Selecting the best payment gateway for WooCommerce is essential for delivering a seamless checkout experience. Efficient payment gateways ensure smooth transactions, reduce cart abandonment, and enhance customer trust. A Baymard Institute study shows that 21% of U.S. online shoppers have abandoned carts due to long or complicated checkouts, underscoring the importance of streamlined processes.

In this guide, we have gathered the 8 best payment gateways for WooCommerce. For each solution, we will detail its key features and benefits to help you choose the best solution for your business.

Continue reading to find out the best one for your store!

8 Best Payment Gateways for WooCommerce

A WooCommerce payment gateway is a service that processes payments for online stores using the WooCommerce platform. It acts as a bridge between your eCommerce website and the financial networks involved with the transaction.

When a customer decides to purchase an item from a WooCommerce store, they choose their preferred WooCommerce payment processing method at checkout. The payment gateway securely captures the payment information and communicates with the bank or payment service to approve or decline the transaction.

If the payment is approved, the funds are transferred from the customer's account to the merchant's account, and both parties receive confirmation. This process is seamless and typically occurs in real time, ensuring a smooth shopping experience for the customer and reliable revenue for the store.

Now that you understand how the payment gateway works, let's explore the best payment gateway for WooCommerce available, based on our testing:

Payment Gateway | Best For | Key Features |

WooCommerce Payments | WooCommerce users wanting built-in integration | Native to WooCommerce, no setup fees, manage payments in dashboard |

Stripe | Global sellers and developers | Supports 135+ currencies, recurring billing, fraud prevention |

PayPal | Businesses needing quick, trusted payment options | Multiple PayPal options (Standard, Express), wide user trust, fast setup |

Square | Physical stores expanding online | Unified POS + online system, transparent pricing, easy integration |

Amazon Pay | Stores targeting Amazon shoppers | Uses Amazon login/payment, fast checkout, fraud protection |

Klarna | Stores offering Buy Now, Pay Later options | Flexible payment plans, improves AOV, work in the US and EU |

Authorize.net | Large or established businesses | Advanced fraud tools, recurring billing, requires merchant account |

PayPal Braintree | Businesses needing all-in-one payment solution | Supports PayPal + cards, recurring payments, secure vault for card storage |

Below, let's dive into the top 8 options that we have curated, each with a detailed analysis of their key features, pros, and cons to help you find the perfect fit for your store's needs.

1. WooCommerce Payments (WooPayments)

- Categories: Processors & gateways; In-person payments.

- Transaction fees: 2.9% + $0.30 per transaction for U.S. cards, +1% for international cards.

- Currencies: 135+ currencies.

- Countries supported: 38 countries.

WooCommerce Payments, or WooPayments, is an in-house payment solution offered by WooCommerce with no setup or monthly fees. In your main dashboard, you can easily handle and manage both online and in-person transactions.

Plus, you can accept all sorts of payments, like credit cards, debit cards, WooPay, and even digital wallets like Apple Pay. This makes it the best payment gateway for WooCommerce that you can consider for your store.

Key features:

- All transactions are managed within WooCommerce, simplifying operations.

- Automate recurring payments for subscriptions, memberships, and more, available exclusively in the U.S.

- Enable Buy Now, Pay Later (BNPL) options with just one click.

- Customize your payout schedule to receive funds daily, weekly, monthly, or on demand, according to your business needs.

- Works flawlessly with WooCommerce Subscriptions, providing an integrated solution for managing recurring payments.

- Payments are directly deposited into your bank account, improving cash flow.

- Customers can save their credit card details for faster checkouts in future transactions.

- Uses Stripe’s security infrastructure to protect against fraud and ensure PCI compliance.

Despite its benefits, WooPayments does have some limitations. First, it is exclusive to WooCommerce, which could limit flexibility should you decide to switch platforms in the future. Additionally, it is not accessible for users in Africa, Asia, and most countries in the Asia-Pacific region, which could restrict opportunities for global expansion.

2. Stripe

- Categories: Processors & gateways; Buy now pay later.

- Transaction fees: 2.9% + $0.30 per transaction.

- Currencies: 135+ currencies.

- Countries supported: 45 countries.

Similar to WooPayments, Stripe operates on a pay-as-you-go pricing model without any setup charges. We highly recommend it as the best payment gateway for WooCommerce small businesses.

