud-based subscription plans for users to choose from:

Plan | Features |

Simple Start ($19/month) | + Unlimited custom quotes and invoices + Tracking expenses and income + Tracking VAT and GST + Reports and insights + Progressive invoicing + For one user (plus an accountant) |

Essentials ($28/month) | + All features in Simple Start + Tracking employee time + Managing payments and bills + Multi-currency + 3 users (plus an accountant) |

Plus ($40/month) | + All features in Essentials + Recurring bills and transactions + Tracking project profitability + Tracking inventory + Managing budgets + 5 users (plus an accountant) |

Advanced ($76/month) | + All features in Plus + Automate workflows + Customizable dashboards and role permissions + Custom reporting fields + Managing revenue recognition + Online backups and data restoration + Up to 25 users |

The Verdict

All in all, QuickBooks takes the lead here: its straightforward and transparent prices allow both beginners and experienced users to find the exact solution they need. NetSuite's lack of clear pricing, on the other hand, can feel quite overwhelming.

3. Ease of use (A tie)

Now that we've covered the pricing, let's move on to usability to confirm how intuitive and user-friendly QuickBooks vs NetSuite really are.

NetSuite ease of use

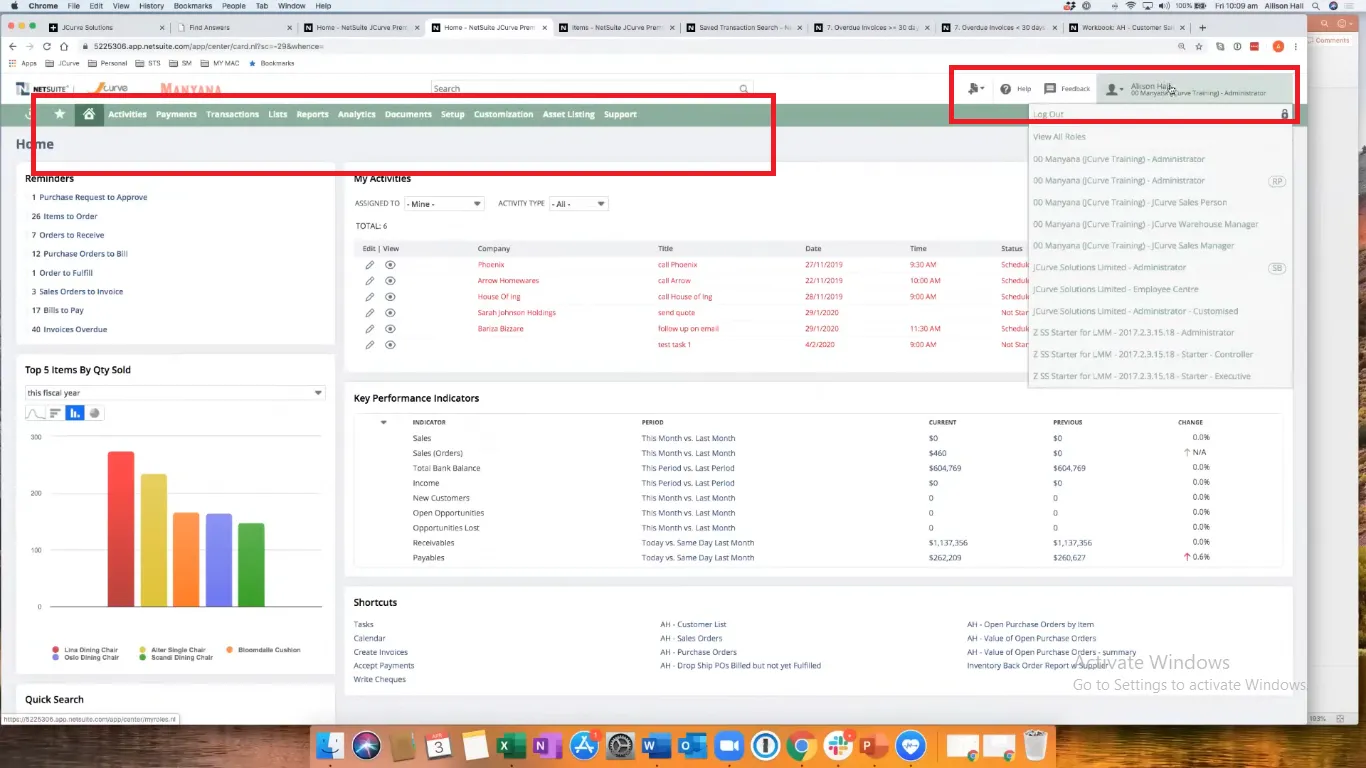

Contacting NetSuite's team personally for purchase might sound like a time-consuming step at first. However, it is actually quite a huge plus since the team also assists you with the onboarding process. Within minutes, you are logged in and exploring the dashboard — no installation required!

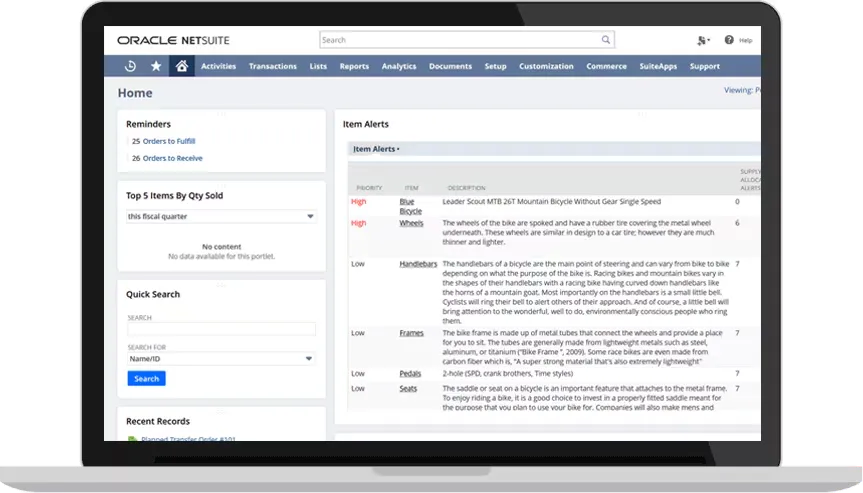

Better yet, the dashboard itself is well-organized and a breeze to navigate. It features eleven key sections arranged horizontally on the same tab, including Activities, Payments, Transactions, Lists, and more. Simply click on each one to adjust the settings.

Of course, the dashboard might include additional options for larger businesses or those with more specific needs. But thanks to this intuitive design, the platform doesn't feel overwhelming in the slightest despite all the extra functions.