It accepts major credit and debit cards, along with local payment methods like Alipay, iDEAL, and SEPA Direct Debit. Stripe’s integrated suite also supports one-time and recurring payments, efficient invoicing, and automated tax calculations.

Key features:

- Features Buy Now, Pay Later (BNPL) services such as Klarna, Afterpay, and Affirm.

- Provides a responsive checkout across devices with built-in options like Link, Apple Pay, and Google Pay.

- Real-time fee reporting and financial reconciliation.

- Advanced fraud protection with Stripe Radar.

- Support for subscription-based billing.

- Broad customization capabilities through APIs.

Using Stripe has its challenges, primarily due to its complex setup and management, which demand technical expertise. This complexity can pose a significant challenge for users without a technical background.

3. PayPal

- Categories: Processors & gateways; In-person payments.

- Transaction fees: 2.99% + fixed fee per transaction for U.S. cards, +1,5% for international cards.

- Currencies: 24 currencies.

- Countries supported: 126 countries.

PayPal is the best payment gateway for WooCommerce stores that have customers all over the world, supporting businesses in more than 200 countries. Its popularity as an online payment method means many of your customers are likely already familiar with it, offering them a sense of comfort and convenience during checkout.

Besides the fact that there are no monthly and setup fees, you can even qualify for lower transaction fees based on your sales volume. This is applied when your store makes more than $3,000 a month and your PayPal account is over 90 days old, saving you money as your business grows.

Key features:

- Lets you offer PayPal, Venmo (US only), Pay Later options and more.

- One-touch checkout for returning customers.

- Extensive fraud protection and risk management.

- Access card payments and bank transfers with immediate crediting.

- Widely recognized and trusted by consumers.

- Immediate access to funds through your PayPal account.

Yet, it presents some challenges; fees for transactions outside the U.S. may be considerably costly. Moreover, merchants often encounter issues with account holds and freezes, which can interfere with the smooth running of business operations.

“As someone building my two WooCommerce stores (ayoui.com and ayoui.com.au), I chose PayPal for its ease of use and trusted reputation. Setting it up was straightforward, and I love how secure and reliable it feels—both for me as a seller and for my future customers. ”

4. Square

- Categories: Processors & gateways; In-person payments.

- Transaction fees:

- 2.6% + $0.10 per swipe, dip, or tap in the U.S.

- 2.9% + $0.30 for online transactions.

- Currencies: 7 currencies.

- Countries supported: 8 countries.

Square stands out as the best payment gateway for WooCommerce if you are a small to medium-sized business, particularly excelling in mobile point-of-sale capabilities. It allows merchants to process debit and credit card payments directly on mobile devices and supports various payment methods for both in-person and online transactions.

While Square's international reach may be more limited, its tailored business plans make it an ideal choice for restaurants, retail operations, and appointment-based services.

Key features:

- Free point-of-sale app and accepts payments offline.

- Supports Cash App payments, Square Gift Cards, and digital wallets like Apple Pay® and Google Pay.

- Automatically syncs new products and updates between WooCommerce and Square in real-time.

- Offers a clear, flat fee structure for transactions, with custom rates available for larger businesses.

- Provides options for instant, next-day, or custom schedule deposits.

- Features detailed, itemized transaction reporting within Square for better business insights.

- Offers significant initial transaction fee waivers and discounts on hardware purchases for new users globally.

The biggest downside of Square is that it is less suited for high-volume or international businesses. This is because its services are only available in a limited number of countries, restricting its global applicability.

5. Amazon Pay

- Categories: Wallets & express checkouts.

- Transaction fees: 2.9% + $0.30 per transaction for U.S. cards, +1% for international cards.

- Currencies: 12+ currencies.

- Countries supported: 18 countries.

Next up on the best payment gateway for WooCommerce that you can have is Amazon Pay. This solution allows customers to use the information stored in their Amazon accounts to check out quickly and securely on third-party websites. Hence, you can enhance the user experience by minimizing the need to enter payment details multiple times.

From our point of view, Amazon Pay is ideal for shoppers familiar with Amazon, offering a seamless payment process that can lead to higher conversion rates for businesses.

Key features:

- Amazon’s fraud protection technology helps secure each transaction.

- Transactions can be made using Amazon Alexa through voice payments.

- The mobile optimization ensures smooth payments on mobile devices.

- Integration with websites is quick, reducing development efforts.