QuickBooks ease of use

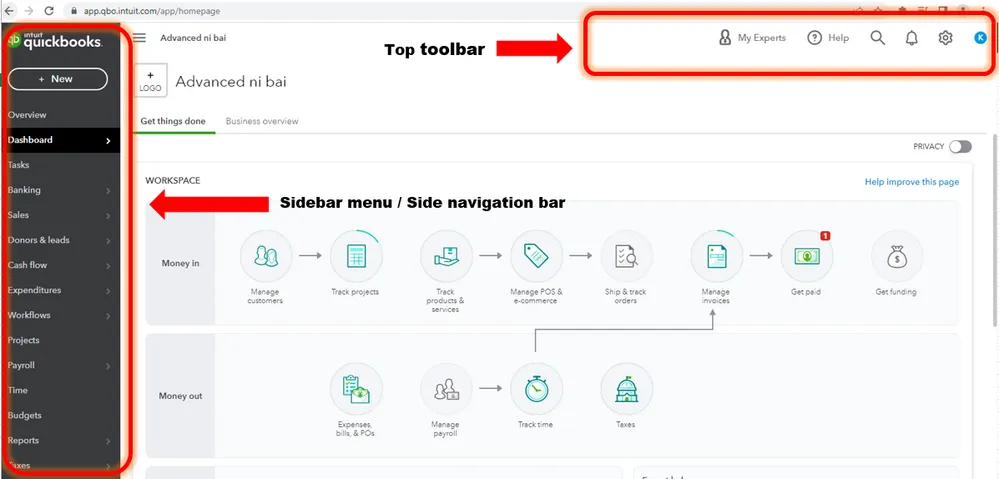

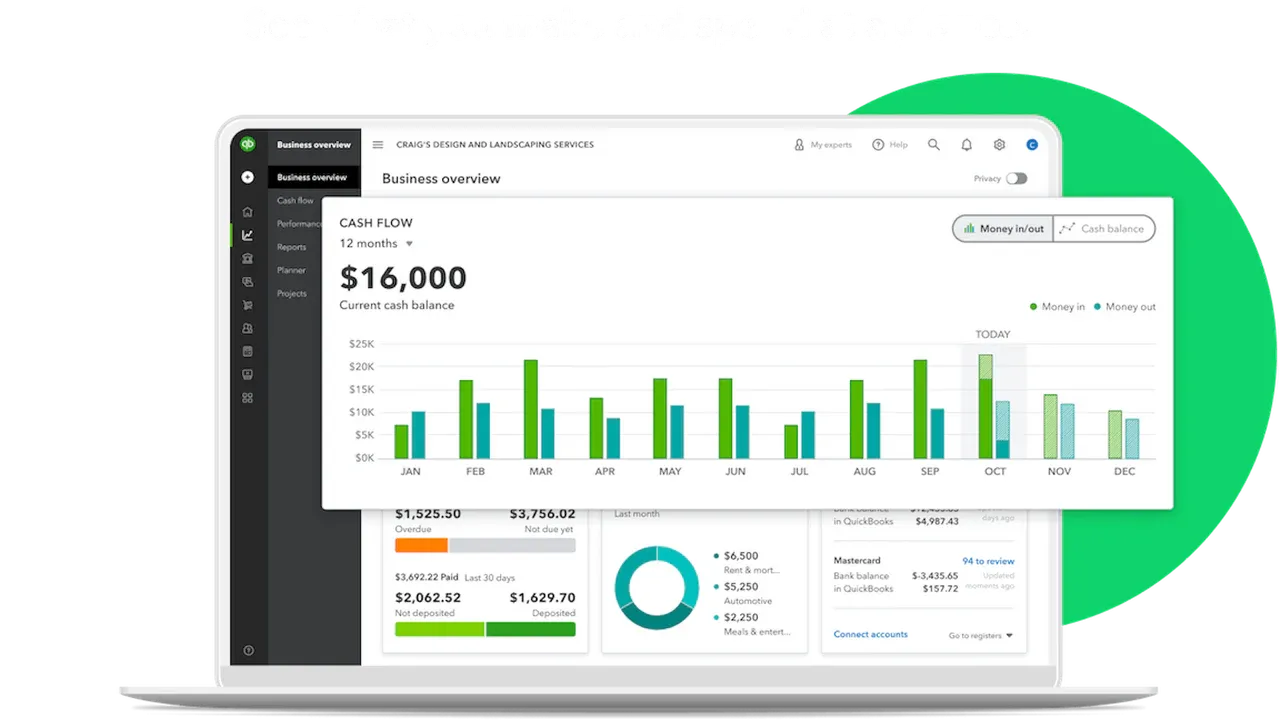

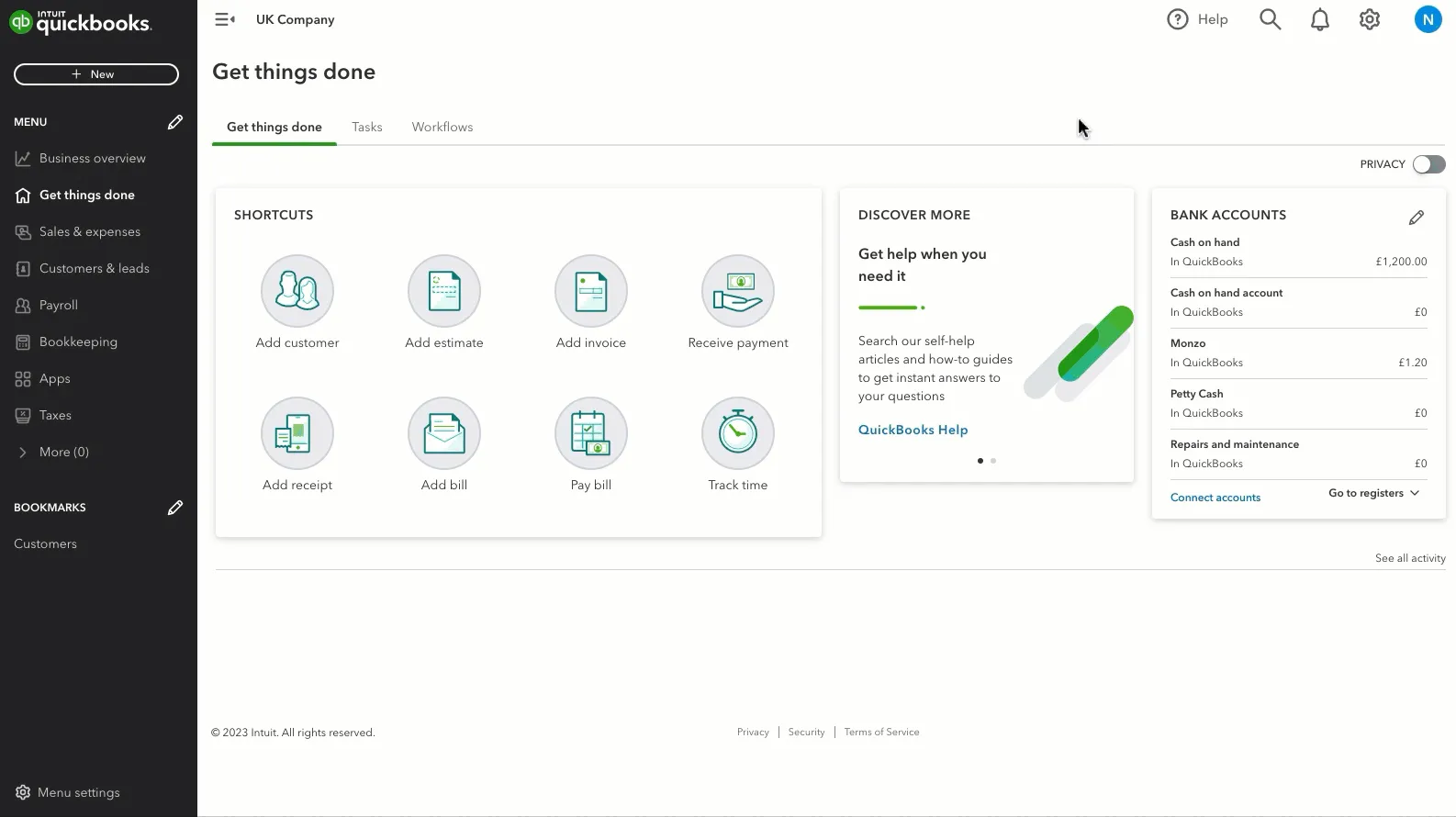

As a subscription-based platform, QuickBooks is clearly designed with beginners in mind. Once creating your account and selecting a plan, you're immediately greeted with a clean, simple, and easy-to-navigate interface!

The top-right toolbar includes basic account features like My Experts, Help, a search tool, notifications, and account settings. At the same time, the main menu (containing all the key management sections) is neatly arranged on the left-hand side. All it takes is a click on each section to start customizing its settings!

The Verdict

Though their onboarding processes differ slightly, both platforms impressed our team with their clean and intuitive interfaces. Hence, we decided to call this round a tie.

4. Workforce management (NetSuite wins)

Needless to say, managing and tracking tasks will become inevitably and increasingly challenging (especially as your team grows over time) without the right tools in place. Let’s take a look at how NetSuite vs QuickBooks addresses this matter:

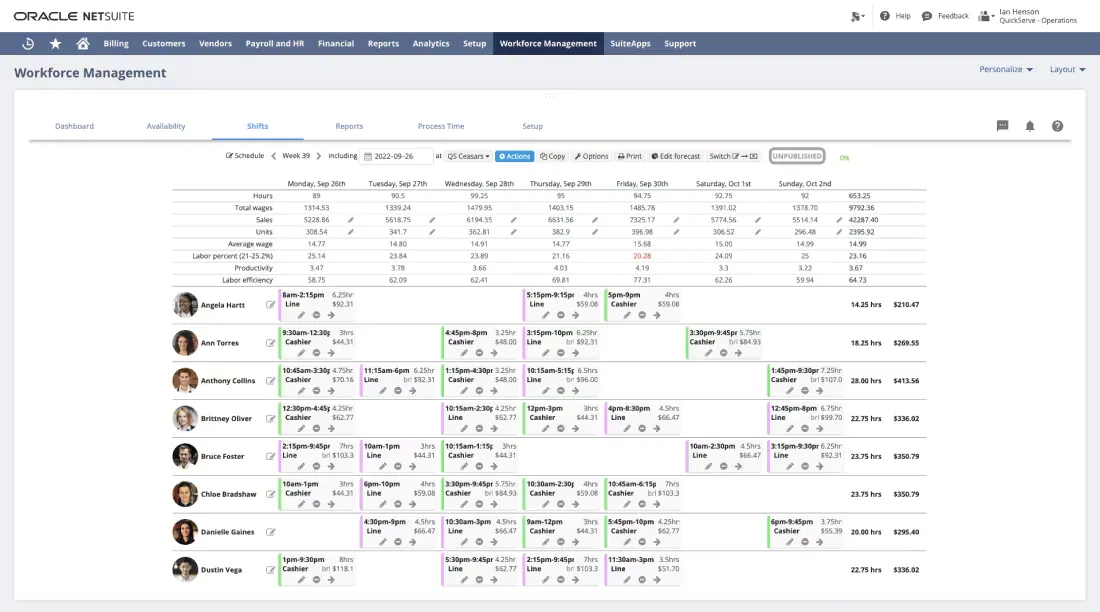

NetSuite workforce management

Regarding employee management, NetSuite offers a comprehensive solution that addresses all key aspects, regardless of the size of your workforce:

- Shift scheduling: Business owners can plan and manage employee schedules. Plus, the time and attendance tracking tool also accurately records work hours across the entire team and feeds them directly into wage calculations.