- Simplifying the checkout process enhances customer convenience.

- The streamlined payment process can decrease cart abandonment rates.

Nonetheless, the platform's limitations are notable. It requires users to possess an Amazon account to initiate payments, which may deter some potential customers. Furthermore, the options for customizing the payment experience are somewhat limited, which could restrict the flexibility needed by some businesses to tailor the checkout process to their specific needs.

6. Klarna

- Categories: Buy now pay later.

- Transaction fees: 2.9% + $0.30 per transaction for U.S. cards, +1% for international cards.

- Currencies: 26 currencies.

- Countries supported: 26 countries.

If you are selling high-ticket items or fashion or run a seasonal business, Klarna is the best payment gateway for WooCommerce to consider. Known for its “Buy Now, Pay Later” feature, Klarna allows your customers to spread their payments over time. This flexibility can significantly boost your conversion rates and increase the average order values.

Key features:

- Deferred payment options are available through Buy Now, Pay Later.

- Adds customized communications at various points in the shopper journey.

- Lets customers link their accounts with pre-set payment preferences.

- A direct payment option is provided for immediate transactions.

- Customers receive an invoice to pay after delivery.

Be aware that Klarna's innovative “Buy Now, Pay Later” service isn't accessible worldwide, which could curtail your expansion into some international markets. The service's credit aspect also raises the potential for increased defaults, which could complicate financial management.

7. Authorize.net

- Categories: Processors & gateways.

- Transaction fees: 2.9% + $0.30 per transaction for U.S. cards, +1% for international cards.

- Currencies: 4+ currencies.

- Countries supported: 4 countries.

Authorize.net is another best payment gateway for WooCommerce, especially for small to medium-sized businesses. Since 1996, it has provided a secure and straightforward way to accept credit card and electronic check payments.

With its robust security features, clear pricing, and dependable customer support, Authorize.net simplifies online transactions. Our take on this solution is that it is a reliable and hassle-free choice for managing payments on your WooCommerce store.

Key features:

- Accepts various forms of payment including credit cards, debit cards, and electronic checks.

- The Advanced Fraud Detection Suite enhances transaction security.

- Recurring billing feature supports subscriptions and regular payments.

- Secure storage of customer payment details is facilitated by the Customer Information Manager.

- Easy integration with numerous eCommerce platforms.

- Mobile payment capabilities are supported for higher accessibility.

The adoption of Authorize.net might be financially challenging due to its structure of transactions and monthly fees. It also requires a technical background for effective setup and management, adding another layer of complexity for businesses.

8. PayPal Braintree

- Categories: Processors & gateways.

- Transaction fees: 2.9% + $0.30 per transaction for U.S. cards, +1% for international cards.

- Currencies: 135 currencies.

- Countries supported: 48 countries.

Braintree started back in 2007 and quickly made a name for itself as a reliable payment platform. In 2013, PayPal saw its potential and brought it into their family, boosting Braintree's ability to handle payments with even better security and more features.

One great feature is how it lets marketplaces split payments among different sellers easily. This makes Braintree perfect for online stores and platforms that work with multiple vendors, helping them manage money matters smoothly and grow their business in the global market.

Key features:

- Processes all major credit cards, including Visa, Mastercard, American Express, Discover, Diners Club, and JCB, as well as PayPal and Apple Pay.

- Meets PCI Compliance SAQ-A standards and includes features like 3D Secure and Hosted Fields.

- Supports WooCommerce Subscriptions and WooCommerce Pre-Orders.

- Route payments in different currencies to corresponding Braintree accounts (requires a currency switcher).

- Customers can securely save their credit cards or link PayPal accounts to your site.

- Includes express checkout options such as Buy Now buttons on product pages.

- Manage refunds, void transactions, and capture charges directly from WooCommerce.

Employing Braintree’s array of features for secure payment processing demands thorough technical knowledge for proper setup and configuration. Such a requirement can hinder businesses that do not have immediate access to tech expertise.

How to Add Payment Gateways to WooCommerce?

Based on our review of the best payment gateway for WooCommerce, you may now have made up your mind with a perfect-fit solution. At this step, we will learn the steps to add your desired payment gateways to the WooCommerce store.