- Time-off management: The platform automates the process for employees to request time off and for managers to approve it. Once a request is approved, time-off balances are automatically updated. You can also enforce policies to ensure employees don't exceed their allowed time off.

- Compensation and benefits: NetSuite provides a centralized system (accompanied by a visual timeline) so HR teams and managers get a clear overview of all compensation changes throughout an employee's lifecycle.

- Performance management: Most importantly, the platform includes built-in tools to set/track goals and conduct performance reviews. As a result, each employee can collaborate better with their managers to assess current performance and plan for future career development.

QuickBooks workforce management

Like NetSuite, QuickBooks also offers practical built-in features to simplify workforce management:

- Time-tracking tools: You can record billable hours in efficient timesheets for both clients and employees. These numbers will then get added automatically to invoices.

- Expense management: QuickBooks lets employees submit expense claims through their accounts, while managers can review, approve, and match these claims to transactions for accurate financial tracking.

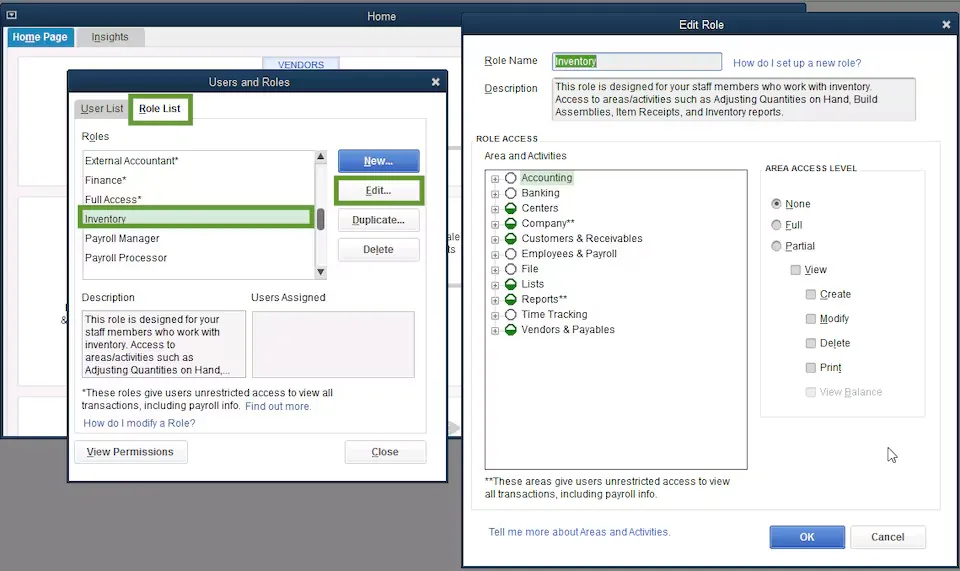

- Customizable roles and permissions: With this feature, you may assign specific access levels (such as Primary Admin, Company Admin, In-House Accountant, Inventory Manager, or Standard Access) to restrict access to sensitive information.