Step 1: Install the Payment Gateway plugin

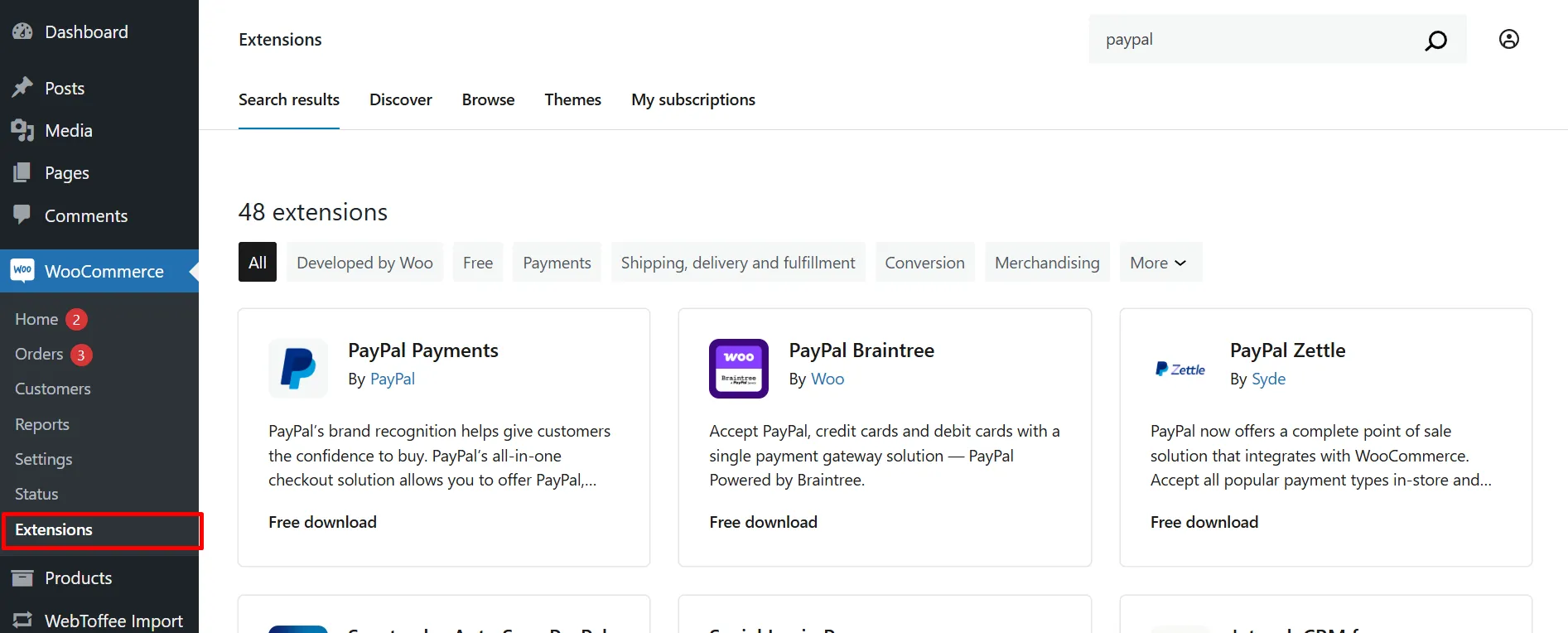

If the payment gateway you want to use isn't available by default, go to WooCommerce > Extension section and search for your desired WooCommerce payment gateway plugin (e.g., Stripe, PayPal, etc.).

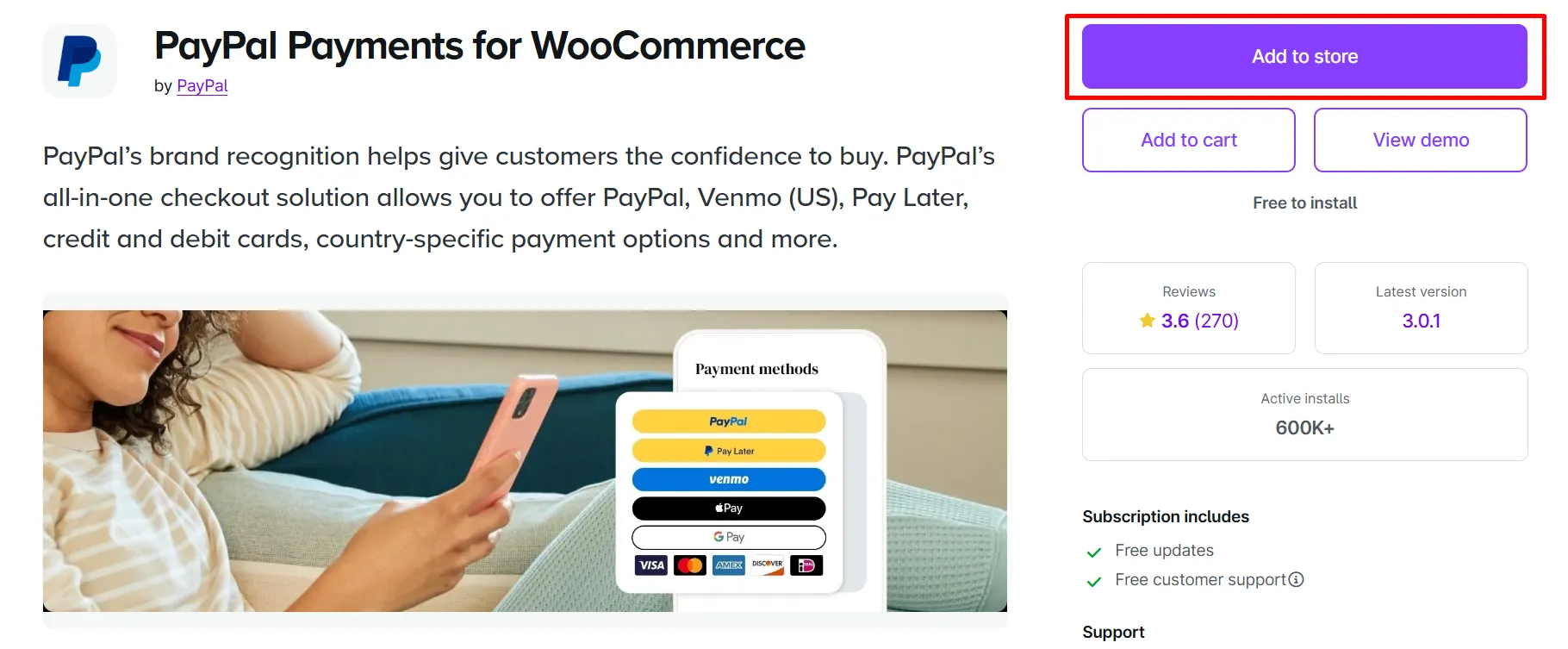

Click Add to Store > Activate, and you are ready to use the plugin.