Nevertheless, note that the customizable permission feature is only available in the Advanced Plan (which supports up to 25 users). Also, when it comes to key performance indicators (KPIs), QuickBooks mostly focuses on tracking the numbers of the entire project rather than each individual employee.

The Verdict

NetSuite clearly takes the lead here; its performance tracking features (for each individual staff) are far more comprehensive than QuickBooks. Plus, these tools easily accommodate large crews — even those with hundreds of members — while QuickBooks can only manage 25 users at best.

5. Financial management (QuickBooks wins)

Keeping track of how money flows into, out of, and within your business is the foundation of any successful operation! Both NetSuite vs. QuickBooks offer features to help monitor your finance situation at any given moment, though their approaches slightly differ:

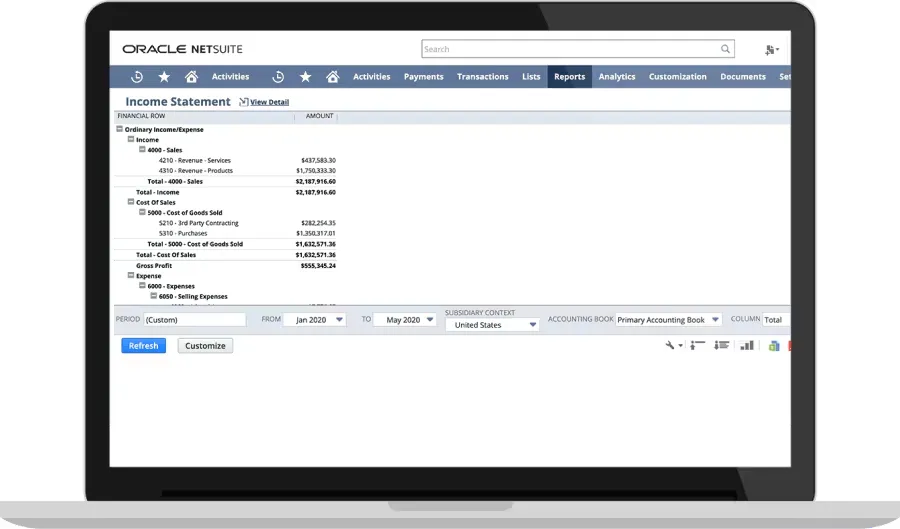

NetSuite financial management

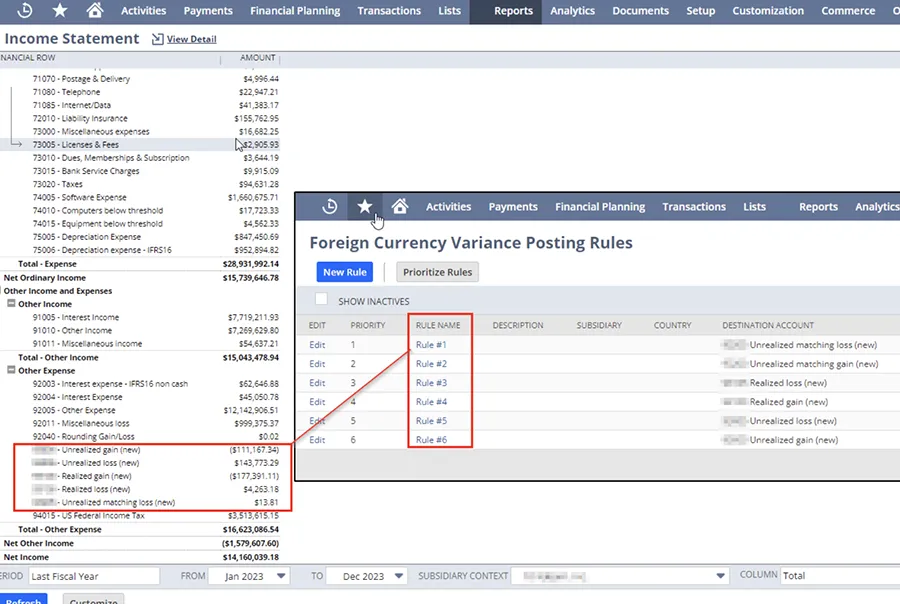

As of this writing, NetSuite offers five core financial management features that cover most basic needs, including:

- Accounting: The accounting tools deliver real-time insights into key metrics, including profitability ratios, taxes, fixed assets, cash positions, and inventory margins. All repetitive tasks (such as reconciling account statements and making journal entries) are 100% automated.

- Subscription billing: For monthly subscriptions, you can combine multiple invoices into one, set up different pricing models, and automate subscription renewals without any manual interventions. As a result, your customers will always be billed accurately and on time.

- Planning and budgeting: The platform uses AI to analyze your data and generate fast, accurate forecasts; that way, you can quickly estimate how much you will earn and spend in the future. It also provides well-written summaries along with these analyses so that everyone on your team can grasp the big picture.

- Revenue recognition: This feature ensures your business follows the rules for recording income and meets international standards. For example, if you sell a subscription or a service delivered over time, NetSuite automatically calculates when and how much revenue to recognize (based on your contracts).

- Financial reporting: Using NetSuite's built-in export tools, you only need minutes to create clear and accurate financial reports (e.g., profit-and-loss statements or balance sheets). There are also pre-built graphs tailored to specific roles (such as CEO or accountant) so that only the most relevant data is displayed depending on your needs.

QuickBooks financial management

Since QuickBooks is primarily an accounting tool, it did not surprise us in the slightest that its accounting features turned out to be far more comprehensive than NetSuite's. The following assets cover not just the basics but essentially every key aspect of financial management, down to detailed hour-based expense tracking:

- Tracking expenses and incomes: Since the platform is connected straight to your bank accounts, it can automatically track and categorize your transactions to give you a clear overview of the business's health. Feel free to modify each category if desired.

- Monitoring professional invoices: QuickBooks always tracks invoice payments to inform you who's paid and who hasn't. To ensure prompt payments, you can set up automated reminders for overdue invoices or even send invoices via WhatsApp.

- Managing tax (VAT and GST): The platform calculates taxes in real-time, tracks outgoing and incoming VAT, and categorizes transactions to help maximize tax deductions.

- Progressive invoicing: For businesses working on long-term projects, QuickBooks offers progress invoicing to make payment tracking easier. This feature lets you break project estimates into multiple invoices tied to specific milestones or stages. You may invoice for full, partial, or custom amounts while automatically tracking what's been paid and what's still owed.