Step 2: Access WooCommerce Settings

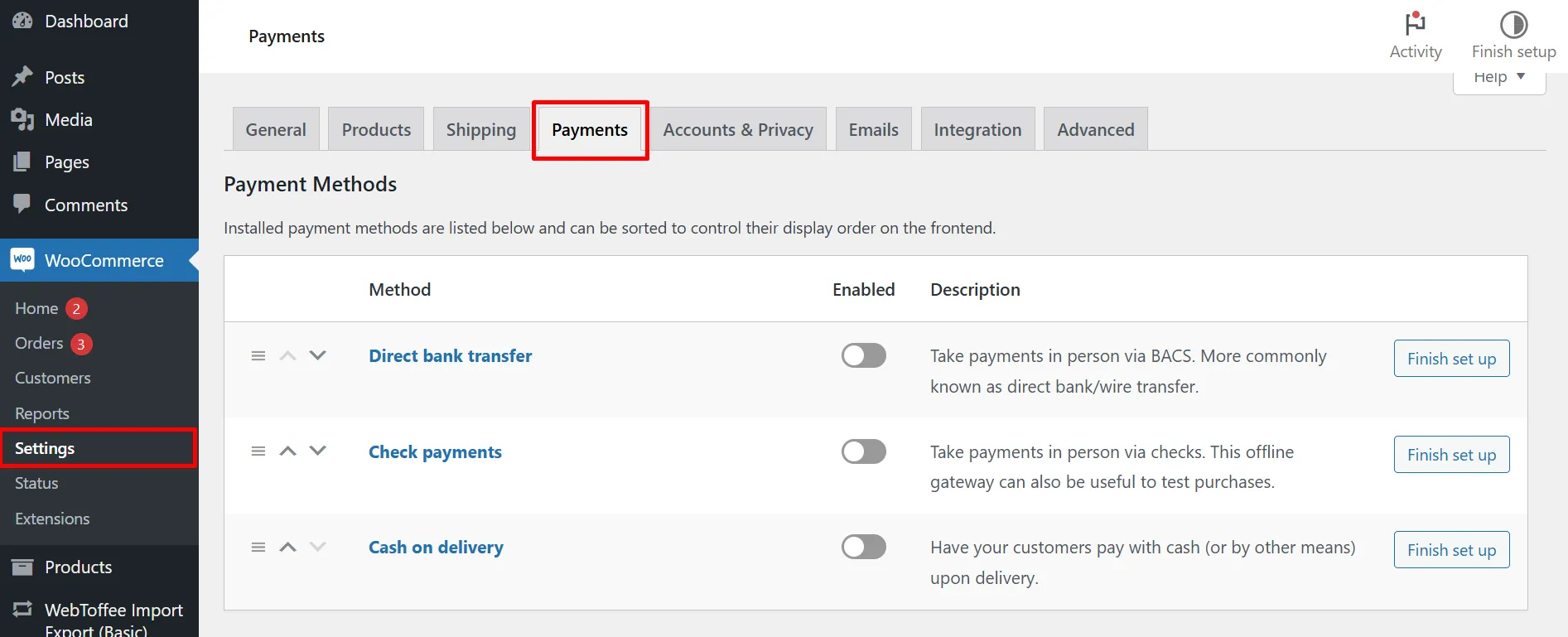

Navigate to the WooCommerce > Settings section from the left sidebar, then select the “Payments” tab to view all available payment gateways.

Step 3: Enable your chosen payment gateway

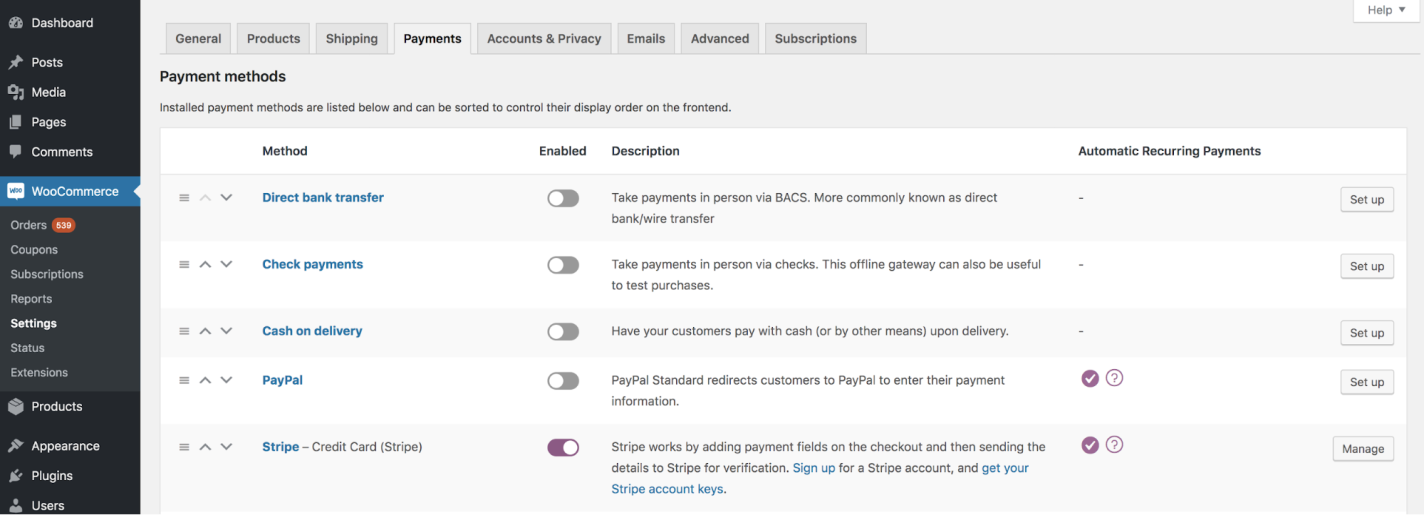

Find the gateway you wish to use from the list and toggle the switch to “On” to enable it.

Step 4: Configure the gateway settings

Click on the “Set Up” button next to the enabled gateway to enter the necessary account details and adjust settings such as payment methods and security options.

Step 5: Test the payment gateway & go live

Ensure functionality by using WooCommerce’s sandbox mode or the gateway’s test mode to simulate transactions. After successful testing, finalize your settings and make the gateway active for real transactions.