- Financial reports: The customizable dashboards and reports will help you understand your business's financial performance down to the smallest details (e.g., profit and loss, expenses, balance sheets). If needed, you can share polished, professional summaries with business partners or stakeholders to keep everyone aligned.

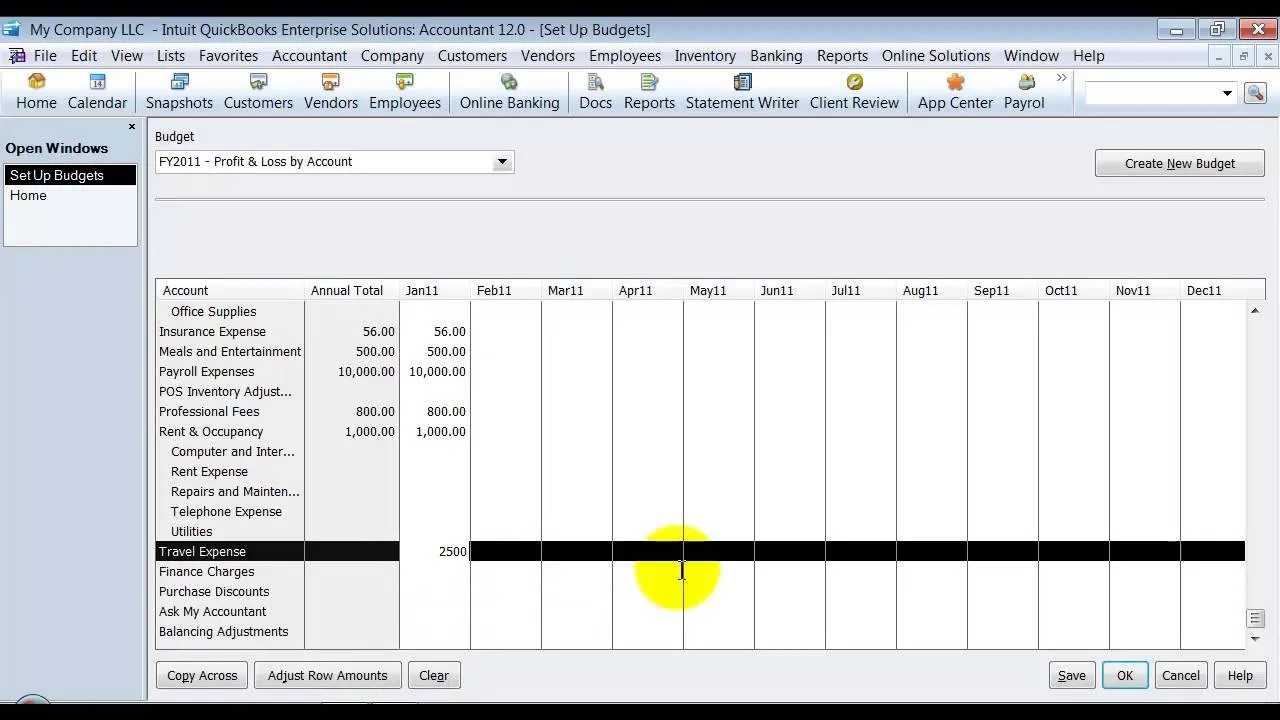

Furthermore, as you upgrade your subscription plans, QuickBooks also unlocks more advanced tools down the line to grow alongside your business. For example, you can:

- Record payments, track bills, set up recurring transactions, and pay multiple vendors at once (starting from Essentials)

- Use budgeting tools to create, monitor, and compare budgets in both percentages and dollars (starting from Plus)

- Manage revenue recognition (Advanced).

The Verdict

Although both platforms have excellent financial management features, QuickBooks holds an edge here thanks to its more inclusive and clearly outlined packages. That way, you can select only the features you currently need (to avoid overspending) and easily upgrade your plan later.

6. Inventory management (NetSuite wins)

Are you currently working in the retail or eCommerce industry? If yes, then understanding which system — NetSuite vs QuickBooks — offers better inventory management is quite crucial. To help you make an informed decision, we have thoroughly evaluated this criterion and summarized our findings below:

NetSuite inventory management

As noted earlier, NetSuite's primary target audience is large-scale or rapidly growing businesses. As a result, its inventory features are specifically tailored for multiple-location management, ensuring accurate real-time tracking across ALL storefronts:

- Multi-location fulfillment: NetSuite provides real-time visibility of stock levels across all locations. So, if a product is out of stock at one location, your sales associates can access inventory across the entire organization to transfer, hold, or ship the product directly to the customer.

- Replenishment: The platform relies on seasonal trends and historical sales data to dynamically adjust stock levels and reorder points. Furthermore, alert messages will be sent to you (or a purchasing manager) automatically whenever stock runs low.

- Cycle counting: Want to keep calculating inventory without halting any business operation? This feature is designed precisely for that purpose! Instead of stopping all transactions at a location, the system can track inventory for individual items while they're being counted.

- Traceability: You can track inventory from purchase to sale using serial numbers (for individual items) and lot numbers (for specific product batches). There's also the option to set rules for inventory usage (e.g., shipping items with the closest expiration date first.)

- Item visibility: The Item 360 dashboard consolidates all information about a specific product (KPI, forecasts for future stock needs, inventory levels, etc.) into one centralized view. With all the relevant data right at your fingertips, you will be able to make better, more informed inventory decisions.

QuickBooks inventory management

Unlike NetSuite, QuickBooks has always catered to small businesses and solo entrepreneurs. This key difference is clearly reflected in its inventory management features, which lack most of the basic multi-branch functionalities and only offer tracking methods within a single location:

- Real-time inventory updates: QuickBooks automatically updates your inventory as stock comes in and out. This real-time tracking helps you see exactly what's available, what's selling well, and what needs to be restocked.

- Stock valuation: The platform instantly updates your financial statements (balance sheets included) as the value of your inventory changes. That way, you always have a clear picture of the business' assets at any time.

- Order management: With QuickBooks, you can track what you've ordered from each supplier and receive alerts when it's time to reorder. Once new inventory arrives, the system converts the purchase order into an expense record so you will pay your suppliers on time.

- Integrated eCommerce: Connecting your inventory management with popular eCommerce platforms (Shopify, WooCommerce, Magento, and BigCommerce) is never easier! All your inventory and sales data are synced in one place, which makes them a breeze to track down.

Also, keep in mind that none of the features listed above are included in the Simple Start and Essentials plans. Only subscribers of the QuickBooks Plus and Advanced plans have direct access to them as of our writing.

The Verdict

QuickBooks' smooth integration with eCommerce platforms truly makes it a strong contender here. Unfortunately, the rest of its features are quite basic compared to NetSuite's more robust selection; that's why we still chose NetSuite as the ultimate winner in this round.

7. Globalization (NetSuite wins)

Does your business manage multiple branches or storefronts across different countries (or work with a culturally diverse team)? Then, this section is a must-read! We have made sure to include globalization as a key criterion in our NetSuite vs QuickBooks comparison.