Factors to Consider When Choosing the Best Payment Gateway for WooCommerce

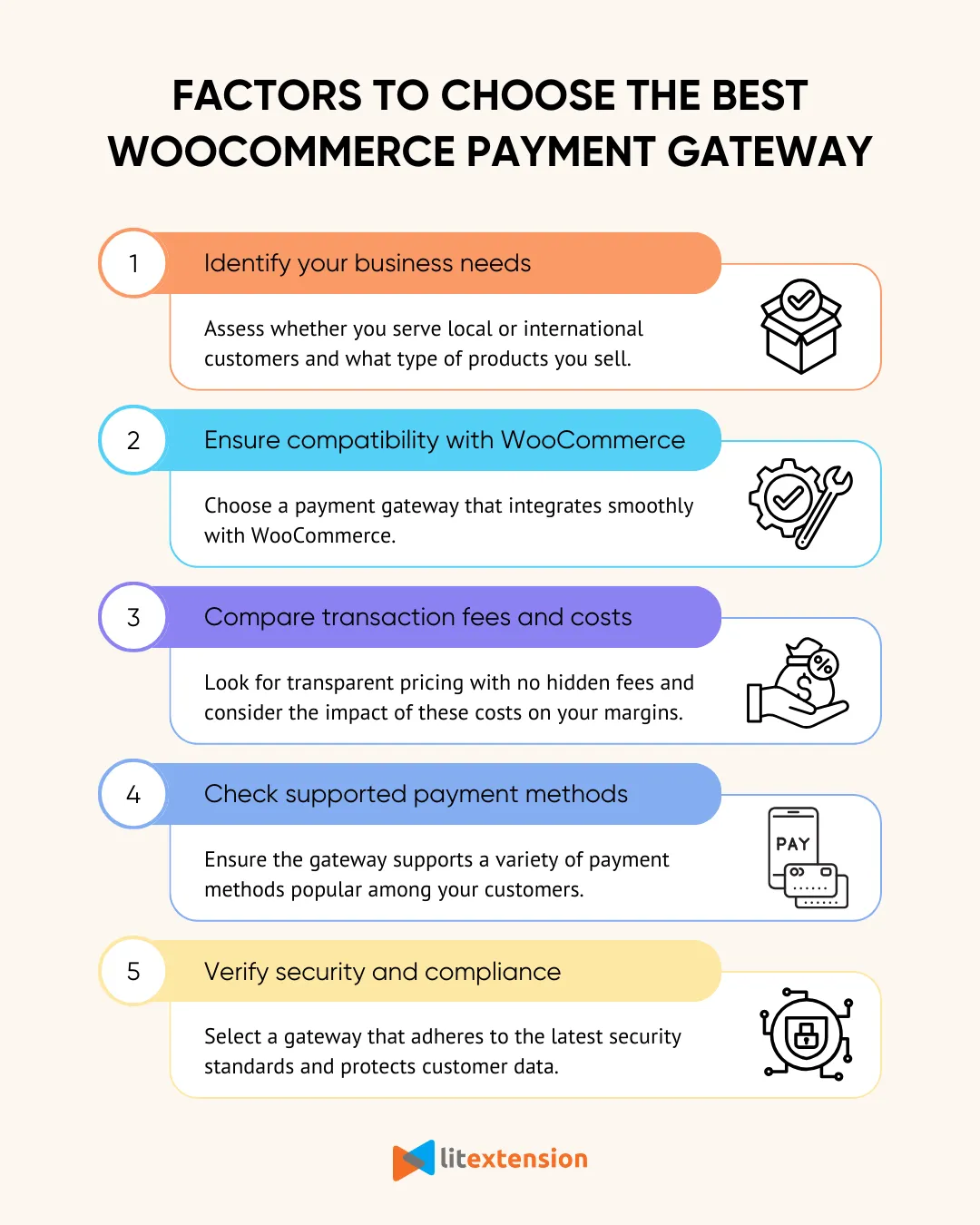

Finding the best payment gateway for WooCommerce store can really boost your business. We all know that, but how do we really find them? Check out the infographic below for a step-by-step guide on selecting the best gateway to fit your store's needs.

We crafted this infographic based on what we've learned to help you find the best payment gateway for your WooCommerce store. Picking the right one might seem a bit daunting, but with these clear, simple tips, you’re set to make a choice that suits your shop just right.