NetSuite globalization

At the moment, NetSuite supports 190 currencies for transactions, reports, and finance management. The most impressive part? There's no stated limit on how many of them can be applied for individual projects or vendors!

On the other hand, NetSuite's language support is far less extensive (though still decent). There are 20 language options in total, including English, German, French, Japanese, and Chinese.

QuickBooks globalization

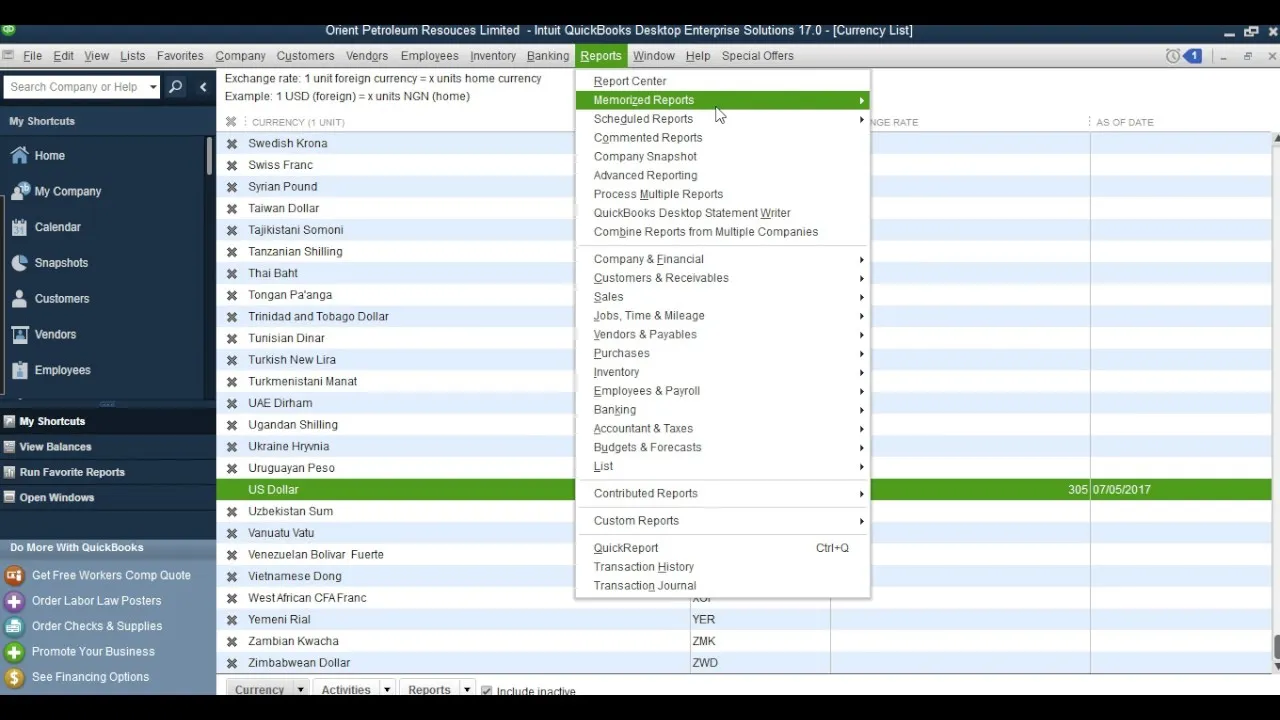

Like NetSuite, QuickBooks' multi-currency feature allows businesses to record payments, bills, and transactions in currencies different from their home currency. It has supported around 155 currencies so far, which covers most global needs.

In terms of language options, QuickBooks supports 11 as of this writing: English, Chinese, Spanish, French, Japanese, German, Korean, Italian, Thai, Arabic, and Portuguese.

The Verdict

Based on sheer numbers alone, NetSuite is the clear winner here. Still, we must say the difference between the two platforms might not be significant for most medium businesses. After all, even some of the largest global companies do not always use up all 190 currencies!

8. App store (A tie)

Aside from the core features, third-party apps can make all the difference to your store's functionality. Hence, we have thoroughly analyzed this criterion for both NetSuite vs QuickBooks:

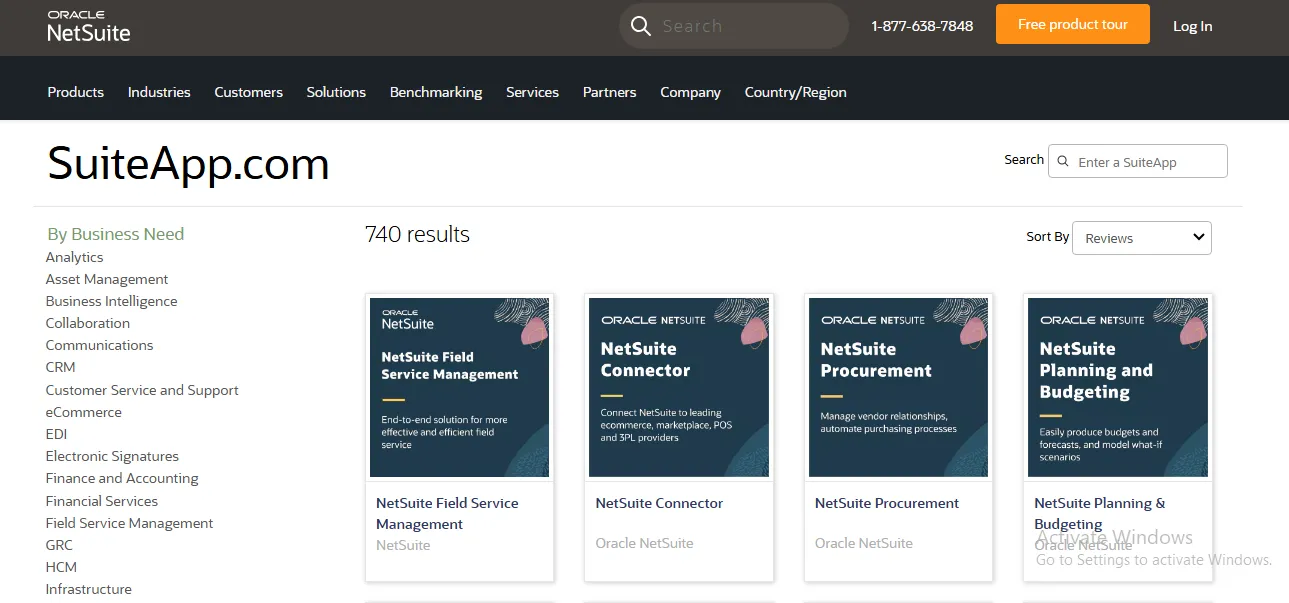

NetSuite app store

From our research, NetSuite's app marketplace (SuiteApp.com) offers around 740 third-party solutions. They can be easily filtered during your search by Business needs (e.g., analytics, CRM, eCommerce), Category (e.g., Staff Picks, Latest), and Country.

Furthermore, all these apps are developed either by NetSuite or its official partners, so compatibility or security issues are the last things to worry about.

Nevertheless, one huge drawback is the lack of transparent pricing and a direct “Install” button like other platforms. Simply put, you'll need to contact either NetSuite or the app's partner itself for setup and price details.

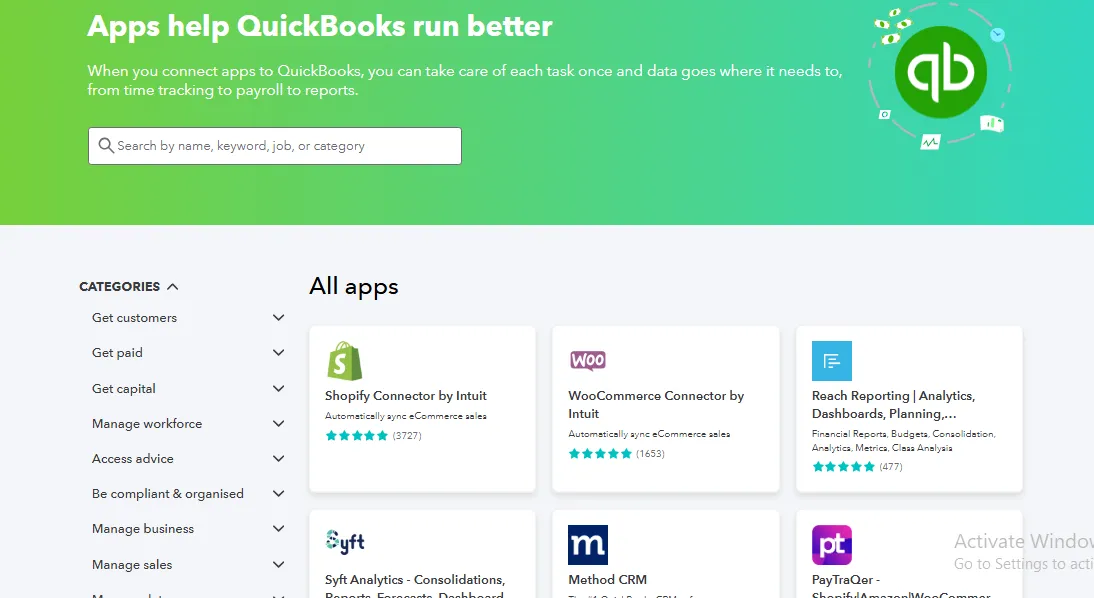

QuickBooks app store

Like NetSuite, QuickBooks also boasts an impressive collection of approximately 750 apps, ranging from free options to premium ones costing up to $150 per month. Plus, many of these apps (not all) come with a convenient “Get the App Now” button, so you may install them in minutes without needing to contact QuickBooks support!

On the other hand, its filtering system is not exactly robust; you can only narrow your search by business needs or categories (e.g., Customer Management, Capital, Workforce Management). So expect some extra scrolling during research unless you already have the specific app's name in mind.

The Verdict

NetSuite offers better filtering options, but QuickBooks provides a slightly larger library in comparison (plus accessible installation for some apps). Since both platforms bring unique strengths to the table, this round ends in a tie.

9. Integration APIs (NetSuite wins)

What if the core features and app store still don’t meet your store’s specific needs? In that case, integration APIs can be your huge life-saver, though their effectiveness ultimately depends on what NetSuite vs QuickBooks has to offer:

NetSuite integration APIs

As a top ERP system, NetSuite provides extensive customization opportunities. It offers five distinct API tools that you can use to tailor your workflows and integrations:

API Tool | Description | Strengths |

SuiteScript | JavaScript-based scripting for custom workflows and automation. | Highly customizable; event-driven. |

RESTlet | Custom REST API scripts for external apps. | Supports JSON/plain text; secure. |

REST API | RESTful API for interacting with NetSuite. | Simple integration; SuiteQL support. |

SuiteQL | Query language for data retrieval. | Efficient, single-query results. |

SOAP API | Legacy API for data access and updates. | Reliable; supports bulk operations. |

QuickBooks integration APIs

QuickBooks, being a subscription-based platform, offers far more limited API functionality.

It primarily supports RESTful APIs with standard HTTP methods (GET, POST, PUT, DELETE) and JSON for data exchange. Not to mention, there are rate limits on API requests, which is definitely a drawback to keep in mind if your business operates on a large scale.

The Verdict

NetSuite clearly takes the lead here due to its much wider range of API tools. That said, if you’re a small-to-medium business or already find yourself satisfied with the core features, QuickBooks’ integration API is still robust enough to support your operations effectively in the long run.

10. Loading speed (QuickBooks wins)

Though loading speed is not always a top priority, it might become extremely important in situations where you need instant, real-time data (e.g., checking the exact quantity of inventory at a given moment). So, let’s take a closer look at how NetSuite and QuickBooks perform in this area.

NetSuite loading speed

We must say that NetSuite's browser client is quite resource-intensive. Based on multiple trials and experiments, we found that a single page takes about 15 seconds to fully load, with some cases reaching up to 25 seconds!

Fortunately, the “General” subtab in the “Set Preferences” section offers some options to help optimize loading speed, such as:

- Delay loading of sublists: Loads subtab information only when clicked.

- Number of rows in list segments: Sets the maximum number of records loaded per segment for long lists (e.g., 100 rows per segment)

- Maximum entries in dropdowns: Limits the number of records displayed in dropdowns (up to 500); excess entries are shown in a popup window.

QuickBooks loading speed

How about QuickBooks? Our experiments showed consistently fast loading times, averaging 10 seconds or even less.

All in all, this number is quite satisfactory for most business owners. But if you’re still looking for further optimization, make sure your browser (e.g., Google Chrome) and operating system are updated to their latest versions.

The Verdict

QuickBooks is the clear winner in terms of loading speed. Its consistent results of under 10 seconds are undoubtedly better than NetSuite's 15 to 25! Nevertheless, NetSuite is actually not a half-bad option in this case since it still offers some built-in settings to increase performance.

11. Security (A tie)

As you can see, NetSuite and QuickBooks both store a significant amount of your business's data. That's why security must be an ABSOLUTE priority unless you want your information to fall into the wrong hands! Here's what we discovered so far about the security measures of both platforms:

NetSuite security

Overall, any NetSuite user can rest assured when it comes to security. The platform undergoes external audits to meet SOC (System and Organization Controls) 1 Type 2 and SOC 2 Type 2 standards while also maintaining compliance with:

- International Organization for Standardization (ISO) 27001

- ISO 27018

- Payment Card Industry Data Security Standard (PCI DSS)

- Payment Application Data Security Standard (PA-DSS).

And that's not all. Aside from all the abovementioned measures, NetSuite also applies token-based, multi-factor authentication and 24/7 monitoring to give you peace of mind.