We focus on keeping it straightforward, secure, and customer-friendly. Remember, the whole idea is to simplify your operations and enhance your store's success.

Best Practices to Optimize WooCommerce Checkout

Improving your checkout experience can help reduce cart abandonment and increase conversions. When the checkout process is smooth and simple, your customers are more likely to complete their purchases. Here are some of the best practices to optimize WooCommerce checkout for better performance and customer satisfaction:

- Keep the checkout process short and simple: A long or complicated checkout often causes frustration. Try to limit the number of steps and only ask for essential information.

- Enable guest checkout: Some customers don’t want to create an account just to place an order. Allowing guest checkout gives them a faster and easier option.

- Offer multiple payment methods: Not all customers prefer the same payment method. By offering a variety of options like credit cards, PayPal, and Buy Now Pay Later, you increase the chances of conversion.

- Use express checkout options: Tools like PayPal Express or Apple Pay let returning customers complete purchases in just a few clicks.

- Optimize for mobile users: A large number of shoppers use their phones. Make sure your checkout layout is responsive, touch-friendly, and loads quickly on all devices.

- Display trust signals and secure badges: Reassure customers by showing SSL certificates, trust badges, and clear privacy policies during checkout.

- Enable autofill and address suggestions: These features speed up form filling and reduce typing errors, especially for returning users.

- Show clear error messages: If a customer makes a mistake, tell them exactly what went wrong and how to fix it. This reduces confusion and helps avoid lost sales.

By following these best practices, you can build a checkout experience that’s fast, reliable, and user-friendly. This not only boosts customer trust but also drives more successful transactions on your WooCommerce store.

Best WooCommerce Payment Gateways: FAQs

What is the recommended payment gateway to use with WooCommerce?

Stripe and PayPal are widely recommended as the best payment gateway for WooCommerce due to their reliability, global acceptance, and seamless integration capabilities. These platforms cater to a broad range of business needs with robust security features and efficient management systems.

Additionally, options like Authorize.net, Square, and Amazon Pay also provide solid, versatile payment solutions, expanding the choices available to suit different business models and transaction types.

What is the best high-risk payment gateway for WooCommerce?

For businesses classified as high-risk due to the nature of their products or services, payment gateways like Authorize.net or PayKings are often recommended. These gateways specialize in handling high-risk merchant accounts and offer tailored services that include advanced fraud protection and chargeback management to mitigate potential risks.

Does WooCommerce have its own payment gateway?

Yes, WooCommerce has its own payment gateway called WooCommerce Payments. It integrates seamlessly into the WooCommerce dashboard, allowing users to manage payments directly without needing to use third-party services. This provides a streamlined experience, making it easier to handle transactions, refunds, and other payment-related tasks.

How do I add a payment gateway to WooCommerce?

To add a payment gateway to WooCommerce, follow these steps:

- Go to your WordPress dashboard and navigate to WooCommerce > Settings > Payments.

- You’ll see a list of available payment gateways. Activate the gateway you want to use by toggling it on.

- Click 'Set Up' (or 'Manage') next to the gateway to enter your credentials and configure settings specific to that gateway.

- Save your changes, and the payment gateway will be active on your site.

What is cheaper, Stripe or Square?

Generally, both Stripe and Square offer a similar base fee for online transactions, typically around 2.9% + $0.30 per transaction. However, for in-person transactions, Square often has slightly lower fees (2.6% + $0.10) compared to Stripe. The best choice depends on your specific sales volume, whether your transactions are mostly online or in-person, and other unique business needs.

Final Thoughts

While there’s no one-size-fits-all solution, the best payment gateways for WooCommerce listed in this guide each offer unique strengths for different needs. By combining the right payment solution with a well-optimized checkout experience, you’ll be able to boost conversions, reduce cart abandonment, and provide a seamless shopping journey from start to finish.

To conclude, if you’re looking for a simple, built-in solution, WooCommerce Payments is a great starting point. For global reach and flexibility, Stripe or PayPal Braintree are solid choices. If you want to offer modern options like Buy Now, Pay Later, Klarna stands out. No matter which gateway you choose, make sure it aligns with your business goals, target audience, and budget.

For more helpful tips and strategies on optimizing your WooCommerce operations, be sure to check out our collection of WooCommerce blog posts or join our community group!