QuickBooks security

Meanwhile, QuickBooks uses DigiCert SSL certificates, a leading authority in secure sockets layer (SSL) technology.

Specifically, the platform employs firewall-protected servers, password-protected logins, and 128-bit encryption — all of which are also used by top global banks. Not to mention, its production equipment is 100% secured with 24/7 physical security (including alarm systems and full-time video surveillance) to safeguard your business against common breaches.

The Verdict

Despite their different approaches, both NetSuite and QuickBooks implement robust methods to protect your business data. Thus, we have another round that ends in a tie.

12. Customer support (QuickBooks)

Lastly, managing a large amount of data in a centralized system is no small task (regardless of how user-friendly the platform might be), so you’ll inevitably need assistance at some point! Below is a quick summary of our experience with the customer support options for both platforms:

NetSuite customer support

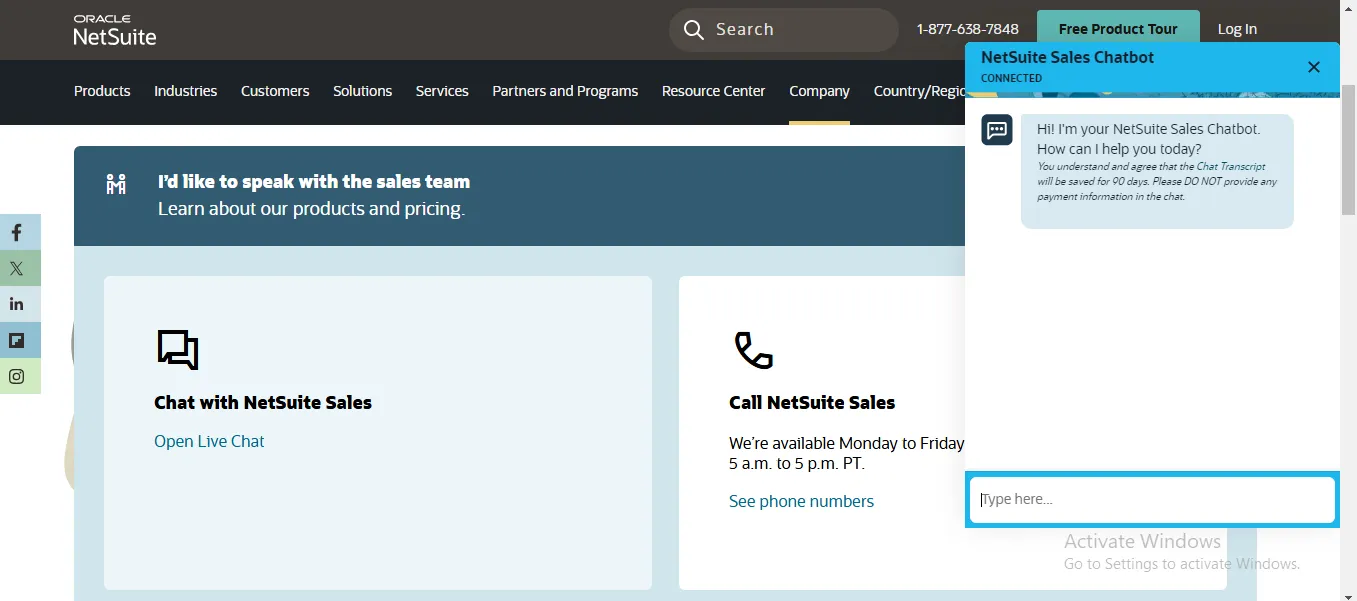

Currently, NetSuite offers four primary options for addressing technical issues:

- SuiteAnswers Knowledge Center

- Support Community Group

- Live chat

- Telephone support

However, there are a few important details to note here.

For instance, for the live chat option, your session always begins with a chatbot. The issue will only escalate to a live agent when the chatbot fails to pinpoint your problem (which turns out to be far more common than we expected).

Secondly, telephone support is available only on weekdays (from Monday to Friday, 5 a.m. to 5 p.m. PT) and is not accessible on weekends. Hence, for extremely urgent issues, you will either need to wait until Monday or rely on alternative options (such as the support group or Knowledge Center) instead.

QuickBooks customer support

Like NetSuite, QuickBooks provides four main support channels:

- Online knowledge base

- Community forums

- Phone support

- Chat assistance

However, in QuickBooks' case, phone and chat support are bundled together; phone support is only offered if the issue cannot be fully resolved via chat.

On the plus side, we are impressed that their support team works consistently from Monday to Saturday (and even 24/7 if you subscribe to the Advanced plan). That is quite a huge step over NetSuite, whose support is limited exclusively to weekdays.

The Verdict

Though both platforms offer a range of robust support options, QuickBooks is the only one that provides consistent support during weekends (even for its starter plans). Hence, we consider QuickBooks the clear winner in this comparison.

Can You Switch from NetSuite to QuickBooks or Vice Versa?

Yes, you can. LitExtension's QuickBooks data migration services make the entire transfer from NetSuite to QuickBooks 100% stress-free.

Given the complex structure of QuickBooks, our team always includes the All-in-One package in the QuickBooks migration service. Specifically, once you communicate your requirements with our team and complete your payment, we'll take over and handle the rest — no more technical headaches!

Better yet, you may also transfer your data from QuickBooks to NetSuite (or any eCommerce platform) or switch between different QuickBooks versions (e.g., from Desktop to Online). Contact us today to learn more!

NetSuite vs QuickBooks: FAQs

What is the difference between NetSuite and QuickBooks?

NetSuite is a comprehensive ERP system for managing financials, CRM, and inventory at a large scale. Meanwhile, QuickBooks is primarily a management/accounting tool suited for small startups or businesses with basic financial needs.

Why do people switch from QuickBooks to NetSuite?

Businesses switch to NetSuite for advanced functionalities, better scalability, and an integrated platform that supports growing operational complexity.

Why are people leaving QuickBooks?

Most businesses outgrow QuickBooks since the platform struggles to meet their growing demands. As their operations keep expanding at a rapid rate, these users need more robust solutions capable of supporting larger-scale campaigns, multi-channel sales, advanced analytics, etc.

Is Oracle better than QuickBooks?

Oracle (via NetSuite) is indeed better than QuickBooks for mid-to-large businesses looking for advanced ERP capabilities. That said, QuickBooks still offers solid features for small businesses focused on core accounting.

Final Words

This quick FAQ section also brings our in-depth comparison of NetSuite vs QuickBooks to a close. Though NetSuite still takes the crown overall, it is quite a tight race; in fact, QuickBooks wins in three categories and ties with NetSuite in four others!

So whether you plan to switch from NetSuite to QuickBooks or vice versa, rest assured that both platforms are solid choices. And the best part? LitExtension can make your entire QuickBooks migration stress-free! With over 12 years of experience and 200,000 satisfied customers, our team will ensure your new business is up and running smoothly in no time.

For more information, check out our QuickBooks guides and join our Facebook community.